1072 Susan Way Novato, CA 94947

Midwest Novato NeighborhoodEstimated Value: $716,971 - $798,000

3

Beds

3

Baths

1,704

Sq Ft

$445/Sq Ft

Est. Value

About This Home

This home is located at 1072 Susan Way, Novato, CA 94947 and is currently estimated at $758,743, approximately $445 per square foot. 1072 Susan Way is a home located in Marin County with nearby schools including Lynwood Elementary School, Novato High School, and Good Shepherd Lutheran School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 9, 2020

Sold by

Albertus Katherine E

Bought by

Katherine E Albertus 2012 Trust and Albertus

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,000

Outstanding Balance

$222,971

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$535,772

Purchase Details

Closed on

Dec 3, 2020

Sold by

Albertus Katherine E

Bought by

Albertus Katherine E and Katherine E Albertus 2012 Trus

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,000

Outstanding Balance

$222,971

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$535,772

Purchase Details

Closed on

Feb 28, 2013

Sold by

Albertus Katherine E

Bought by

Albertus Katherine E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$275,800

Interest Rate

3.49%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 3, 2012

Sold by

Albertus Katherine E

Bought by

Albertus Katherine E

Purchase Details

Closed on

Dec 23, 2009

Sold by

Jennings Steven Martin

Bought by

Albertus Katherine E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$301,250

Interest Rate

4.78%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 28, 2004

Sold by

Courtney Carol

Bought by

Jennings Steven Martin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$418,000

Interest Rate

5.62%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 30, 2001

Sold by

Courtney Carol A and Courtney Carol

Bought by

Courtney Carol

Purchase Details

Closed on

Aug 15, 1998

Sold by

Spremich John G and Spremich Carolyn J J

Bought by

Courtney Carol A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$196,000

Interest Rate

6.91%

Purchase Details

Closed on

Apr 22, 1996

Sold by

Spremich John G

Bought by

Spremich John G and Spremich Carolyn Jones

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Katherine E Albertus 2012 Trust | -- | Old Republic Title | |

| Albertus Katherine E | -- | Old Republic Title Company | |

| Albertus Katherine E | -- | Old Republic Title | |

| Albertus Katherine E | -- | Old Republic Title Company | |

| Albertus Katherine E | -- | Old Republic Title Company | |

| Albertus Katherine E | -- | None Available | |

| Albertus Katherine E | $401,500 | Fidelity National Title Co | |

| Jennings Steven Martin | $522,500 | Old Republic Title Company | |

| Courtney Carol | -- | -- | |

| Courtney Carol A | $245,000 | First American Title Co | |

| Spremich John G | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Albertus Katherine E | $250,000 | |

| Previous Owner | Albertus Katherine E | $275,800 | |

| Previous Owner | Albertus Katherine E | $301,250 | |

| Previous Owner | Jennings Steven Martin | $418,000 | |

| Previous Owner | Courtney Carol A | $196,000 | |

| Closed | Jennings Steven Martin | $100,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,205 | $518,228 | $258,146 | $260,082 |

| 2024 | $7,205 | $508,070 | $253,086 | $254,984 |

| 2023 | $7,036 | $498,108 | $248,124 | $249,984 |

| 2022 | $6,875 | $488,344 | $243,260 | $245,084 |

| 2021 | $6,863 | $478,772 | $238,492 | $240,280 |

| 2020 | $6,761 | $473,866 | $236,048 | $237,818 |

| 2019 | $6,496 | $464,575 | $231,420 | $233,155 |

| 2018 | $6,397 | $455,469 | $226,884 | $228,585 |

| 2017 | $6,279 | $446,540 | $222,436 | $224,104 |

| 2016 | $5,846 | $437,787 | $218,076 | $219,711 |

| 2015 | $5,747 | $431,215 | $214,802 | $216,413 |

| 2014 | $5,634 | $422,771 | $210,596 | $212,175 |

Source: Public Records

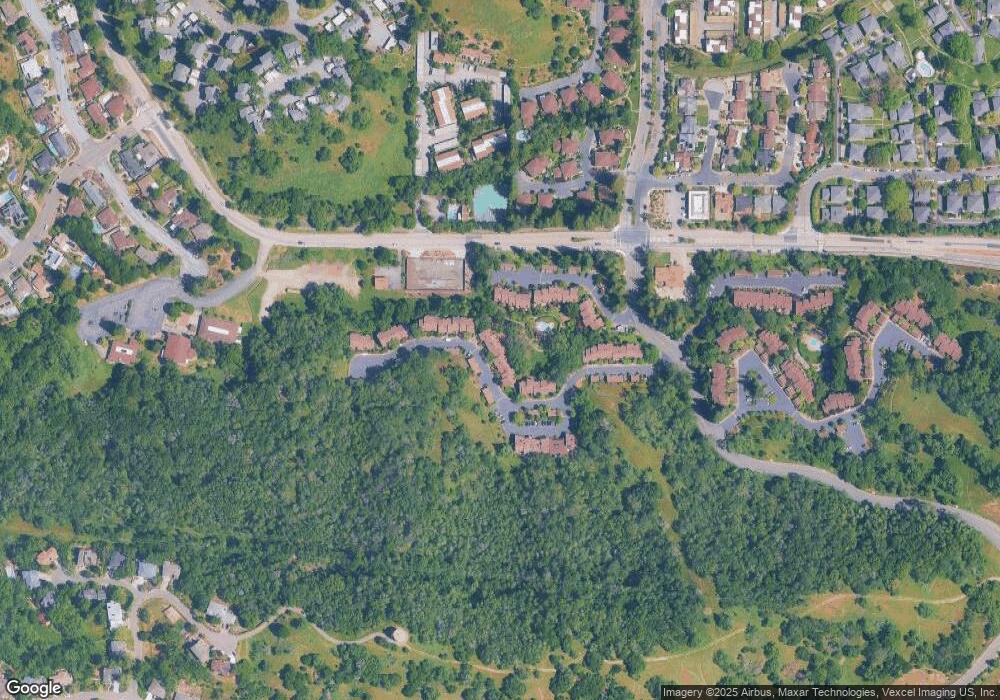

Map

Nearby Homes

- 121 Cheda Ln

- 323 Silvio Ln Unit 4

- 844 Arlene Way

- 1 Columbine Ln

- 201 Deborah Ct

- 64 Los Padres Cir

- 86 Sequoia Glen Ln

- 109 Albion Ct

- 38 Plumas Cir Unit 2

- 5 Briarwood Ct

- 1256 Highland Dr

- 809 Arlington Cir

- 1 Oak Crest Ct Unit D

- 71 Oak Grove Dr

- 120 Fairway Dr

- 130 Fairway Dr

- 540 Marin Oaks Dr

- 45 Wimbledon Ct

- 432 Calle de la Mesa

- 8 Oak Grove Dr Unit 201

- 1068 Susan Way

- 1076 Susan Way

- 1080 Susan Way

- 1064 Susan Way

- 1060 Susan Way

- 1056 Susan Way

- 1084 Susan Way

- 1052 Susan Way

- 1092 Susan Way

- 1048 Susan Way

- 1049 Margaret Ct

- 1045 Margaret Ct

- 1053 Margaret Ct

- 1044 Susan Way

- 1096 Susan Way

- 1057 Margaret Ct

- 1041 Margaret Ct

- 1040 Susan Way

- 1100 Susan Way

- 1036 Susan Way