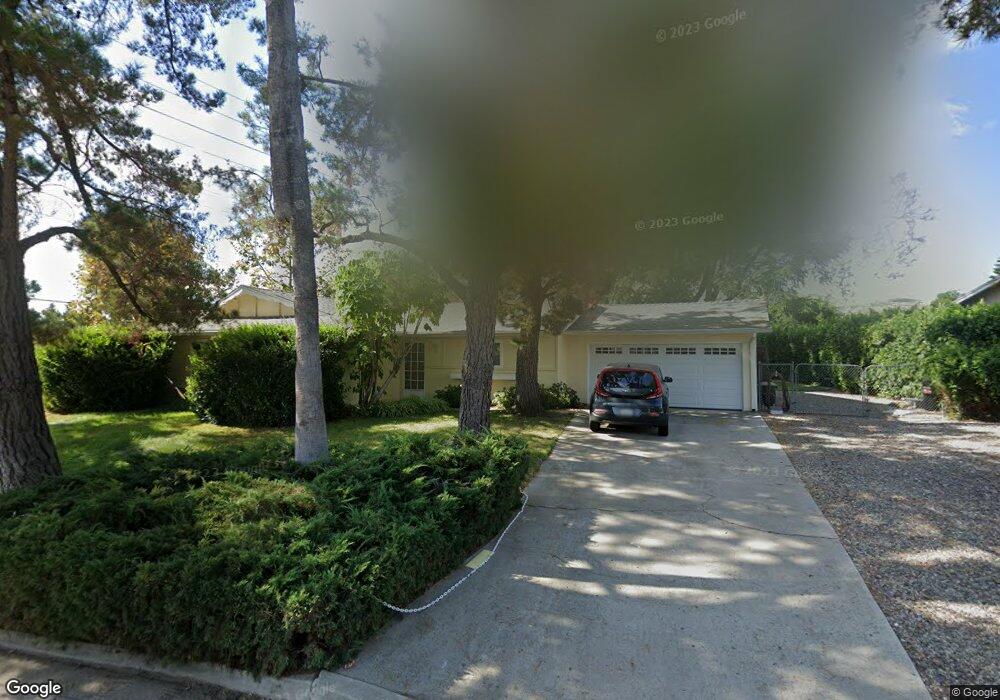

1411 Vaquero Dr Simi Valley, CA 93065

West Simi Valley NeighborhoodEstimated Value: $733,000 - $918,000

3

Beds

2

Baths

1,268

Sq Ft

$659/Sq Ft

Est. Value

About This Home

This home is located at 1411 Vaquero Dr, Simi Valley, CA 93065 and is currently estimated at $835,479, approximately $658 per square foot. 1411 Vaquero Dr is a home located in Ventura County with nearby schools including Madera Elementary School, Sinaloa Middle School, and Royal High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 12, 2018

Sold by

Read Mary Ann and Torchio James Anthony

Bought by

Read Mary Ann and Torchio James Anthony

Current Estimated Value

Purchase Details

Closed on

Jun 7, 1996

Sold by

Corbell Marjorie

Bought by

Torchio James Anthony and Read Mary Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$154,653

Outstanding Balance

$10,151

Interest Rate

8.3%

Mortgage Type

FHA

Estimated Equity

$825,328

Purchase Details

Closed on

Nov 29, 1993

Sold by

Corbell Marjorie

Bought by

Corbell Marjorie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$64,000

Interest Rate

4%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Read Mary Ann | -- | None Available | |

| Torchio James Anthony | $160,000 | First American Title Ins Co | |

| Corbell Marjorie | -- | Fidelity National Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Torchio James Anthony | $154,653 | |

| Previous Owner | Corbell Marjorie | $64,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,517 | $260,560 | $104,221 | $156,339 |

| 2024 | $3,517 | $255,451 | $102,177 | $153,274 |

| 2023 | $3,304 | $250,443 | $100,174 | $150,269 |

| 2022 | $3,268 | $245,533 | $98,210 | $147,323 |

| 2021 | $3,223 | $240,719 | $96,284 | $144,435 |

| 2020 | $3,143 | $238,253 | $95,298 | $142,955 |

| 2019 | $2,997 | $233,582 | $93,430 | $140,152 |

| 2018 | $2,957 | $229,003 | $91,599 | $137,404 |

| 2017 | $2,881 | $224,513 | $89,803 | $134,710 |

| 2016 | $2,747 | $220,112 | $88,043 | $132,069 |

| 2015 | $2,678 | $216,807 | $86,721 | $130,086 |

| 2014 | $2,628 | $212,562 | $85,023 | $127,539 |

Source: Public Records

Map

Nearby Homes

- 233 E Bonita Dr

- 1675 Tanglebush Ln

- 42 Skyflower Ln Unit 249

- 252 Capri Dr

- 459 Mark Dr

- 230 Farmhouse Dr Unit 3

- 1101 Hacienda Dr

- 300 Farmhouse Dr Unit 3

- 533 Mark Dr

- 114 Red Brick Dr Unit 1

- 118 Red Brick Dr Unit 1

- 310 Farmhouse Dr Unit 4

- 101 Red Brick Dr Unit 5

- 76 Robbins Ct

- 1100 N Country Club Dr

- 75 Vista Lago Dr

- 265 Hermes St

- 1778 Sinaloa Rd Unit 193

- 1778 Sinaloa Rd Unit 294

- 1421 Vaquero Dr

- 225 Royal Ave

- 1404 Vaquero Dr

- 1410 Vaquero Dr

- 222 Royal Ave

- 1420 Vaquero Dr

- 1441 Vaquero Dr

- 1430 Vaquero Dr

- 1405 Elvado Dr

- 1451 Vaquero Dr

- 1440 Vaquero Dr

- 1419 Elvado Dr

- 1427 Elvado Dr

- 1467 Elvado Dr

- 1450 Vaquero Dr

- 1461 Vaquero Dr

- 1487 Elvado Dr

- 1460 Vaquero Dr

- 1505 Elvado Dr

- 281 Royal Ave