926 N Redding Way Unit 43 Upland, CA 91786

Estimated Value: $555,000 - $595,000

3

Beds

3

Baths

1,746

Sq Ft

$328/Sq Ft

Est. Value

About This Home

This home is located at 926 N Redding Way Unit 43, Upland, CA 91786 and is currently estimated at $573,244, approximately $328 per square foot. 926 N Redding Way Unit 43 is a home located in San Bernardino County with nearby schools including Baldy View Elementary School, Upland Junior High School, and Upland High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 30, 2020

Sold by

Shanti Properties Llc

Bought by

Shiva Properties Llc

Current Estimated Value

Purchase Details

Closed on

Jul 29, 2009

Sold by

Laxpati Jatin

Bought by

Shanti Properties Llc

Purchase Details

Closed on

Feb 9, 2006

Sold by

Millet Susan P

Bought by

Laxpati Jatin and Laxpati Shaila

Purchase Details

Closed on

Jul 13, 2000

Sold by

Druga Mary J

Bought by

Millett Susan P and Maranon Ymasumac A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,850

Interest Rate

8.16%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shiva Properties Llc | -- | None Available | |

| Shanti Properties Llc | -- | None Available | |

| Laxpati Jatin | $375,000 | Lawyers Title | |

| Millett Susan P | $143,000 | Chicago Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Millett Susan P | $135,850 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,145 | $283,986 | $99,395 | $184,591 |

| 2024 | $3,145 | $278,418 | $97,446 | $180,972 |

| 2023 | $3,096 | $272,959 | $95,535 | $177,424 |

| 2022 | $3,029 | $267,607 | $93,662 | $173,945 |

| 2021 | $3,024 | $262,359 | $91,825 | $170,534 |

| 2020 | $2,942 | $259,668 | $90,883 | $168,785 |

| 2019 | $2,932 | $254,576 | $89,101 | $165,475 |

| 2018 | $2,863 | $249,584 | $87,354 | $162,230 |

| 2017 | $2,781 | $244,690 | $85,641 | $159,049 |

| 2016 | $2,594 | $239,892 | $83,962 | $155,930 |

| 2015 | $2,535 | $236,289 | $82,701 | $153,588 |

| 2014 | $2,470 | $231,660 | $81,081 | $150,579 |

Source: Public Records

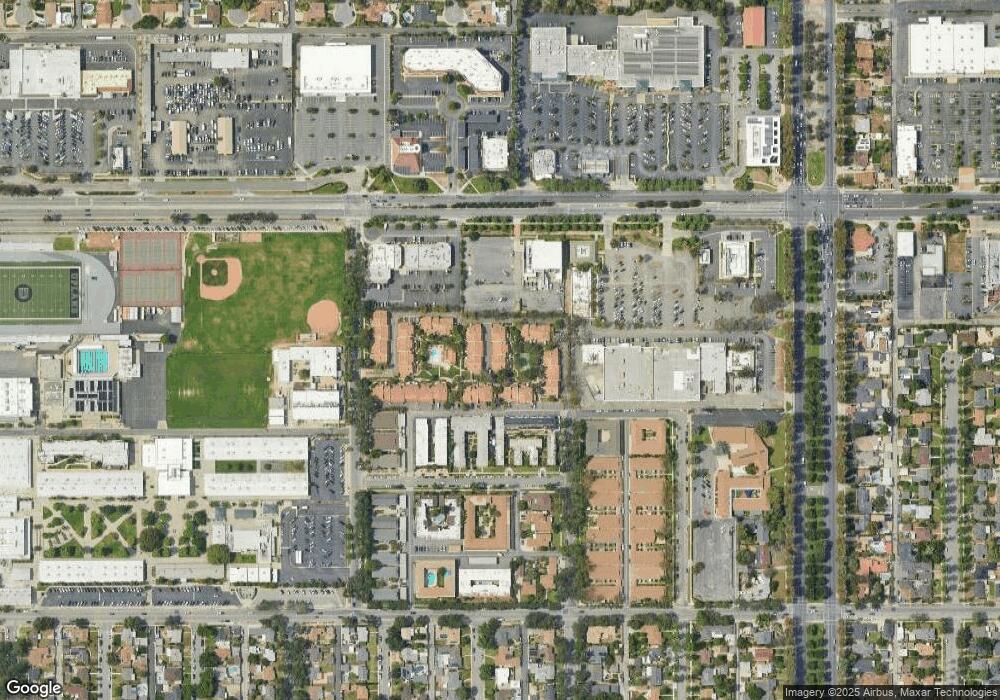

Map

Nearby Homes

- 928 N Redding Way Unit D

- 910 N Redding Way Unit F

- 855 N Palm Ave

- 1234 N Laurel Ave

- 691 N 3rd Ave

- 1346 N Euclid Ave

- 368 West St

- 1188 N 3rd Ave

- 125 Towns Ave

- 0 Bay St Unit AR25093919

- 952 N 4th Ave

- 435 W 9th St Unit F5

- 435 W 9th St Unit B3

- 823 N 5th Ave

- 939 W Pine St Unit 44

- 1404 N Euclid Ave

- 1361 N 3rd Ave

- 537 W 9th St

- 609 N 6th Ave

- 524 E Arrow Hwy

- 926 N Redding Way Unit A

- 926 N Redding Way Unit C

- 926 N Redding Way Unit D

- 926 N Redding Way Unit 45

- 926 N Redding Way

- 926 N Redding Way

- 926 N Redding Way

- 926 N Redding Way Unit E

- 928 N Redding Way

- 928 N Redding Way

- 928 N Redding Way

- 928 N Redding Way Unit E

- 928 N Redding Way Unit B

- 928 N Redding Way Unit A

- 942 N Redding Way Unit D

- 942 N Redding Way

- 942 N Redding Way

- 942 N Redding Way Unit B

- 942 N Redding Way Unit A

- 922 N Redding Way Unit C