101 Redding Rd Unit A1 Campbell, CA 95008

Estimated Value: $838,000 - $1,034,000

2

Beds

2

Baths

1,279

Sq Ft

$709/Sq Ft

Est. Value

About This Home

This home is located at 101 Redding Rd Unit A1, Campbell, CA 95008 and is currently estimated at $906,626, approximately $708 per square foot. 101 Redding Rd Unit A1 is a home located in Santa Clara County with nearby schools including Leigh High School, Branham High School, and Farnham Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 1, 2022

Sold by

Lohr Gary

Bought by

Lohr Family Trust

Current Estimated Value

Purchase Details

Closed on

Sep 4, 2001

Sold by

Tinsley Michael J and Tinsley Marlane D

Bought by

Ueno Masashi

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$272,000

Interest Rate

7%

Purchase Details

Closed on

Dec 28, 1998

Sold by

Hayes Cynthia A

Bought by

Tinsley Michael J and Tinsley Marlane D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$192,000

Interest Rate

6.82%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lohr Family Trust | -- | -- | |

| Lohr Gary | -- | -- | |

| Ueno Masashi | $340,000 | North American Title Co | |

| Tinsley Michael J | $240,000 | Old Republic Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ueno Masashi | $272,000 | |

| Previous Owner | Tinsley Michael J | $192,000 | |

| Closed | Tinsley Michael J | $12,000 | |

| Closed | Ueno Masashi | $34,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,974 | $502,254 | $251,127 | $251,127 |

| 2024 | $6,974 | $492,406 | $246,203 | $246,203 |

| 2023 | $6,959 | $482,752 | $241,376 | $241,376 |

| 2022 | $6,857 | $473,288 | $236,644 | $236,644 |

| 2021 | $6,712 | $464,008 | $232,004 | $232,004 |

| 2020 | $6,403 | $459,252 | $229,626 | $229,626 |

| 2019 | $6,303 | $450,248 | $225,124 | $225,124 |

| 2018 | $6,102 | $441,420 | $220,710 | $220,710 |

| 2017 | $5,928 | $432,766 | $216,383 | $216,383 |

| 2016 | $5,616 | $424,282 | $212,141 | $212,141 |

| 2015 | $5,513 | $417,910 | $208,955 | $208,955 |

| 2014 | $5,346 | $409,724 | $204,862 | $204,862 |

Source: Public Records

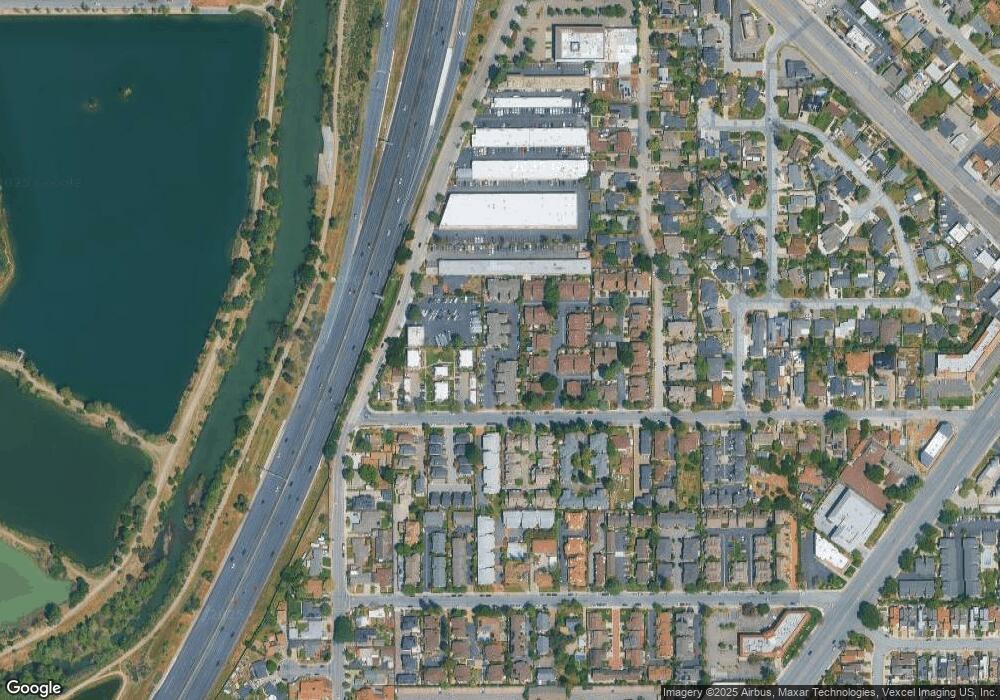

Map

Nearby Homes

- 101 Redding Rd Unit A4

- 2363 Shelley Ave

- 3489 Wine Barrel Way

- 1500 Camden Ave

- 3673 S Bascom Ave

- 3449 Wine Cask Way

- 1061 Shamrock Dr

- 2265 Sun Glory Ln Unit B

- 16154 Loretta Ln

- 2785 S Bascom Ave Unit 26

- 203 Oak Tree Cir

- 422 W Sunnyoaks Ave

- 14 Timber Cove Dr Unit 14

- 2207 Vizcaya Cir

- 2122 Vizcaya Way

- 4157 Mystic Dr

- 15171 Chelsea Dr

- 99 Timber Cove Dr Unit 99

- 870 Camden Ave Unit 96

- 3076 Union Ave

- 101 Redding Rd

- 101 Redding Rd Unit B3

- 101 Redding Rd Unit B1

- 101 Redding Rd

- 101 Redding Rd Unit C6

- 101 Redding Rd Unit A8

- 101 Redding Rd Unit A7

- 101 Redding Rd Unit A6

- 101 Redding Rd Unit A5

- 101 Redding Rd Unit A3

- 101 Redding Rd Unit A2

- 101 Redding Rd Unit B1

- 101 Redding Rd Unit B2

- 101 Redding Rd Unit B3

- 101 Redding Rd Unit B4

- 101 Redding Rd Unit B5

- 101 Redding Rd Unit B6

- 101 Redding Rd Unit C1

- 101 Redding Rd Unit C2

- 101 Redding Rd Unit C3