1223 Ramal Ln Nipomo, CA 93444

Estimated Value: $2,022,000 - $2,576,495

4

Beds

5

Baths

4,752

Sq Ft

$482/Sq Ft

Est. Value

About This Home

This home is located at 1223 Ramal Ln, Nipomo, CA 93444 and is currently estimated at $2,289,124, approximately $481 per square foot. 1223 Ramal Ln is a home located in San Luis Obispo County with nearby schools including Nipomo Elementary School, Mesa Middle School, and Nipomo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 26, 2018

Sold by

Stephan Ruffino Construction Inc

Bought by

Smith Candace Oressa

Current Estimated Value

Purchase Details

Closed on

Feb 26, 2015

Sold by

Lanini Eloise

Bought by

Ruffino Construction Inc

Purchase Details

Closed on

May 10, 2011

Sold by

Lanini Properties Llc

Bought by

Lanini Roland and Lanini Eloise

Purchase Details

Closed on

May 8, 2008

Sold by

Lanini Roland Henry and Lanini Eloise Lavae

Bought by

Lanini Properties Llc

Purchase Details

Closed on

Feb 19, 1997

Sold by

Mid State Bank

Bought by

Lanini Roland Henry and Lanini Eloise Lavae

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$61,000

Interest Rate

7.85%

Purchase Details

Closed on

Apr 5, 1995

Sold by

Mid State Bank

Bought by

Mid State Bank

Purchase Details

Closed on

Nov 8, 1994

Sold by

Mid Coast Land Company Inc

Bought by

Mid Coast Land Company Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Smith Candace Oressa | $1,300,000 | Fidelity National Title Co | |

| Ruffino Construction Inc | $185,000 | Fidelity National Title Co | |

| Lanini Roland | -- | None Available | |

| Lanini Properties Llc | -- | None Available | |

| Lanini Roland Henry | $85,000 | First American Title Ins Co | |

| Mid State Bank | $1,900,000 | -- | |

| Mid Coast Land Company Inc | $1,452,125 | Chicago Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lanini Roland Henry | $61,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $19,133 | $1,860,159 | $597,358 | $1,262,801 |

| 2024 | $18,914 | $1,823,687 | $585,646 | $1,238,041 |

| 2023 | $18,914 | $1,787,929 | $574,163 | $1,213,766 |

| 2022 | $16,545 | $1,556,794 | $562,905 | $993,889 |

| 2021 | $16,515 | $1,526,269 | $551,868 | $974,401 |

| 2020 | $16,326 | $1,510,620 | $546,210 | $964,410 |

| 2019 | $14,798 | $1,350,700 | $535,500 | $815,200 |

| 2018 | $10,605 | $960,408 | $246,408 | $714,000 |

| 2017 | $4,582 | $414,577 | $191,577 | $223,000 |

| 2016 | $1,997 | $187,821 | $187,821 | $0 |

| 2015 | $1,225 | $115,178 | $115,178 | $0 |

| 2014 | $1,180 | $112,922 | $112,922 | $0 |

Source: Public Records

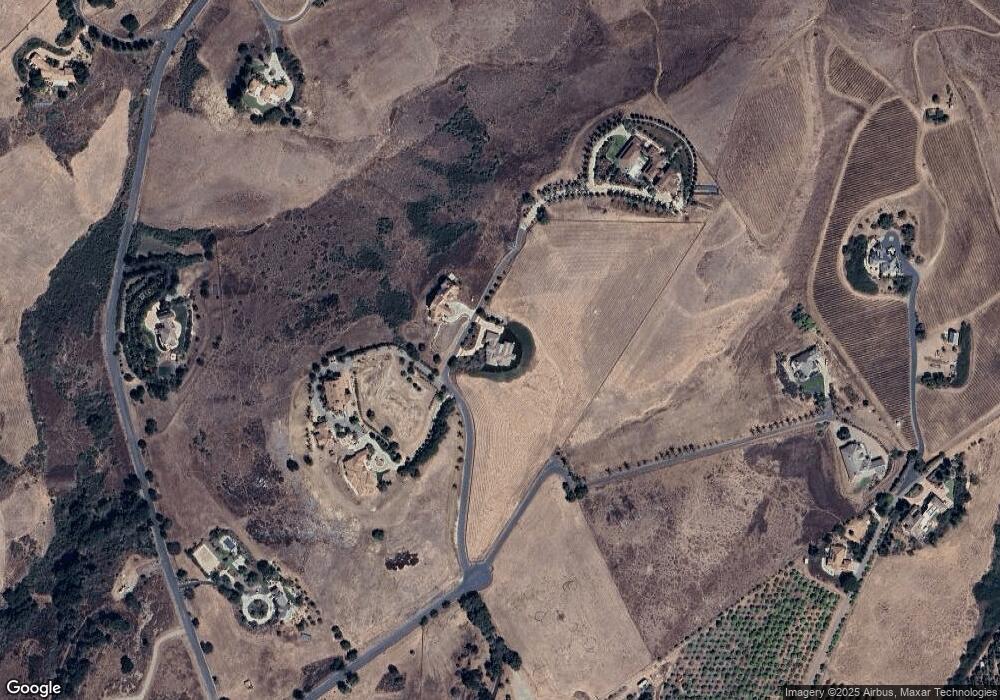

Map

Nearby Homes

- 225 Broken Arrow Rd

- 1012 Upper Los Berros Rd

- 230 Hans Place

- 1276 Pomeroy Rd

- 1680 Los Berros Rd

- 400 N Oakglen Ave

- 285 E Tefft St

- 150 E Chestnut St

- 189 E Tefft St

- 462 Camino Perillo

- 1 W Branch St

- 1150 Redberry Place

- 1010 1012 Upper Los Berros Rd

- 255 Encino Ln

- 0 S Burton St

- 160 San Antonio Ln

- 228 Chaparral Ln

- 90111003 W Price St

- 217 Hope Way

- 449 W Tefft St

- 1223 Ramal Ln

- 1216 Ramal Ln Unit LOT

- 1216 Ramal Ln

- 1220 Ramal Ln

- 1212 Ramal Ln

- 671 Riata Ln Unit LOT

- 671 Riata Ln

- 1225 Ramal Ln

- 775 Riata Ln Unit 35

- 775 Riata Ln Unit LOT

- 775 Riata Ln

- 791 Riata Ln Unit LOT

- 875 Riata Ln

- 1235 Ramal Ln

- 1235 Ramal Ln Unit LOT

- 881 Riata Ln Unit LOT

- 1229 Ramal Ln Unit LOT

- 1229 Ramal Ln

- 675 Sheehy Rd

- 691 Sheehy Rd