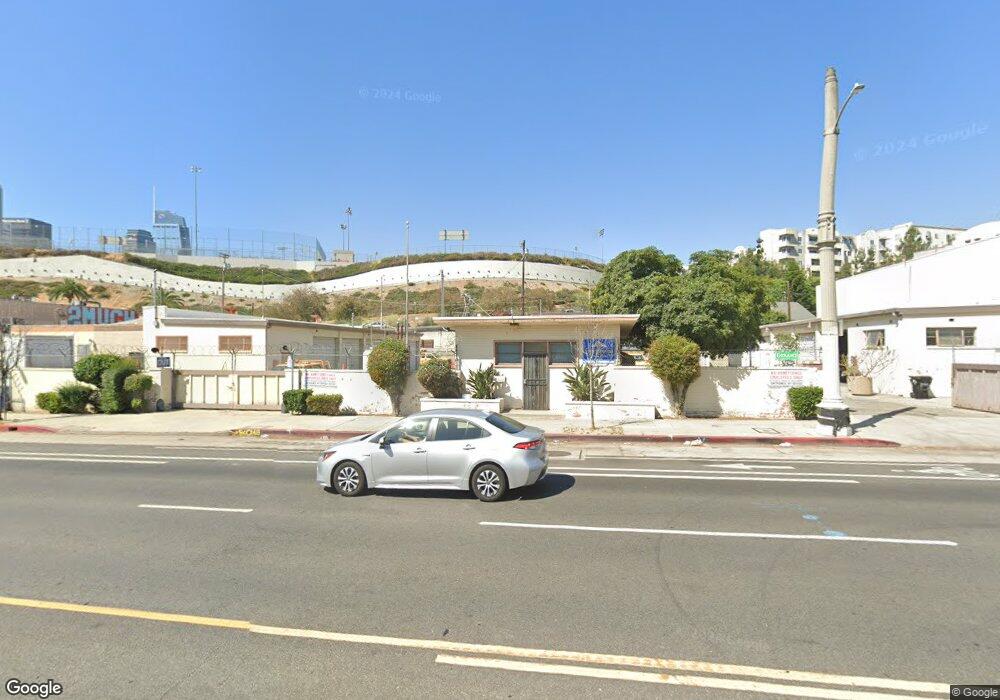

1274 W 2nd St Los Angeles, CA 90026

Westlake NeighborhoodEstimated Value: $806,000 - $885,000

2

Beds

2

Baths

1,312

Sq Ft

$653/Sq Ft

Est. Value

About This Home

This home is located at 1274 W 2nd St, Los Angeles, CA 90026 and is currently estimated at $857,066, approximately $653 per square foot. 1274 W 2nd St is a home located in Los Angeles County with nearby schools including Sal Castro Middle School, Academic Leadership Community Miguel Contreras Learning Complex, and Belmont High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 16, 2004

Sold by

Akemon Helen Amelia and Helen A Akemon Revocable Trust

Bought by

Barnes Gerald and Cristino Marian

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$396,000

Outstanding Balance

$210,535

Interest Rate

6.99%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$646,531

Purchase Details

Closed on

Sep 18, 2003

Sold by

Akemon Helen A

Bought by

Akemon Helen Amelia and The Helen A Akemon Revocable T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,000

Interest Rate

6.3%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Oct 19, 1999

Sold by

Caldwell Ellis R

Bought by

Helen Amelia Akemon Living Trust

Purchase Details

Closed on

Apr 10, 1996

Sold by

Akemon Helen A

Bought by

Akemon Helan A and Akemon Rene Caldwell

Purchase Details

Closed on

Dec 13, 1995

Sold by

Caldwell Ellis Rene

Bought by

Akemon Helen Amelia

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Barnes Gerald | $495,000 | First American Title Company | |

| Akemon Helen Amelia | -- | Ticor Title Company | |

| Helen Amelia Akemon Living Trust | -- | -- | |

| Akemon Helan A | -- | -- | |

| Akemon Helen Amelia | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Barnes Gerald | $396,000 | |

| Previous Owner | Akemon Helen Amelia | $250,000 | |

| Closed | Barnes Gerald | $99,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,273 | $689,971 | $533,166 | $156,805 |

| 2024 | $8,273 | $676,443 | $522,712 | $153,731 |

| 2023 | $8,112 | $663,180 | $512,463 | $150,717 |

| 2022 | $7,732 | $650,177 | $502,415 | $147,762 |

| 2021 | $7,635 | $637,429 | $492,564 | $144,865 |

| 2019 | $7,069 | $590,000 | $455,700 | $134,300 |

| 2018 | $7,123 | $590,000 | $455,700 | $134,300 |

| 2017 | $6,613 | $549,000 | $424,000 | $125,000 |

| 2016 | $5,824 | $485,000 | $374,900 | $110,100 |

| 2015 | $5,257 | $437,400 | $338,100 | $99,300 |

| 2014 | $5,383 | $437,400 | $338,100 | $99,300 |

Source: Public Records

Map

Nearby Homes

- 117 N Toluca St

- 145 N Toluca St

- 1260 W 1st St

- 224 N Bixel St

- 216 Columbia Place

- 306 N Bixel St

- 308 E Edgeware Rd

- 217 Columbia Place

- 261 Witmer St

- 1415 W Court St

- 340 Firmin St

- 324 Witmer St

- 311 Witmer St

- 341 Douglas St

- 334 Witmer St

- 400 Witmer St

- 318 Columbia Ave

- 401 Witmer St

- 880 W 1st St Unit 211

- 880 W 1st St Unit 304

- 222 1/2 S Toluca St

- 222 S Toluca St

- 1262 W 2nd St

- 251 Emerald St

- 0 N Toluca St

- 242 S Toluca St

- 1273 W 2nd St

- 1265 W 2nd St

- 1263 W 2nd St

- 1264 W 1st St

- 1259 W 2nd St

- 1249 W 2nd St

- 1258 W 1st St

- 1245 W 2nd St

- 119 S Bixel St

- 117 S Bixel St

- 1252 W 1st St Unit B

- 1304 W 2nd St

- 212 Emerald St

- 200 Lucas Ave