973 Waverly Common Livermore, CA 94551

Portola Glen NeighborhoodEstimated Value: $918,782 - $1,050,000

3

Beds

2

Baths

1,805

Sq Ft

$535/Sq Ft

Est. Value

About This Home

This home is located at 973 Waverly Common, Livermore, CA 94551 and is currently estimated at $966,196, approximately $535 per square foot. 973 Waverly Common is a home located in Alameda County with nearby schools including Junction Avenue K-8 School, Livermore High School, and Valley Montessori School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 29, 2001

Sold by

Brooks Joyce A

Bought by

Brooks Joyce A and Joyce A Brooks Living Trust

Current Estimated Value

Purchase Details

Closed on

Dec 7, 1998

Sold by

Dias Carlos M and Dias Kimberly A

Bought by

Imrie Sabina R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$225,000

Interest Rate

6.78%

Purchase Details

Closed on

May 11, 1996

Sold by

Dias Carlos M

Bought by

Dias Carlos M and Dias Kimberly A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$25,000

Interest Rate

7.8%

Purchase Details

Closed on

Sep 11, 1995

Sold by

Dias Carlos M

Bought by

Dias Carlos M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brooks Joyce A | -- | American Title Co | |

| Brooks Joyce A | $374,500 | American Title Co | |

| Imrie Sabina R | $281,500 | North American Title Co | |

| Imrie Sabina R | -- | North American Title Co | |

| Dias Carlos M | -- | United Title Company | |

| Dias Carlos M | -- | Nations Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Imrie Sabina R | $225,000 | |

| Previous Owner | Dias Carlos M | $25,000 | |

| Closed | Imrie Sabina R | $14,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,929 | $546,211 | $166,037 | $387,174 |

| 2024 | $6,929 | $535,365 | $162,782 | $379,583 |

| 2023 | $6,823 | $531,733 | $159,591 | $372,142 |

| 2022 | $6,722 | $514,306 | $156,461 | $364,845 |

| 2021 | $6,582 | $504,087 | $153,394 | $357,693 |

| 2020 | $6,365 | $505,848 | $151,822 | $354,026 |

| 2019 | $6,369 | $495,930 | $148,845 | $347,085 |

| 2018 | $6,233 | $486,208 | $145,927 | $340,281 |

| 2017 | $6,071 | $476,678 | $143,067 | $333,611 |

| 2016 | $5,767 | $467,333 | $140,262 | $327,071 |

| 2015 | $5,425 | $460,316 | $138,156 | $322,160 |

| 2014 | $5,342 | $451,301 | $135,450 | $315,851 |

Source: Public Records

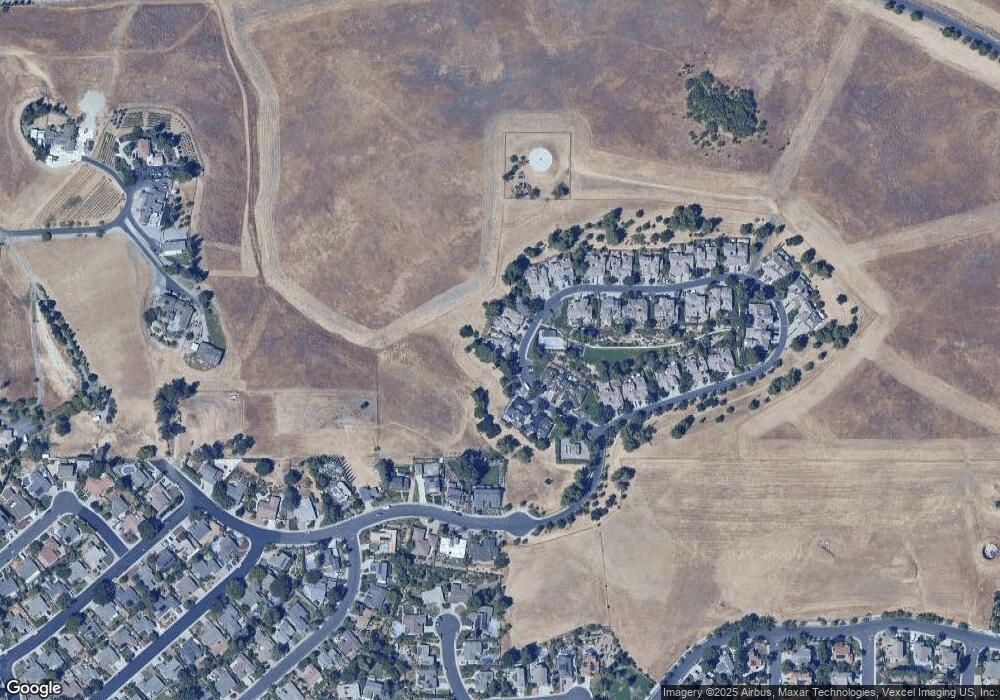

Map

Nearby Homes

- 984 Waverly Common

- 2840 Waverley Way

- 3473 Edinburgh Dr

- 3933 Portola Common Unit 1

- 3873 Inverness Common

- 112 Martin Ave

- 2840 Salt Pond Common

- 4003 Loch Lomand Way

- 4128 Camrose Ave

- 0 N K St

- 350 N K St

- 2155 Chestnut St

- 560 N M St

- 1844 Elm St

- 1815 Pine St

- 3959 Purdue Way

- 3965 Purdue Way

- 1785 Paseo Laguna Seco

- 1234 N P St

- 317 Hillcrest Ave

- 971 Waverly Common

- 967 Waverly Common

- 965 Waverly Common

- 966 Waverly Common

- 987 Waverly Common

- 989 Waverly Common

- 959 Waverly Common

- 996 Waverly Common

- 993 Waverly Common

- 938 Waverly Common

- 957 Waverly Common

- 998 Waverly Common

- 945 Waverly Common

- 936 Waverly Common

- 943 Waverly Common

- 912 Waverly Common

- 802 Waverly Common

- 927 Waverly Common

- 910 Waverly Common

- 804 Waverly Common

Your Personal Tour Guide

Ask me questions while you tour the home.