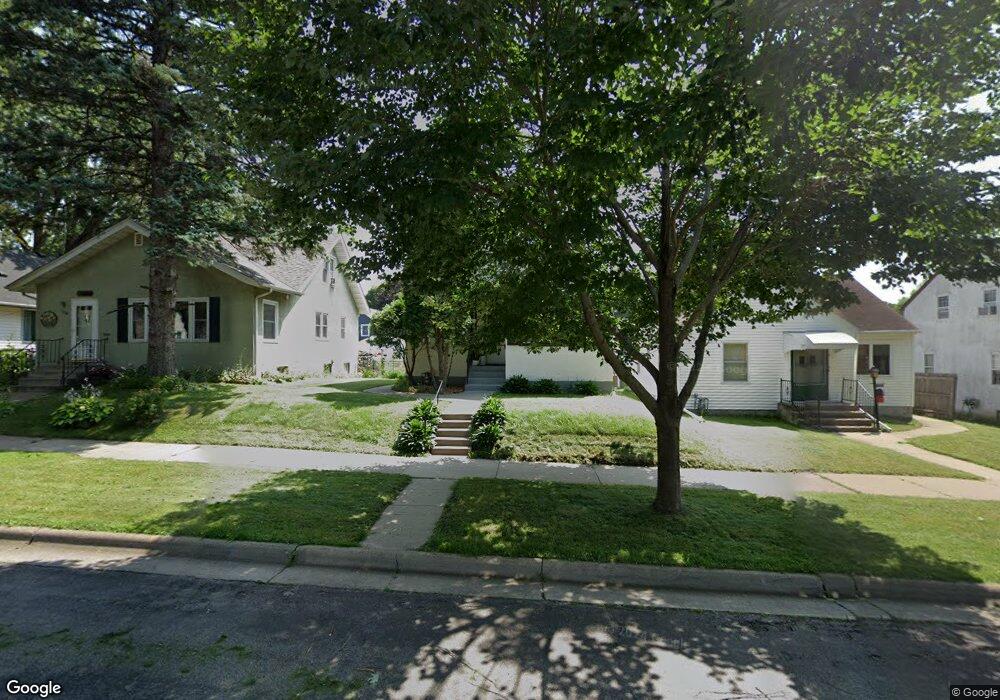

1866 Hyacinth Ave E Saint Paul, MN 55119

Southern Hayden Heights NeighborhoodEstimated Value: $269,698 - $281,000

3

Beds

2

Baths

1,524

Sq Ft

$180/Sq Ft

Est. Value

About This Home

This home is located at 1866 Hyacinth Ave E, Saint Paul, MN 55119 and is currently estimated at $274,675, approximately $180 per square foot. 1866 Hyacinth Ave E is a home located in Ramsey County with nearby schools including The Heights Community School, Battle Creek Middle School, and Johnson Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 30, 2025

Sold by

Heuser Monica Denise and Harmon Li

Bought by

Harmon Veda Jo

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$201,000

Outstanding Balance

$199,761

Interest Rate

6.72%

Mortgage Type

New Conventional

Estimated Equity

$74,914

Purchase Details

Closed on

Jul 27, 2021

Sold by

Jungemann Nathan and Huisken Rebecca

Bought by

Heuser Monica Denise and Harmon Li

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$202,500

Interest Rate

2.93%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 19, 2016

Sold by

Kelsey Mary C and Kelsey Paul A

Bought by

Jungemann Nathan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$145,015

Interest Rate

4.03%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 15, 1998

Sold by

Mischnick Jeffery L and Mischnick Debra L

Bought by

Bibeau Jeffrey A and Bibeau Alison P

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Harmon Veda Jo | $251,250 | Watermark Title | |

| Heuser Monica Denise | $225,000 | Edina Realty Title Inc | |

| Jungemann Nathan | $154,030 | On Site Title Llc | |

| Bibeau Jeffrey A | $75,000 | -- | |

| Heuser Monica Monica | $225,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Harmon Veda Jo | $201,000 | |

| Previous Owner | Heuser Monica Denise | $202,500 | |

| Previous Owner | Jungemann Nathan | $145,015 | |

| Closed | Heuser Monica Monica | $202,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,888 | $278,700 | $30,000 | $248,700 |

| 2023 | $3,888 | $252,300 | $25,000 | $227,300 |

| 2022 | $3,324 | $256,900 | $25,000 | $231,900 |

| 2021 | $3,004 | $217,900 | $25,000 | $192,900 |

| 2020 | $2,626 | $205,600 | $19,400 | $186,200 |

| 2019 | $2,684 | $172,300 | $19,400 | $152,900 |

| 2018 | $2,156 | $173,100 | $19,400 | $153,700 |

| 2017 | $2,932 | $148,100 | $19,400 | $128,700 |

| 2016 | $2,884 | $0 | $0 | $0 |

| 2015 | $2,930 | $124,500 | $19,400 | $105,100 |

| 2014 | $2,118 | $0 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 1806 Maryland Ave E

- 1728 Orange Ave E

- 1842 Arlington Ave E

- 1732 Maryland Ave E

- 2014 Cottage Ave E

- 2003 Cottage Ave E

- 1406 Furness Pkwy

- 1822 Nevada Ave E

- 1729 Sherwood Ave

- 1963 Arlington Ave E

- 1144 Flandrau St

- 1675 Clear Ave

- 1093 Breen St

- 1836 Mechanic Ave

- 1178 Herbert St

- 1879 Ames Ave

- 2061 Arlington Ave E

- 1862 Ames Ave

- 1874 Hoyt Ave E

- 2112 Hawthorne Ave E

- 1860 Hyacinth Ave E

- 1870 Hyacinth Ave E

- 1874 Hyacinth Ave E

- 1854 Hyacinth Ave E

- 1876 Hyacinth Ave E

- 1865 Orange Ave E

- 1869 Orange Ave E

- 1869 1869 Orange-Avenue-e

- 1861 1861 Orange-Avenue-e

- 1861 Orange Ave E

- 1880 Hyacinth Ave E

- 1873 Orange Ave E

- 1848 Hyacinth Ave E

- 1855 Orange Ave E

- 1877 Orange Ave E

- 1867 Hyacinth Ave E

- 1884 Hyacinth Ave E

- 1884 1884 Hyacinth-Avenue-e

- 1849 Orange Ave E

- 1849 1849 Orange-Avenue-e

Your Personal Tour Guide

Ask me questions while you tour the home.