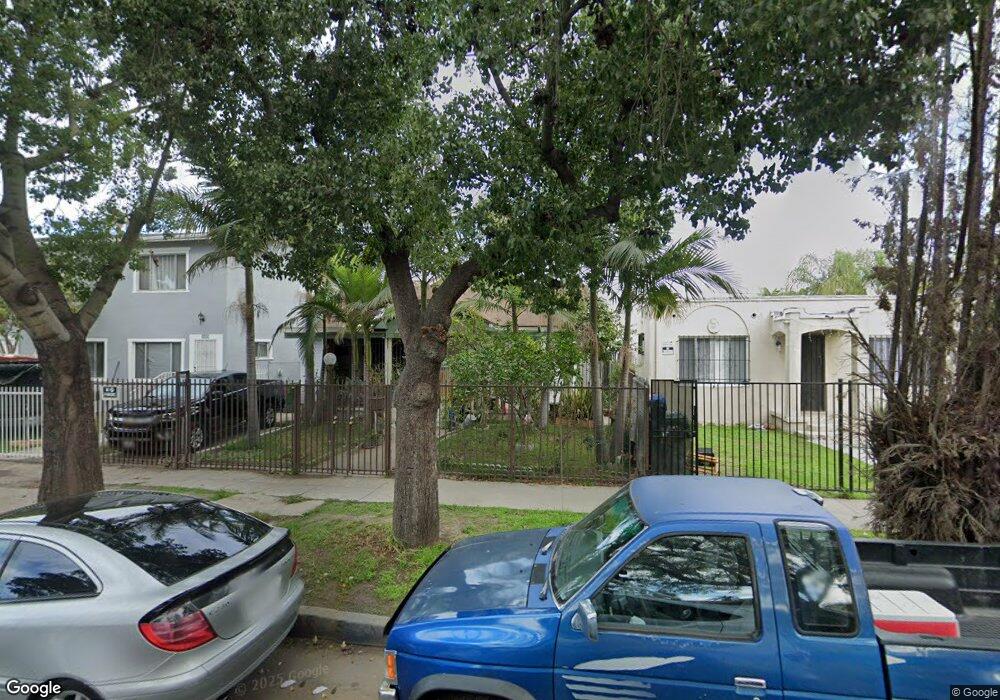

1655 W 38th Place Los Angeles, CA 90062

Exposition Park NeighborhoodEstimated Value: $733,381 - $799,000

3

Beds

1

Bath

1,310

Sq Ft

$579/Sq Ft

Est. Value

About This Home

This home is located at 1655 W 38th Place, Los Angeles, CA 90062 and is currently estimated at $758,595, approximately $579 per square foot. 1655 W 38th Place is a home located in Los Angeles County with nearby schools including Martin Luther King Jr. Elementary School, Manual Arts Senior High School, and New Heights Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 23, 2020

Sold by

Medrano Alfredo

Bought by

Medrano Alfredo and Alfredo Medrano Living Trust

Current Estimated Value

Purchase Details

Closed on

Feb 27, 2008

Sold by

Medrano Alfredo

Bought by

Medrano Alfredo

Purchase Details

Closed on

Mar 4, 2004

Sold by

Stewart Zelma Mary Farr and Stewart James Houston

Bought by

Medrano Alfredo

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$196,000

Outstanding Balance

$91,730

Interest Rate

5.69%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$666,865

Purchase Details

Closed on

Jan 16, 2003

Sold by

Stewart James H and Stewart Zelma M

Bought by

Stewart James Houston

Purchase Details

Closed on

May 13, 1994

Sold by

Stewart Walter N

Bought by

Stewart Walter N

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Medrano Alfredo | -- | None Available | |

| Medrano Alfredo | -- | None Available | |

| Medrano Alfredo | $245,000 | Gateway Title Company | |

| Stewart James Houston | -- | -- | |

| Stewart Walter N | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Medrano Alfredo | $196,000 | |

| Closed | Medrano Alfredo | $49,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,300 | $348,315 | $278,661 | $69,654 |

| 2024 | $4,300 | $341,487 | $273,198 | $68,289 |

| 2023 | $4,222 | $334,792 | $267,842 | $66,950 |

| 2022 | $4,034 | $328,229 | $262,591 | $65,638 |

| 2021 | $3,977 | $321,794 | $257,443 | $64,351 |

| 2019 | $3,860 | $312,252 | $249,808 | $62,444 |

| 2018 | $3,772 | $306,130 | $244,910 | $61,220 |

| 2016 | $3,598 | $294,244 | $235,400 | $58,844 |

| 2015 | $3,546 | $289,826 | $231,865 | $57,961 |

| 2014 | $3,565 | $284,150 | $227,324 | $56,826 |

Source: Public Records

Map

Nearby Homes

- 3803 S Saint Andrews Place

- 1619 W 38th St

- 1659 W 39th St

- 1619 W 39th St

- 3775 Ruthelen St

- 1821 Middleton Place

- 3720 S St Andrews Place

- 3711 S Western Ave

- 3705 S St Andrews Place

- 1782 W 36th Place

- 1726 Leighton Ave

- 3734 S Harvard Blvd

- 1723 Browning Blvd

- 1637 W 37th St

- 1572 W 37th Place

- 3702 Cimarron St

- 3877 Denker Ave

- 1929 Rochester Cir

- 1742 W 36th St

- 1597 W 37th St

- 1653 W 38th Place Unit 4

- 1653 W 38th Place

- 3814 S St Andrews Place

- 1657 W 38th Place

- 3815 S St Andrews Place

- 3810 S St Andrews Place

- 1647 W 38th Place

- 3815 S St Andrews Place

- 3811 S St Andrews Place

- 3808 S St Andrews Place

- 3807 S St Andrews Place

- 1641 W 38th Place

- 1707 W 38th Place

- 1650 W 38th St

- 1654 W 38th St

- 3804 S St Andrews Pl Place

- 3805 S Saint Andrews Place

- 3804 S St Andrews Place

- 1639 W 38th Place

- 1711 W 38th Place