20735 Pebble Ln Lenexa, KS 66220

Estimated Value: $699,000 - $743,000

5

Beds

5

Baths

3,538

Sq Ft

$205/Sq Ft

Est. Value

About This Home

This home is located at 20735 Pebble Ln, Lenexa, KS 66220 and is currently estimated at $726,673, approximately $205 per square foot. 20735 Pebble Ln is a home located in Johnson County with nearby schools including Manchester Park Elementary School, Prairie Trail Middle School, and Olathe Northwest High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 15, 2005

Sold by

Simpson Jeffrey and Simpson Jeffrey D

Bought by

Lundgren Steven W and Lundgren Dee A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$281,000

Outstanding Balance

$147,138

Interest Rate

5.61%

Mortgage Type

New Conventional

Estimated Equity

$579,535

Purchase Details

Closed on

Mar 4, 2003

Sold by

Assmann Deeann M

Bought by

Simpson Jeffrey D

Purchase Details

Closed on

May 9, 2002

Sold by

Simpson Jeffrey and Assman Deeann M

Bought by

Simpson Jeffrey and Assman Deeann M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$183,000

Interest Rate

6.48%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lundgren Steven W | -- | Chicago Title Insurance Co | |

| Simpson Jeffrey D | -- | -- | |

| Simpson Jeffrey | -- | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lundgren Steven W | $281,000 | |

| Previous Owner | Simpson Jeffrey | $183,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $9,253 | $75,152 | $10,841 | $64,311 |

| 2023 | $7,435 | $59,398 | $9,856 | $49,542 |

| 2022 | $7,131 | $55,556 | $8,956 | $46,600 |

| 2021 | $6,658 | $49,358 | $8,956 | $40,402 |

| 2020 | $6,487 | $47,621 | $8,956 | $38,665 |

| 2019 | $6,459 | $47,070 | $6,423 | $40,647 |

| 2017 | $6,404 | $45,161 | $6,423 | $38,738 |

| 2016 | $5,918 | $42,665 | $6,423 | $36,242 |

Source: Public Records

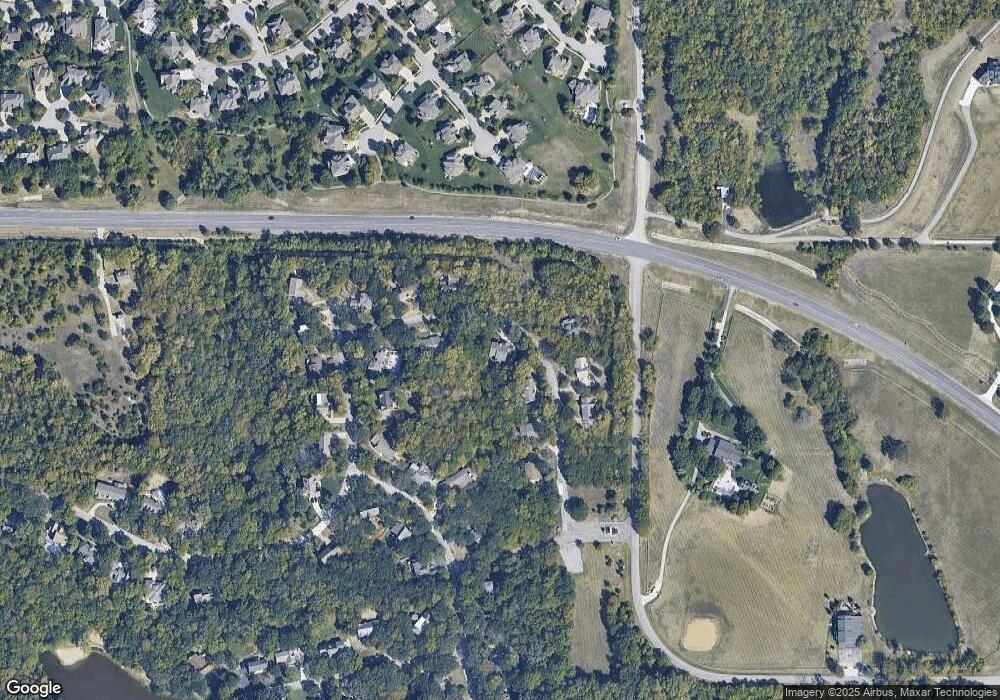

Map

Nearby Homes

- 20413 Crickett Ln

- The Brookridge IV Plan at Bristol Highlands - The Estates

- The Courtland Reverse Plan at Bristol Highlands - The Estates

- The Madison II Plan at Bristol Highlands - The Estates

- 8005 Millridge St

- 21615 W 80th Terrace

- 8013 Millridge St

- 17104 Earnshaw St

- 8001 Millridge St

- 7911 Millridge St

- 7939 Millridge St

- 7919 Millridge St

- 7935 Millridge St

- 7923 Millridge St

- 7903 Millridge St

- 8181 Valley Rd

- 21706 W 80th Terrace

- 8216 Aurora St

- 8164 Roundtree St

- 8211 Aurora St

- 20727 Pebble Ln

- 20901 Pebble Ln

- 20719 Pebble Ln

- 20742 Pebble Ln

- 20806 Pebble Ln

- 20734 Pebble Ln

- 20711 Pebble Ln

- 20902 Pebble Ln

- 21015 Bittersweet Dr

- 8405 Redbud Ln

- 21011 Bittersweet Dr

- 8407 Redbud Ln

- 20802 Whispering Dr

- 8183 Bittersweet Dr

- 8176 Bittersweet Dr

- 21010 Bittersweet Dr

- 21014 Bittersweet Dr

- 8408 Redbud Ln

- 8402 Redbud Ln

- 21006 Bittersweet Dr