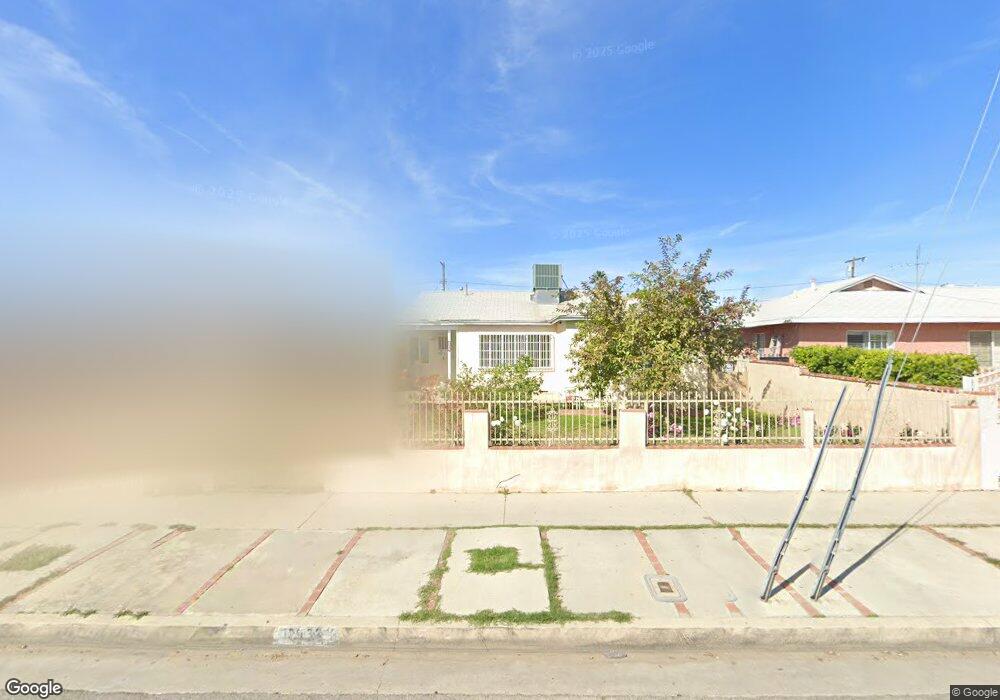

12933 Osborne St Pacoima, CA 91331

Estimated Value: $618,000 - $742,000

2

Beds

1

Bath

883

Sq Ft

$751/Sq Ft

Est. Value

About This Home

This home is located at 12933 Osborne St, Pacoima, CA 91331 and is currently estimated at $663,193, approximately $751 per square foot. 12933 Osborne St is a home located in Los Angeles County with nearby schools including Pacoima Middle School, San Fernando Senior High School, and Montague Charter Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 12, 2009

Sold by

Us Bank National Association

Bought by

Siguenza Mario Humberto and Siguenza Maria Delaluz

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$194,413

Interest Rate

5.14%

Mortgage Type

FHA

Purchase Details

Closed on

Feb 6, 2009

Sold by

Castellon Rosa M

Bought by

Us Bank National Association

Purchase Details

Closed on

Jun 3, 1998

Sold by

Castellon Gilberto

Bought by

Castellon Gilberto and Castellon Rosa M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,070

Interest Rate

7.17%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 16, 1997

Sold by

Castellon Jose

Bought by

Castellon Gilberto and Castellon Rosa M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Siguenza Mario Humberto | $198,000 | First American Title Company | |

| Us Bank National Association | $175,000 | None Available | |

| Castellon Gilberto | -- | Benefit Land Title Company | |

| Castellon Gilberto | -- | American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Siguenza Mario Humberto | $194,413 | |

| Previous Owner | Castellon Gilberto | $119,070 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,199 | $255,569 | $103,388 | $152,181 |

| 2024 | $3,199 | $250,559 | $101,361 | $149,198 |

| 2023 | $3,139 | $245,647 | $99,374 | $146,273 |

| 2022 | $2,997 | $240,831 | $97,426 | $143,405 |

| 2021 | $2,958 | $236,110 | $95,516 | $140,594 |

| 2019 | $2,871 | $229,109 | $92,684 | $136,425 |

| 2018 | $2,744 | $224,617 | $90,867 | $133,750 |

| 2016 | $2,614 | $215,897 | $87,340 | $128,557 |

| 2015 | $2,576 | $212,655 | $86,029 | $126,626 |

| 2014 | $2,591 | $208,490 | $84,344 | $124,146 |

Source: Public Records

Map

Nearby Homes

- 13161 Kelowna St

- 12985 Kagel Canyon St

- 9722 Pine Orchard St

- 13200 Glamis St

- 9654 Laurel Canyon Blvd

- 13157 Glamis St

- 12557 Debell St

- 10397 San Fernando

- 9660 Pine Orchard St

- 10028 San Fernando Rd

- 10028 San Fernando Rd Unit 34

- 10004 San Fernando Rd

- 10004 San Fernando Rd Unit 3

- 9562 Sundance St

- 9502 Laurel Canyon Blvd

- 13068 Mineola St

- 10246 Haddon Ave

- 9606 Vena Ave

- 10218 Bradley Ave

- 13511 Terra Bella St

- 12929 Osborne St

- 12937 Osborne St

- 12925 Osborne St

- 12941 Osborne St

- 12919 Osborne St

- 12945 Osborne St

- 12972 Sunburst St

- 12976 Sunburst St

- 12966 Sunburst St

- 12982 Sunburst St

- 12962 Sunburst St

- 12915 Osborne St

- 12951 Osborne St

- 12986 Sunburst St

- 12956 Sunburst St

- 12928 Osborne St

- 12922 Osborne St

- 12936 Osborne St

- 12909 Osborne St

- 12957 Osborne St

Your Personal Tour Guide

Ask me questions while you tour the home.