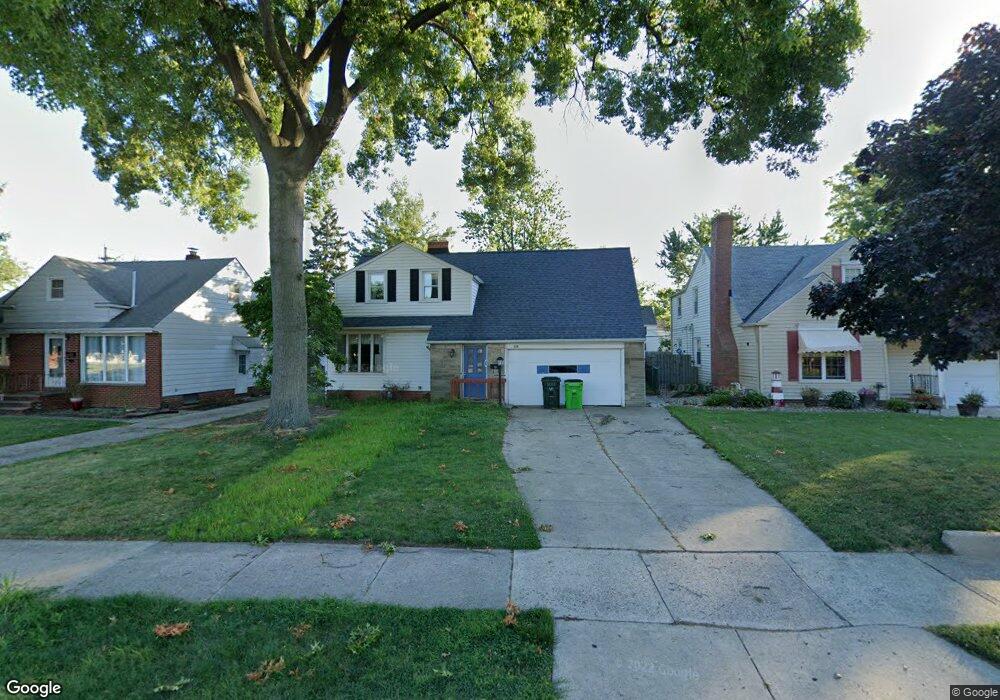

125 E 293rd St Willowick, OH 44095

Estimated Value: $166,000 - $198,000

3

Beds

2

Baths

1,034

Sq Ft

$175/Sq Ft

Est. Value

About This Home

This home is located at 125 E 293rd St, Willowick, OH 44095 and is currently estimated at $181,400, approximately $175 per square foot. 125 E 293rd St is a home located in Lake County with nearby schools including Royalview Elementary School, Willowick Middle School, and North High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 20, 2024

Sold by

Rohl Laurence E

Bought by

Laurence E Rohl Revocable Trust and Rohl

Current Estimated Value

Purchase Details

Closed on

Dec 13, 2024

Sold by

Ross Fweneti Mitchell

Bought by

Rohl Laurence E

Purchase Details

Closed on

Feb 21, 2024

Sold by

Rohl Laurence E

Bought by

Ross Fweneti Mitchell

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,300

Interest Rate

6.69%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 14, 2022

Sold by

Helen Herman Revocable Trust

Bought by

Rohl Laurence E

Purchase Details

Closed on

Nov 30, 2020

Sold by

Herman Helen

Bought by

Herman Helen and The Revocable Trust Of Helen H

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Laurence E Rohl Revocable Trust | -- | Infinity Title | |

| Laurence E Rohl Revocable Trust | -- | Infinity Title | |

| Rohl Laurence E | $156,000 | Infinity Title | |

| Rohl Laurence E | $156,000 | Infinity Title | |

| Ross Fweneti Mitchell | $140,000 | None Listed On Document | |

| Rohl Laurence E | $120,000 | Infinity Title | |

| Herman Helen | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ross Fweneti Mitchell | $135,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $60,760 | $12,600 | $48,160 |

| 2024 | -- | $60,760 | $12,600 | $48,160 |

| 2023 | $3,341 | $45,370 | $9,800 | $35,570 |

| 2022 | $2,651 | $45,370 | $9,800 | $35,570 |

| 2021 | $2,661 | $45,370 | $9,800 | $35,570 |

| 2020 | $2,542 | $40,510 | $8,750 | $31,760 |

| 2019 | $2,383 | $40,510 | $8,750 | $31,760 |

| 2018 | $2,273 | $36,920 | $15,050 | $21,870 |

| 2017 | $2,191 | $36,920 | $15,050 | $21,870 |

| 2016 | $2,187 | $36,920 | $15,050 | $21,870 |

| 2015 | $2,134 | $36,920 | $15,050 | $21,870 |

| 2014 | $2,040 | $36,920 | $15,050 | $21,870 |

| 2013 | $2,040 | $36,920 | $15,050 | $21,870 |

Source: Public Records

Map

Nearby Homes

- 318 Lakewick Ln

- 294 Lakewick Ln

- 311 E 293rd St

- 28525 Lakeshore Blvd

- 226 E 286th St

- 278 E 286th St

- 355 Blissfield Dr

- 150 Westbrook Dr

- 29107 Edgewood Dr

- 28642 Forest Rd

- 29010 Barjode Rd

- 29103 Barjode Rd

- 29034 Barjode Rd

- 295 E 276th St

- 30317 Thomas St

- 29933 Enid Rd

- 30325 Mildred Dr

- 30051 Regent Rd

- 30704 Willowick Dr

- 29616 Grand Blvd

- 121 E 293rd St

- 131 E 293rd St

- 135 E 293rd St

- 115 E 293rd St

- 124 E 294th St

- 130 E 294th St

- 120 E 294th St

- 141 E 293rd St

- 134 E 294th St

- 114 E 294th St

- 124 E 293rd St

- 140 E 294th St

- 145 E 293rd St

- 134 E 293rd St

- 114 E 293rd St

- 29320 Cresthaven Dr

- 29360 Cresthaven Dr

- 144 E 294th St

- 29366 Cresthaven Dr

- 29310 Cresthaven Dr