14055 Giant Forest Loop Chino Hills, CA 91709

North Chino Hills NeighborhoodEstimated Value: $1,525,000 - $2,302,000

3

Beds

3

Baths

4,088

Sq Ft

$464/Sq Ft

Est. Value

About This Home

This home is located at 14055 Giant Forest Loop, Chino Hills, CA 91709 and is currently estimated at $1,898,440, approximately $464 per square foot. 14055 Giant Forest Loop is a home located in San Bernardino County with nearby schools including Gerald F. Litel Elementary School, Canyon Hills Junior High School, and Ruben S. Ayala High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 23, 2020

Sold by

Evangeline Fernandes Trust and Fernandes Evangeline

Bought by

Evangeline Fernandes Trust and Fernandes

Current Estimated Value

Purchase Details

Closed on

May 22, 2018

Sold by

Fernandes Evangeline and The Evangeline Fernanfes Trust

Bought by

Fernandes Evangeline M and The Evanggeline Fernandes Trus

Purchase Details

Closed on

Dec 4, 2001

Sold by

Fernandes Evangeline and Antonio Fernandes Family Trust

Bought by

Fernandes Evangeline and Evangeline Fernandes Trust

Purchase Details

Closed on

Feb 14, 1995

Sold by

Fernandes Evangeline and Lourenco Jack C

Bought by

Lourenco Manuel C and Fernandes Evangeline

Purchase Details

Closed on

Nov 22, 1994

Sold by

Fernandes Evangeline and Antonio Fernandes Family Trust

Bought by

Fernandes Evangeline and Antonio Fernandes Family Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Evangeline Fernandes Trust | -- | Fernandes Evangeline | |

| Fernandes Evangeline M | -- | None Available | |

| Fernandes Evangeline | -- | -- | |

| Lourenco Manuel C | -- | -- | |

| Lourenco Manuel C | -- | -- | |

| Fernandes Evangeline | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,802 | $904,986 | $211,234 | $693,752 |

| 2024 | $9,802 | $887,241 | $207,092 | $680,149 |

| 2023 | $9,531 | $869,844 | $203,031 | $666,813 |

| 2022 | $9,474 | $852,788 | $199,050 | $653,738 |

| 2021 | $9,290 | $836,067 | $195,147 | $640,920 |

| 2020 | $14,738 | $1,331,747 | $417,873 | $913,874 |

| 2019 | $14,480 | $1,305,634 | $409,679 | $895,955 |

| 2018 | $8,732 | $795,341 | $188,414 | $606,927 |

| 2017 | $8,575 | $779,746 | $184,720 | $595,026 |

| 2016 | $8,010 | $764,457 | $181,098 | $583,359 |

| 2015 | $7,848 | $752,974 | $178,378 | $574,596 |

| 2014 | $8,245 | $738,224 | $174,884 | $563,340 |

Source: Public Records

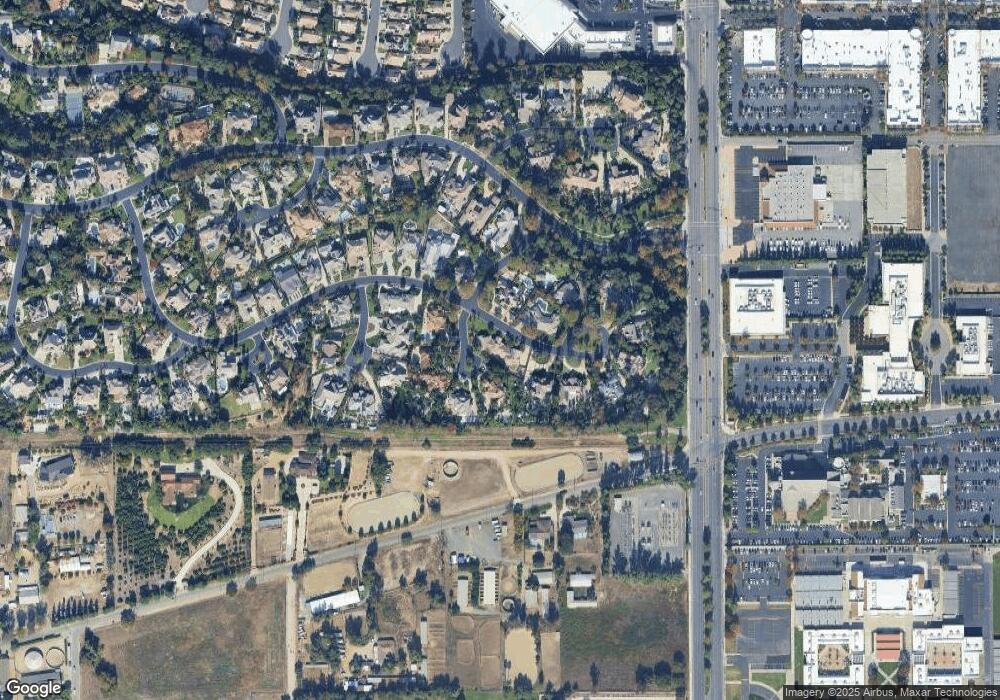

Map

Nearby Homes

- 3248 Giant Forest Loop

- 3056 Giant Forest Loop

- 13798 Roswell Ave

- 13530 Tawny Ln

- 3546 Garden Ct

- 3199 Morningfield Dr

- 3167 Morningfield Dr

- 3159 Morningfield Dr

- 3786 Daisy Dr

- 3714 Garden Ct

- 2460 Windmill Creek Rd

- 13593 Monte Royale Dr

- 2515 Pointe Coupee

- 13255 Sonrisa Dr

- 3964 Alder Place

- 3473 Terrace Dr

- 2509 Moon Dust Dr Unit A

- 2286 Black Pine Rd

- 14726 Moon Crest Ln Unit E

- 2432 Moon Dust Dr Unit B

- 14067 Golden Raintree Ln

- 3218 Giant Forest Loop

- 3206 Giant Forest Loop

- 3219 Giant Forest Loop

- 14044 Golden Raintree Ln

- 14068 Golden Raintree Ln

- 14056 Golden Raintree Ln

- 3188 Giant Forest Loop

- 3231 Giant Forest Loop

- 3230 Giant Forest Loop

- 14047 Evening Primrose Place

- 3161 Giant Forest Loop

- 14059 Evening Primrose Place

- 14020 Golden Raintree Ln

- 3241 Giant Forest Loop

- 3242 Giant Forest Loop

- 3248 Giant Forest Loop

- 3164 Giant Forest Loop

- 3175 Payne Ranch Rd

- 14071 Evening Primrose Place