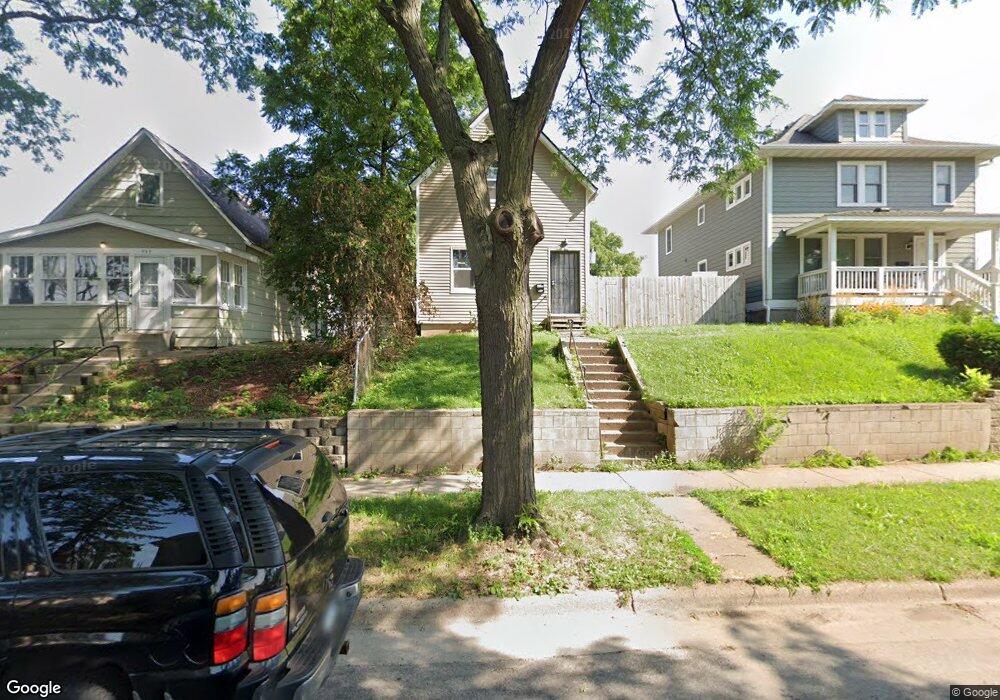

961 Jenks Ave Saint Paul, MN 55106

Payne-Phalen NeighborhoodEstimated Value: $210,000 - $247,000

4

Beds

2

Baths

1,271

Sq Ft

$179/Sq Ft

Est. Value

About This Home

This home is located at 961 Jenks Ave, Saint Paul, MN 55106 and is currently estimated at $226,919, approximately $178 per square foot. 961 Jenks Ave is a home located in Ramsey County with nearby schools including Frost Lake Elementary School, Txuj Ci HMong Language and Culture Upper Campus, and Johnson Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 6, 2020

Sold by

Hang Shoua N and Yang Pa

Bought by

Anderson Lewis

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$177,230

Outstanding Balance

$157,636

Interest Rate

3.5%

Mortgage Type

FHA

Estimated Equity

$69,283

Purchase Details

Closed on

Oct 17, 2016

Sold by

Molitor Brian Brian

Bought by

Hang Shoua Shoua

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$104,350

Interest Rate

3.47%

Purchase Details

Closed on

Apr 27, 2011

Sold by

Molitor Brent and Molitor Jennifer

Bought by

Molitor Brian

Purchase Details

Closed on

Sep 20, 2002

Sold by

Archild Edgar E and Archild Maria Corca

Bought by

Hernandez Carlos D T and Banosmena Alma C

Purchase Details

Closed on

Jun 27, 1997

Sold by

Eagle Flight Development Llp

Bought by

Archila Maria Corea and Archila Edgar E

Purchase Details

Closed on

Feb 19, 1997

Sold by

Federal National Mortgage Association

Bought by

Eagle Flight Development Llp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Anderson Lewis | $180,500 | Land Title Inc | |

| Hang Shoua Shoua | $109,900 | -- | |

| Molitor Brian | $60,000 | -- | |

| Hernandez Carlos D T | $151,500 | -- | |

| Archila Maria Corea | $74,500 | -- | |

| Eagle Flight Development Llp | $28,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Anderson Lewis | $177,230 | |

| Previous Owner | Hang Shoua Shoua | $104,350 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,552 | $213,300 | $25,000 | $188,300 |

| 2023 | $3,552 | $216,300 | $20,000 | $196,300 |

| 2022 | $5,514 | $209,000 | $20,000 | $189,000 |

| 2021 | $2,298 | $165,000 | $19,200 | $145,800 |

| 2020 | $2,064 | $154,400 | $9,600 | $144,800 |

| 2019 | $1,522 | $141,200 | $9,600 | $131,600 |

| 2018 | $1,458 | $109,700 | $9,600 | $100,100 |

| 2017 | $1,686 | $109,300 | $9,600 | $99,700 |

| 2016 | $1,832 | $0 | $0 | $0 |

| 2015 | $1,726 | $91,100 | $9,600 | $81,500 |

| 2014 | $1,808 | $0 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 959 959 Jenks-Avenue-

- 971 Jenks Ave

- 959 Jenks Ave

- 957 Jenks Ave

- 977 Jenks Ave

- 955 Jenks Ave

- 964 Lawson Ave E

- 972 Lawson Ave E

- 974 974 Jenks-Avenue-

- 985 Jenks Ave

- 953 Jenks Ave

- 962 Lawson Ave E

- 962 962 Lawson-Avenue-e

- 976 Lawson Ave E

- 968 Lawson Ave E

- 976 Jenks Ave

- 970 Jenks Ave

- 956 Lawson Ave E

- 982 Lawson Ave E

- 974 Jenks Ave