11532 Westhill Terrace Lakeside, CA 92040

Estimated Value: $719,000 - $938,000

3

Beds

2

Baths

1,040

Sq Ft

$751/Sq Ft

Est. Value

About This Home

This home is located at 11532 Westhill Terrace, Lakeside, CA 92040 and is currently estimated at $781,255, approximately $751 per square foot. 11532 Westhill Terrace is a home located in San Diego County with nearby schools including Lemon Crest Elementary School, Lakeside Middle School, and Santana High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 26, 2005

Sold by

Clark Daniel L and Cardoza Trisha R

Bought by

Cardoza Trisha R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$359,650

Outstanding Balance

$187,713

Interest Rate

5.56%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Estimated Equity

$593,542

Purchase Details

Closed on

May 26, 2005

Sold by

Clark Daniel L

Bought by

Clark Daniel L and Cardoza Trisha R

Purchase Details

Closed on

Jun 9, 1998

Sold by

Miller Steven J

Bought by

Clark Daniel L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$149,838

Interest Rate

7.17%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cardoza Trisha R | -- | Fidelity National Title Co | |

| Clark Daniel L | -- | -- | |

| Clark Daniel L | $147,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cardoza Trisha R | $359,650 | |

| Closed | Clark Daniel L | $149,838 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,365 | $573,917 | $266,461 | $307,456 |

| 2024 | $7,365 | $562,665 | $261,237 | $301,428 |

| 2023 | $7,094 | $551,633 | $256,115 | $295,518 |

| 2022 | $6,962 | $540,818 | $251,094 | $289,724 |

| 2021 | $6,863 | $530,215 | $246,171 | $284,044 |

| 2020 | $6,096 | $470,000 | $220,000 | $250,000 |

| 2019 | $5,850 | $450,000 | $211,000 | $239,000 |

| 2018 | $5,242 | $400,000 | $188,000 | $212,000 |

| 2017 | $822 | $350,000 | $165,000 | $185,000 |

| 2016 | $4,314 | $330,000 | $156,000 | $174,000 |

| 2015 | $4,232 | $320,000 | $152,000 | $168,000 |

| 2014 | $3,408 | $260,000 | $124,000 | $136,000 |

Source: Public Records

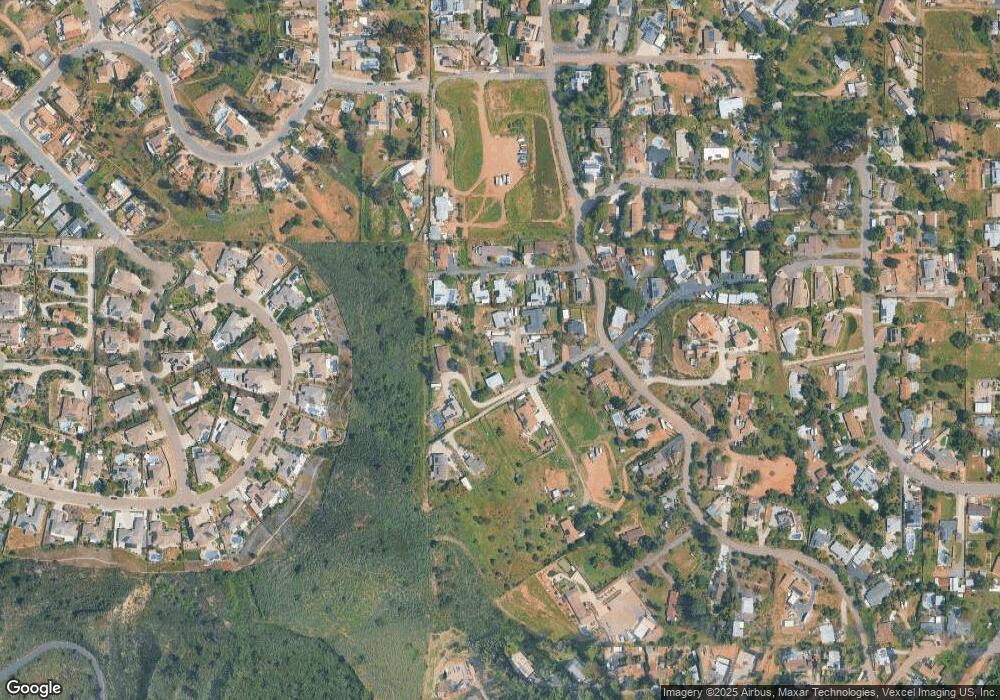

Map

Nearby Homes

- 8933 Diamondback Dr

- 8720 Almond Rd

- 9125 Creekford Dr

- 9420 Emerald Grove Ave

- 9126 Heatherdale St

- 8968 Winter Gardens Blvd Unit 4

- 11007 Larkridge St

- 6301 Triana St

- 8733 Winter Gardens Blvd

- 11061 Crystal Springs Rd

- 11529 Woodside Ave

- 9563 Riverview Ave

- 10969 Crystal Springs Rd

- 5120 Sevilla St

- 1605 Calabria St

- 1705 Montilla St

- 11977 Raceway Ln

- 8661 Winter Gardens Blvd Unit 66

- 8661 Winter Gardens Blvd Unit 103

- 8661 Winter Gardens Blvd Unit 78

- 11536 Westhill Terrace

- 11528 Westhill Terrace

- 11546 Westhill Terrace

- 11540 Westhill Terrace

- 11516 Westhill Terrace

- 11512 Westhill Terrace

- 11510 Westhill Terrace

- 9126 Westhill Rd

- 9128 Westhill Rd

- 9124 Westhill Rd

- 9130 Westhill Rd

- 11552 Westhill Terrace

- 9134 Westhill Rd

- 9122 Westhill Rd

- 9058 Westhill Rd

- 9132 Westhill Rd

- 9115 Westhill Rd

- 11509 Westhill Terrace

- 9129 Westhill Rd

- 9212 Westhill Rd