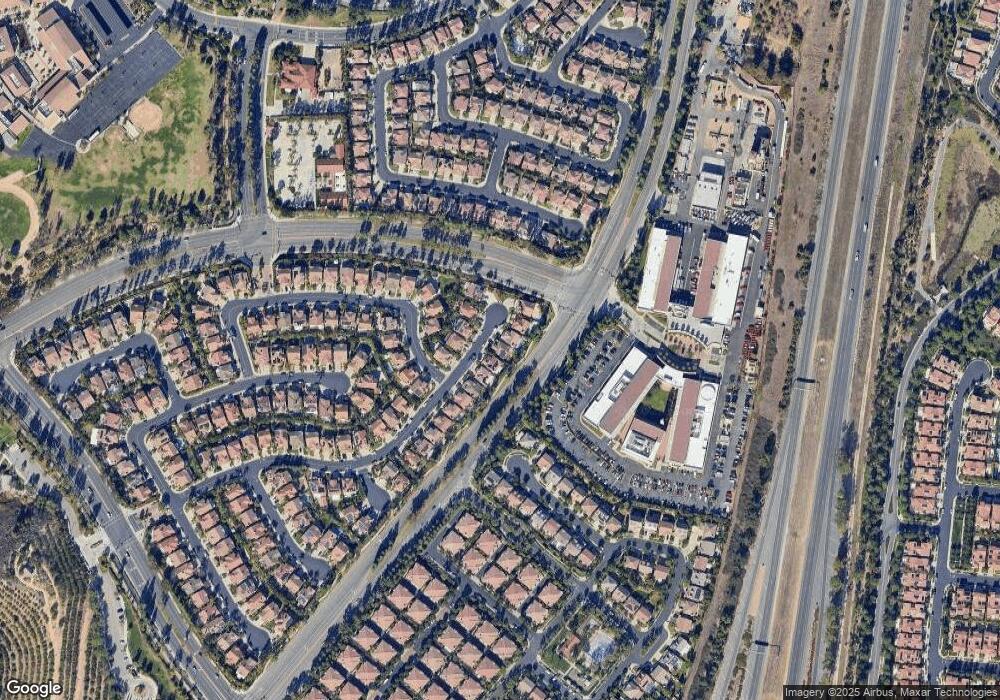

11530 Allen Tustin, CA 92782

Tustin Ranch NeighborhoodEstimated Value: $1,842,000 - $2,178,000

4

Beds

3

Baths

2,734

Sq Ft

$743/Sq Ft

Est. Value

About This Home

This home is located at 11530 Allen, Tustin, CA 92782 and is currently estimated at $2,030,936, approximately $742 per square foot. 11530 Allen is a home located in Orange County with nearby schools including Peters Canyon Elementary School, Pioneer Middle School, and Arnold O. Beckman High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 9, 2001

Sold by

Selman Jack Lynn and Selman Susan Wray

Bought by

Selman Jack Lynn and Selman Susan Wray

Current Estimated Value

Purchase Details

Closed on

Sep 3, 1998

Sold by

Richmond American Homes California Inc

Bought by

Selman Jakc L and Selman Susan Wray

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$362,700

Interest Rate

6.78%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Selman Jack Lynn | -- | -- | |

| Selman Jakc L | $403,500 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Selman Jakc L | $362,700 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,469 | $632,566 | $270,452 | $362,114 |

| 2024 | $6,469 | $620,163 | $265,149 | $355,014 |

| 2023 | $6,320 | $608,003 | $259,950 | $348,053 |

| 2022 | $7,466 | $596,082 | $254,853 | $341,229 |

| 2021 | $7,296 | $584,395 | $249,856 | $334,539 |

| 2020 | $7,177 | $578,403 | $247,294 | $331,109 |

| 2019 | $7,040 | $567,062 | $242,445 | $324,617 |

| 2018 | $6,878 | $555,944 | $237,692 | $318,252 |

| 2017 | $6,651 | $545,044 | $233,032 | $312,012 |

| 2016 | $6,534 | $534,357 | $228,462 | $305,895 |

| 2015 | $6,474 | $526,331 | $225,030 | $301,301 |

| 2014 | $6,430 | $516,021 | $220,622 | $295,399 |

Source: Public Records

Map

Nearby Homes

- 50 Linhaven

- 10 Shadybend

- 65 Glacier Valley

- 11755 Collar Ave

- 120 Long Fence

- 33 Winterfield Rd

- 84 Rockinghorse

- 2605 Augusta

- 66 Furlong

- 117 Andirons

- 8 Versailles

- 54 Granite Knoll

- 234 Gallery Way Unit 163

- 242 Sutters Mill

- 2737 Dietrich Dr

- 23 Red Coat Place

- 2503 Newman Ave

- 59 Boulder Creek Way

- 104 Working Ranch

- 28 Boulder Creek Way

Your Personal Tour Guide

Ask me questions while you tour the home.