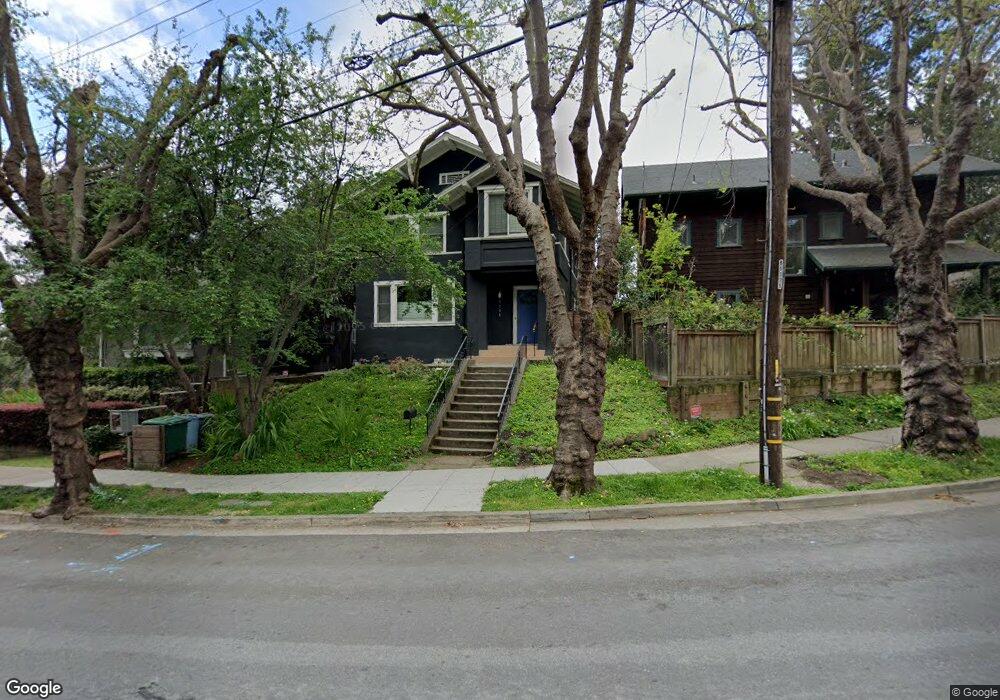

1190 Euclid Ave Berkeley, CA 94708

Berkeley Hills NeighborhoodEstimated Value: $1,470,000 - $1,668,000

4

Beds

3

Baths

1,931

Sq Ft

$817/Sq Ft

Est. Value

About This Home

This home is located at 1190 Euclid Ave, Berkeley, CA 94708 and is currently estimated at $1,576,704, approximately $816 per square foot. 1190 Euclid Ave is a home located in Alameda County with nearby schools including Cragmont Elementary School, Berkeley Arts Magnet at Whittier School, and Washington Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 16, 2018

Sold by

Wagner Richard W and Wagner Martha G

Bought by

Rothman Steven J and Tierney Kathleen

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$375,000

Outstanding Balance

$233,576

Interest Rate

4.6%

Mortgage Type

New Conventional

Estimated Equity

$1,343,128

Purchase Details

Closed on

Apr 18, 2016

Sold by

Alavi Amir

Bought by

The Martha G Wagner Revocable Trust

Purchase Details

Closed on

Nov 2, 2011

Sold by

Alavi Amir

Bought by

Citibank Na

Purchase Details

Closed on

Apr 5, 2006

Sold by

Smith Glenn A and Smith Cheri

Bought by

Alavi Amir

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$521,250

Interest Rate

7.75%

Mortgage Type

Balloon

Purchase Details

Closed on

Jun 21, 2000

Sold by

Smith R W and Smith Morgia S

Bought by

Smith Richard W and Smith Morgia S

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rothman Steven J | $1,235,000 | Chicago Title Company | |

| The Martha G Wagner Revocable Trust | $1,125,000 | North American Title Co Inc | |

| Citibank Na | $545,000 | Accommodation | |

| Alavi Amir | $695,000 | First American Title Co | |

| Smith Richard W | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rothman Steven J | $375,000 | |

| Previous Owner | Alavi Amir | $521,250 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $21,786 | $1,370,641 | $413,292 | $964,349 |

| 2024 | $21,786 | $1,343,632 | $405,189 | $945,443 |

| 2023 | $20,286 | $1,324,154 | $397,246 | $926,908 |

| 2022 | $19,838 | $1,291,194 | $389,458 | $908,736 |

| 2021 | $19,997 | $1,272,741 | $381,822 | $890,919 |

| 2020 | $19,068 | $1,259,700 | $377,910 | $881,790 |

| 2019 | $18,458 | $1,235,000 | $370,500 | $864,500 |

| 2018 | $17,655 | $1,170,450 | $351,135 | $819,315 |

| 2017 | $17,237 | $1,147,500 | $344,250 | $803,250 |

| 2016 | $12,660 | $802,280 | $240,684 | $561,596 |

| 2015 | $12,479 | $790,235 | $237,070 | $553,165 |

| 2014 | $12,374 | $774,757 | $232,427 | $542,330 |

Source: Public Records

Map

Nearby Homes

- 1106 Cragmont Ave

- 1165 Cragmont Ave

- 1110 Sterling Ave

- 1024 Miller Ave

- 1444 Walnut St

- 0 Queens Rd Unit ML82024219

- 1375 Queens Rd

- 2012 Rose St

- 1923 Yolo Ave

- 826 Indian Rock Ave

- 1123 Park Hills Rd

- 935 Grizzly Peak Blvd

- 2634 Virginia St Unit 13

- 2340 Virginia St

- 2451 Le Conte Ave

- 209 Fairlawn Dr

- 2201 Virginia St Unit 2

- 2700 Le Conte Ave Unit 301

- 2700 Le Conte Ave Unit 402

- 2704 Le Conte Ave Unit 4

- 1186 Euclid Ave

- 1196 Euclid Ave

- 2425 Eunice St

- 1181 Laurel St

- 2415 Eunice St

- 1182 Euclid Ave

- 1189 Euclid Ave

- 1181 Euclid Ave

- 1199 Laurel St

- 1191 Euclid Ave

- 1195 Euclid Ave

- 1195 Euclid Ave Unit 2

- 1195 Euclid Ave Unit 1

- 1177 Euclid Ave

- 1169 Euclid Ave

- 1197 Euclid Ave

- 1197 Euclid Ave Unit F

- 1197 Euclid Ave Unit G

- 1197 Euclid Ave Unit E

- 1163 Laurel St

Your Personal Tour Guide

Ask me questions while you tour the home.