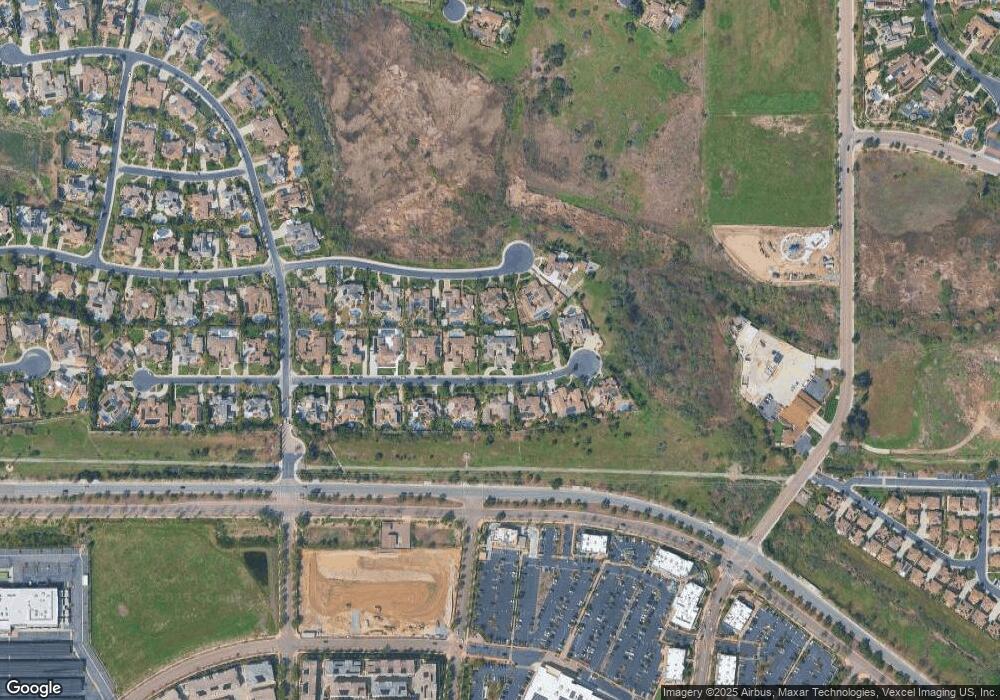

9352 Fostoria Ct San Diego, CA 92127

4S Ranch NeighborhoodEstimated Value: $2,983,000 - $3,276,000

5

Beds

6

Baths

4,684

Sq Ft

$681/Sq Ft

Est. Value

About This Home

This home is located at 9352 Fostoria Ct, San Diego, CA 92127 and is currently estimated at $3,190,177, approximately $681 per square foot. 9352 Fostoria Ct is a home located in San Diego County with nearby schools including Del Sur Elementary School, Oak Valley Middle, and Del Norte High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 19, 2013

Sold by

Brengle David R and Brengle Rochele

Bought by

Brengle David R and Brengle Rochele

Current Estimated Value

Purchase Details

Closed on

Sep 7, 2011

Sold by

Brengle David R and Brengle Rochele

Bought by

Brengle David R and Brengle Rochele

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$675,000

Outstanding Balance

$458,465

Interest Rate

4.09%

Mortgage Type

New Conventional

Estimated Equity

$2,731,712

Purchase Details

Closed on

Feb 22, 2010

Sold by

Brengle David R and Brengle Rochele

Bought by

Brengle David R and Brengle Rochele

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$686,600

Interest Rate

4.93%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 5, 2002

Sold by

Bernardo Lakes San Diego Lp

Bought by

Brengle David R and Brengle Rochele

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$625,000

Interest Rate

6.05%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brengle David R | -- | None Available | |

| Brengle David R | -- | None Available | |

| Brengle David R | -- | Western Resources Title | |

| Brengle David R | -- | Western Resources Title | |

| Brengle David R | -- | Accommodation | |

| Brengle David R | -- | Ticor Title Company | |

| Brengle David R | $844,500 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Brengle David R | $675,000 | |

| Closed | Brengle David R | $686,600 | |

| Previous Owner | Brengle David R | $625,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $19,316 | $1,378,792 | $398,280 | $980,512 |

| 2024 | $19,316 | $1,351,758 | $390,471 | $961,287 |

| 2023 | $18,780 | $1,325,254 | $382,815 | $942,439 |

| 2022 | $18,500 | $1,299,269 | $375,309 | $923,960 |

| 2021 | $18,180 | $1,273,794 | $367,950 | $905,844 |

| 2020 | $17,979 | $1,260,734 | $364,178 | $896,556 |

| 2019 | $17,581 | $1,236,015 | $357,038 | $878,977 |

| 2018 | $17,168 | $1,211,781 | $350,038 | $861,743 |

| 2017 | $16,858 | $1,188,022 | $343,175 | $844,847 |

| 2016 | $16,964 | $1,164,729 | $336,447 | $828,282 |

| 2015 | $16,540 | $1,147,235 | $331,394 | $815,841 |

| 2014 | $16,195 | $1,124,763 | $324,903 | $799,860 |

Source: Public Records

Map

Nearby Homes

- 9343 Bernardo Lakes Dr

- 17117 Tallow Tree Ln

- Artesian Rd & End of Camino Lima

- Artesian Rd Camino Lima Parcel 33

- Artesian Rd & Camino Lima Parcel -32

- Lot #1 Trailside Ln

- Artesian Rd & Camino Lima (Corner Lot 34)

- Lot #2 Trailside Ln

- 16750 Coyote Bush Dr Unit 47

- 16750 Coyote Bush Dr Unit 107

- 16750 Coyote Bush Dr Unit 31

- 16750 Coyote Bush Dr Unit 19

- 15105 Lincoln Loop

- 15929 Parkview Loop

- 0 Camino Santa fe Dr Unit 21 250034399

- 15653 Tanner Ridge Rd

- 10237 Paseo de Linda

- 10214 Sienna Hills Dr

- 16935 Laurel Hill Ln Unit 171

- 15809 Concord Ridge Terrace

- 9340 Fostoria Ct

- 9364 Fostoria Ct

- 9351 Bernardo Lakes Dr

- 9349 Fostoria Ct

- 9359 Bernardo Lakes Dr

- 9357 Fostoria Ct

- 9341 Fostoria Ct

- 9332 Fostoria Ct

- 9376 Fostoria Ct

- 9365 Fostoria Ct

- 9335 Bernardo Lakes Dr

- 1 A Run of the Knolls

- 38 5 Sendero de Alba

- 7808 Top O the Morning Way

- 16514 Road To Morocco

- 3 .17AC RIO VIST Rio Vista Rd

- 0 2.52 AC Artesian Rd

- 8249 Top of the Morning Dr

- 8242 Top O the Morning

- 2 .44 AC Cam Del Vientecito