1073 Trinita Terrace Unit C Davis, CA 95618

East Davis NeighborhoodEstimated Value: $447,000 - $627,000

2

Beds

2

Baths

1,361

Sq Ft

$395/Sq Ft

Est. Value

About This Home

This home is located at 1073 Trinita Terrace Unit C, Davis, CA 95618 and is currently estimated at $537,216, approximately $394 per square foot. 1073 Trinita Terrace Unit C is a home located in Yolo County with nearby schools including Fred T. Korematsu Elementary School At Mace Ranch, Frances Ellen Watkins Harper Junior High School, and Davis Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 22, 2023

Sold by

Profumo Michael J

Bought by

Profumo Family Trust and Profumo

Current Estimated Value

Purchase Details

Closed on

May 22, 2001

Sold by

Profumo Michael Jason and Profumo Jason M

Bought by

Profumo Michael Jason

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$188,000

Interest Rate

7.15%

Purchase Details

Closed on

Jun 3, 1997

Sold by

Braemer Davis Ltd Partnership

Bought by

Profumo M Jason

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$130,150

Interest Rate

8.08%

Mortgage Type

Balloon

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Profumo Family Trust | -- | None Listed On Document | |

| Profumo Michael Jason | -- | Landsafe Title | |

| Profumo M Jason | $145,000 | Placer Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Profumo Michael Jason | $188,000 | |

| Previous Owner | Profumo M Jason | $130,150 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,837 | $235,539 | $65,132 | $170,407 |

| 2023 | $4,837 | $226,394 | $62,603 | $163,791 |

| 2022 | $4,700 | $221,956 | $61,376 | $160,580 |

| 2021 | $4,612 | $217,605 | $60,173 | $157,432 |

| 2020 | $4,620 | $215,374 | $59,556 | $155,818 |

| 2019 | $4,368 | $211,152 | $58,389 | $152,763 |

| 2018 | $4,161 | $207,013 | $57,245 | $149,768 |

| 2017 | $4,103 | $202,955 | $56,123 | $146,832 |

| 2016 | $4,014 | $198,976 | $55,023 | $143,953 |

| 2015 | $3,889 | $195,988 | $54,197 | $141,791 |

| 2014 | $3,889 | $192,150 | $53,136 | $139,014 |

Source: Public Records

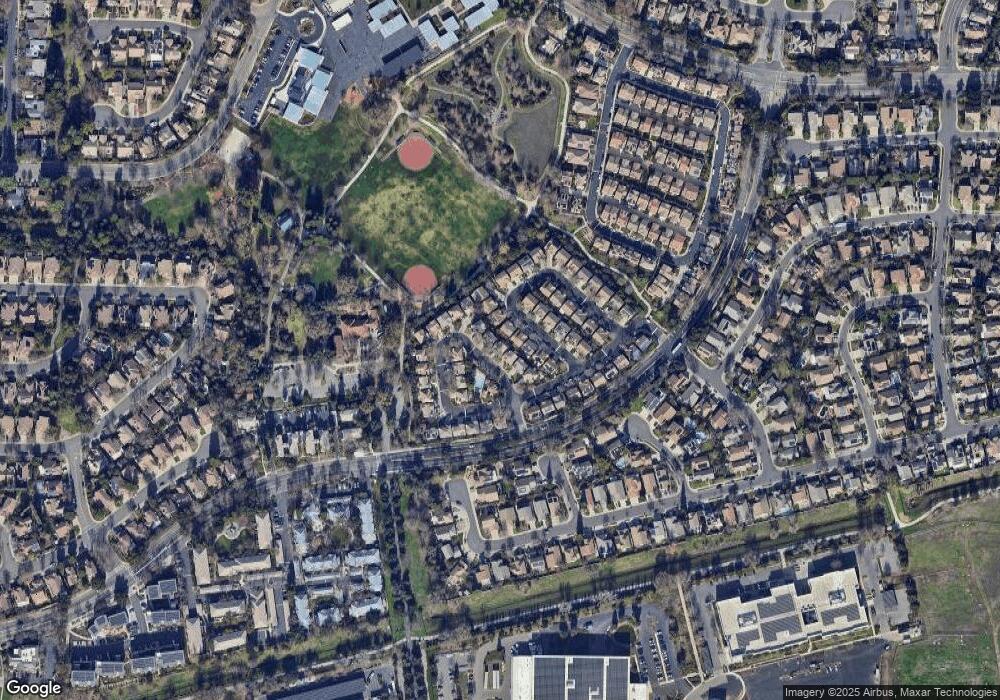

Map

Nearby Homes

- 1008 San Gallo Terrace

- 1421 Vigo Ct

- 217 La Vida Way

- 1408 Santander Ct

- 2727 Adrian Dr

- 1540 Pastal Way

- 4121 Vista Way

- 2317 E 8th St

- 218 Full Cir

- 3423 Monte Vista Ave

- 4100 Hackberry Place

- 4088 Hackberry Place

- 103 Full Cir

- 2781 Brentwood Place

- 131 Full Cir

- 96 Full Cir

- 2011 Regis Dr

- 22 Outer Cir

- 4606 San Marino Dr

- 1175 Greene Terrace

- 1079 Trinita Terrace

- 1067 Trinita Terrace Unit B

- 1021 San Gallo Terrace

- 1027 San Gallo Terrace

- 1085 Trinita Terrace Unit E

- 1015 San Gallo Terrace

- 1061 Trinita Terrace

- 1033 San Gallo Terrace

- 1009 San Gallo Terrace

- 1091 Trinita Terrace Unit F

- 1022 Trinita Terrace Unit D

- 1039 San Gallo Terrace

- 1016 Trinita Terrace

- 1055 Trinita Terrace Unit E

- 1010 Trinita Terrace

- 1003 San Gallo Terrace

- 1026 San Gallo Terrace

- 1049 Trinita Terrace

- 1032 San Gallo Terrace

- 1020 San Gallo Terrace