1286 Stagecoach Trail Loop Unit 4 Chula Vista, CA 91915

Eastlake NeighborhoodEstimated Value: $569,689 - $650,000

2

Beds

2

Baths

1,039

Sq Ft

$590/Sq Ft

Est. Value

About This Home

This home is located at 1286 Stagecoach Trail Loop Unit 4, Chula Vista, CA 91915 and is currently estimated at $613,422, approximately $590 per square foot. 1286 Stagecoach Trail Loop Unit 4 is a home located in San Diego County with nearby schools including Eastlake Middle School, Eastlake High School, and Arroyo Vista Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 1, 2007

Sold by

Wells Fargo Bank Na

Bought by

Harness Michael R

Current Estimated Value

Purchase Details

Closed on

Nov 24, 2006

Sold by

Sanchez Martha L

Bought by

Wells Fargo Bank Na

Purchase Details

Closed on

Jun 15, 2005

Sold by

Durante Gina M

Bought by

Sanchez Martha L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$355,500

Interest Rate

6.55%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Dec 2, 2002

Sold by

Shea Homes Ltd Partnership

Bought by

Durante Gina M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$197,350

Interest Rate

5.4%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Harness Michael R | $247,000 | Chicago Title Co Irvine | |

| Wells Fargo Bank Na | $336,000 | Accommodation | |

| Sanchez Martha L | $395,000 | First American Title Co | |

| Durante Gina M | $247,000 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sanchez Martha L | $355,500 | |

| Previous Owner | Durante Gina M | $197,350 | |

| Closed | Durante Gina M | $48,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,030 | $367,762 | $183,881 | $183,881 |

| 2024 | $5,030 | $360,552 | $180,276 | $180,276 |

| 2023 | $4,935 | $353,484 | $176,742 | $176,742 |

| 2022 | $4,777 | $346,554 | $173,277 | $173,277 |

| 2021 | $4,661 | $339,760 | $169,880 | $169,880 |

| 2020 | $4,547 | $336,278 | $168,139 | $168,139 |

| 2019 | $4,429 | $329,686 | $164,843 | $164,843 |

| 2018 | $4,352 | $323,222 | $161,611 | $161,611 |

| 2017 | $4,200 | $310,000 | $138,000 | $172,000 |

| 2016 | $3,820 | $280,000 | $125,000 | $155,000 |

| 2015 | $3,539 | $255,000 | $114,000 | $141,000 |

| 2014 | $3,225 | $220,000 | $99,000 | $121,000 |

Source: Public Records

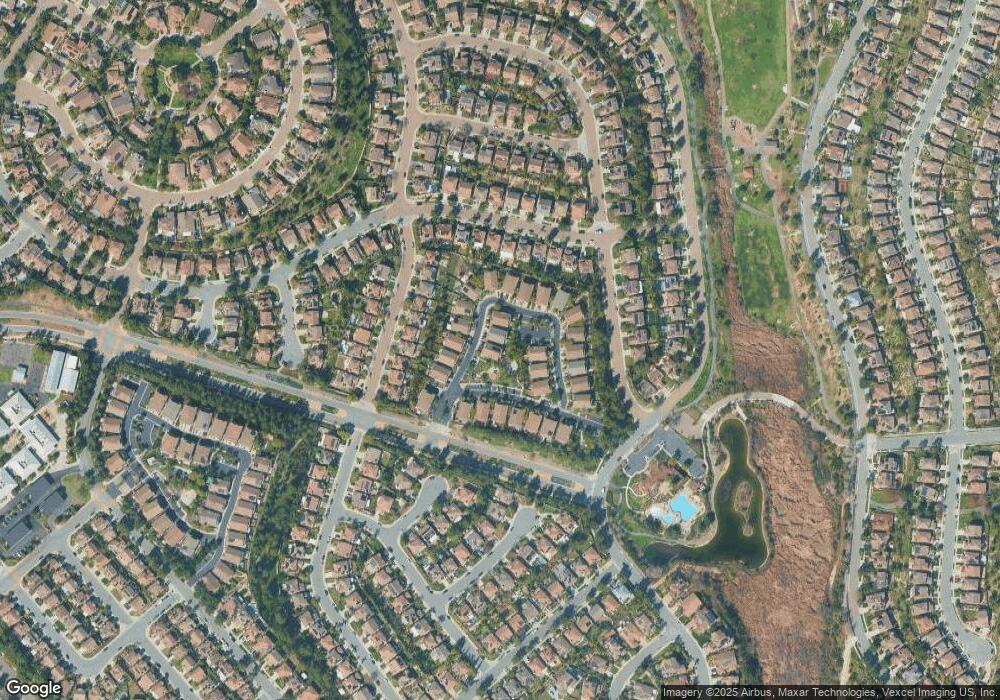

Map

Nearby Homes

- 1277 Granite Springs Dr

- 1288 Long View Dr

- 2744 Rambling Vista Rd

- 1427 Marble Canyon Way

- 1452 S Creekside Dr

- 1238 Silver Hawk Way

- 2792 Rambling Vista Rd

- 1436 Horn Canyon Ave

- 1498 Marble Canyon Way

- 2471 Myrtle Beach Way

- 2817 Red Rock Canyon Rd

- 2832 Echo Ridge Ct

- 1328 N Paradise Ridge Way

- 2721 Castlehill Rd Unit 1

- 1505 Laurel Grove Dr Unit 3

- 1461 Agate Creek Way

- 2850 Palmetto Point Ct

- 2796 Bear Valley Rd

- 2811 Bear Valley Rd

- 1569 Hackberry Place

- 1290 Stagecoach Trail Loop Unit 5

- 1288 Stagecoach Trail Loop

- 1288 Stagecoach Trail Loop

- 1280 Stagecoach Trail Loop

- 1284 Stagecoach Trail Loop

- 2610 Wildhorse Trail Way Unit 1

- 1276 Stagecoach Trail Loop

- 1274 Stagecoach Trail Loop

- 2616 Wildhorse Trail Way

- 2616 Wildhorse Trail Way

- 2620 Wildhorse Trail Way

- 1278 Stagecoach Trail Loop

- 2634 Wildhorse Trail Way

- 1281 Granite Springs Dr

- 1285 Granite Springs Dr

- 1270 Stagecoach Trail Loop

- 1271 Stagecoach Trail Loop

- 1273 Granite Springs Dr

- 2642 Wildhorse Trail Way Unit 71

- 1268 Stagecoach Trail Loop