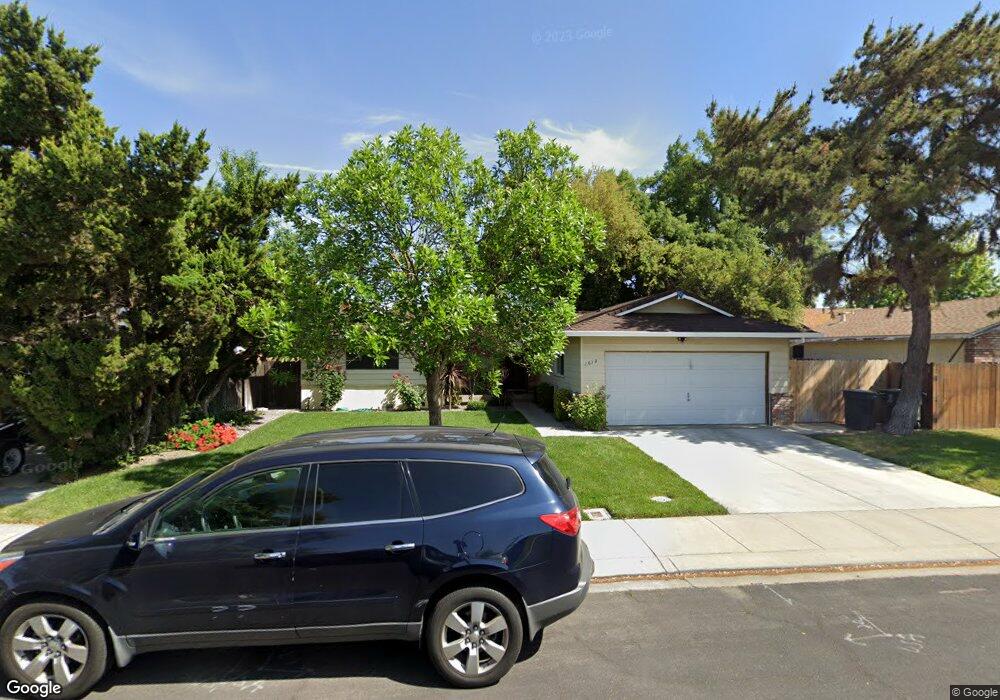

1613 Delphine Ave Modesto, CA 95350

Estimated Value: $372,000 - $480,000

3

Beds

2

Baths

1,448

Sq Ft

$298/Sq Ft

Est. Value

About This Home

This home is located at 1613 Delphine Ave, Modesto, CA 95350 and is currently estimated at $430,991, approximately $297 per square foot. 1613 Delphine Ave is a home located in Stanislaus County with nearby schools including George Eisenhut Elementary School, Prescott Junior High School, and Grace M. Davis High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 16, 2019

Sold by

Braley Keith G and Braley Keith

Bought by

Anderson Scott M and Andersen Naomi M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$275,500

Outstanding Balance

$239,802

Interest Rate

3.82%

Mortgage Type

New Conventional

Estimated Equity

$191,189

Purchase Details

Closed on

Sep 26, 2014

Sold by

Henman Kerry L and Braley Kerry L

Bought by

Keith & Kerry Braley Revocable Trust

Purchase Details

Closed on

Jun 13, 1994

Sold by

Henman Kerry L

Bought by

Henman Kerry L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$65,000

Interest Rate

6%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Anderson Scott M | $290,000 | Old Republic Title Company | |

| Keith & Kerry Braley Revocable Trust | -- | None Available | |

| Henman Kerry L | -- | Fidelity National Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Anderson Scott M | $275,500 | |

| Previous Owner | Henman Kerry L | $65,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,575 | $317,154 | $153,109 | $164,045 |

| 2024 | $3,447 | $310,936 | $150,107 | $160,829 |

| 2023 | $3,383 | $304,840 | $147,164 | $157,676 |

| 2022 | $3,290 | $298,864 | $144,279 | $154,585 |

| 2021 | $3,108 | $293,004 | $141,450 | $151,554 |

| 2020 | $3,066 | $290,000 | $140,000 | $150,000 |

| 2019 | $739 | $67,651 | $14,487 | $53,164 |

| 2018 | $730 | $66,325 | $14,203 | $52,122 |

| 2017 | $713 | $65,025 | $13,925 | $51,100 |

| 2016 | $694 | $63,751 | $13,652 | $50,099 |

| 2015 | $688 | $62,794 | $13,447 | $49,347 |

| 2014 | $681 | $61,565 | $13,184 | $48,381 |

Source: Public Records

Map

Nearby Homes

- 3141 Lisa Dr

- 1540 Switzer Ct

- 1805 Glaston Ave

- 3212 Royalton Ave

- 1436 Montclair Dr

- 3104 Wollam Dr

- 2840 Levon Ave

- 3101 Wyatt Way

- 1953 Debonaire Dr

- 1459 Standiford Ave Unit 68

- 1459 Standiford Ave Unit SP 24

- 3601 Agate Dr

- 1306 Joni Ave

- 3700 Tully Rd Unit 57

- 3700 Tully Rd Unit 120

- 2052 Esther Dr

- 3713 Felkirk Way

- 1905 Shell Ct

- 2044 Juanita Ct

- 2128 Barrington Ln