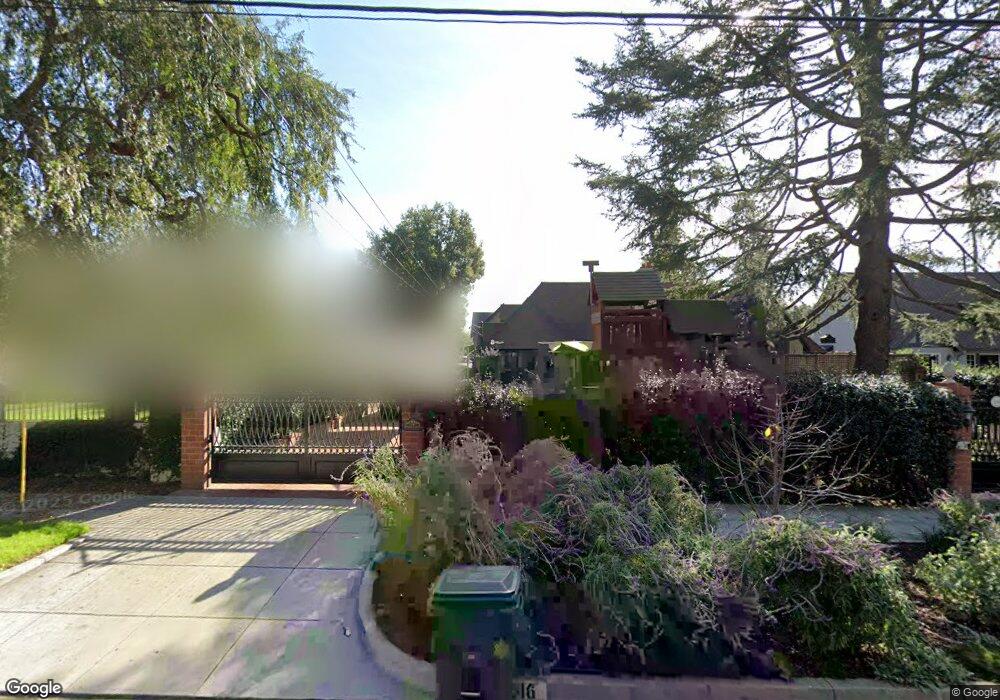

1246 E Calaveras St Altadena, CA 91001

Estimated Value: $1,030,000 - $1,868,103

4

Beds

3

Baths

2,931

Sq Ft

$491/Sq Ft

Est. Value

About This Home

This home is located at 1246 E Calaveras St, Altadena, CA 91001 and is currently estimated at $1,438,034, approximately $490 per square foot. 1246 E Calaveras St is a home located in Los Angeles County with nearby schools including Altadena Arts Magnet Elementary, Charles W. Eliot Arts Magnet Academy, and Pasadena High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 11, 2017

Sold by

Calkins John and Calkins Guadalupe

Bought by

Calkins John and Calkins Guadalupe

Current Estimated Value

Purchase Details

Closed on

Oct 28, 2001

Sold by

Cornell Brad

Bought by

Calkins John L and Calkins Guadalupe

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$564,000

Outstanding Balance

$220,601

Interest Rate

6.73%

Estimated Equity

$1,217,433

Purchase Details

Closed on

May 16, 2000

Sold by

Trust Marlow Marilyn Tr Hortense M Reece

Bought by

Cornell Brad

Purchase Details

Closed on

Mar 18, 1998

Sold by

Reece Hortense M

Bought by

Marlow Marilyn and Declaration Of Trust Of Horten

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Calkins John | -- | None Available | |

| Calkins John | -- | None Available | |

| Calkins John L | $705,000 | Southland Title Corporation | |

| Cornell Brad | $450,000 | Southland Title Corporation | |

| Marlow Marilyn | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Calkins John L | $564,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,757 | $1,109,610 | $672,165 | $437,445 |

| 2024 | $12,757 | $1,087,854 | $658,986 | $428,868 |

| 2023 | $12,648 | $1,066,524 | $646,065 | $420,459 |

| 2022 | $12,213 | $1,045,613 | $633,398 | $412,215 |

| 2021 | $11,587 | $1,025,112 | $620,979 | $404,133 |

| 2019 | $11,152 | $994,709 | $602,561 | $392,148 |

| 2018 | $11,293 | $975,206 | $590,747 | $384,459 |

| 2016 | $10,942 | $937,339 | $567,808 | $369,531 |

| 2015 | $10,824 | $923,260 | $559,279 | $363,981 |

| 2014 | $10,598 | $905,176 | $548,324 | $356,852 |

Source: Public Records

Map

Nearby Homes

- 2186 Mar Vista Ave

- 1299 Boston St

- 2469 Holliston Ave

- 1485 E Mendocino St

- 287 287 E Calaveras St

- 2032 Lewis Ave

- 2574 Ganesha Ave

- 1371 El Corto Dr

- 1134 E Altadena Dr

- 1920 Maiden Ln

- 912 E Altadena Dr

- 1201 E Altadena Dr

- 801 E Mendocino St Unit 4A

- 1052 New York Dr

- 2548 El Molino Ave

- 2151 Sinaloa Ave

- 1578 Morada Place

- 1125 Rubio St

- 1678 Braeburn Rd

- 2685 Maiden Ln

- 1234 E Calaveras St

- 1260 E Calaveras St

- 1222 E Calaveras St

- 1272 E Calaveras St

- 1241 Meadowbrook Rd

- 1251 Meadowbrook Rd

- 1231 Meadowbrook Rd

- 1261 Meadowbrook Rd

- 1233 E Calaveras St

- 1212 E Calaveras St

- 1286 E Calaveras St

- 1227 Meadowbrook Rd

- 1249 E Calaveras St

- 1273 Meadowbrook Rd

- 1263 E Calaveras St

- 1215 Meadowbrook Rd

- 1281 Meadowbrook Rd

- 1223 E Calaveras St

- 1237 E Calaveras St

- 1296 E Calaveras St