Estimated Value: $201,044 - $224,000

2

Beds

2

Baths

1,206

Sq Ft

$177/Sq Ft

Est. Value

About This Home

This home is located at 214 Summerstone Bend, Byron, GA 31008 and is currently estimated at $213,511, approximately $177 per square foot. 214 Summerstone Bend is a home located in Houston County with nearby schools including Eagle Springs Elementary School, Thomson Middle School, and Northside High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 21, 2019

Sold by

Secreta Of Veterans Affairs

Bought by

Teat Chad

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$112,520

Outstanding Balance

$98,928

Interest Rate

4.2%

Mortgage Type

New Conventional

Estimated Equity

$114,583

Purchase Details

Closed on

Jan 10, 2019

Sold by

Bank Of American Na

Bought by

Secretary Of Veterans Affairs

Purchase Details

Closed on

Mar 20, 2009

Sold by

Bry Mel Homes Inc

Bought by

Calaman David A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,004

Interest Rate

5.13%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Teat Chad | -- | None Available | |

| Secretary Of Veterans Affairs | -- | None Available | |

| Bank Of America N A | $98,339 | None Available | |

| Calaman David A | $116,500 | None Available | |

| Bry Mel Homes Inc | $28,500 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Teat Chad | $112,520 | |

| Previous Owner | Bry Mel Homes Inc | $119,004 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,207 | $68,840 | $12,000 | $56,840 |

| 2023 | $1,944 | $60,360 | $10,000 | $50,360 |

| 2022 | $1,159 | $50,420 | $10,000 | $40,420 |

| 2021 | $1,078 | $46,640 | $10,000 | $36,640 |

| 2020 | $1,075 | $46,280 | $10,000 | $36,280 |

| 2019 | $1,075 | $46,280 | $10,000 | $36,280 |

| 2018 | $856 | $46,000 | $10,000 | $36,000 |

| 2017 | $857 | $46,000 | $10,000 | $36,000 |

| 2016 | $858 | $46,000 | $10,000 | $36,000 |

| 2015 | -- | $46,000 | $10,000 | $36,000 |

| 2014 | -- | $46,000 | $10,000 | $36,000 |

| 2013 | -- | $46,000 | $10,000 | $36,000 |

Source: Public Records

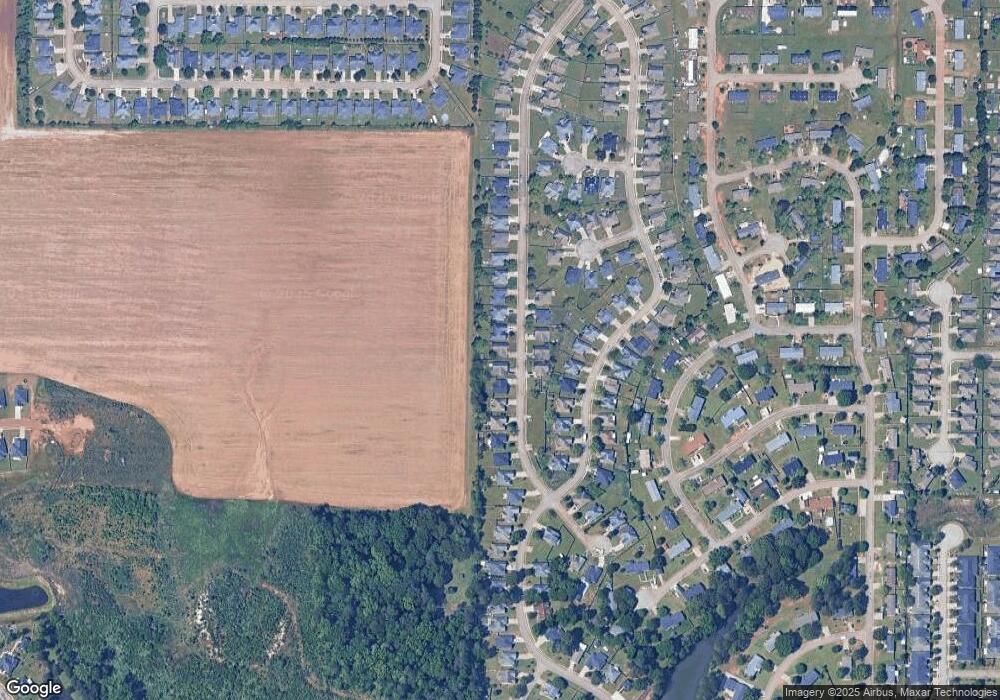

Map

Nearby Homes

- 106 Coventry Manor Ct

- 100 Coventry Manor Ct

- 417 Covington Cove

- 206 Amber Dr

- 205 Burr Dr

- 217 Caleb Way

- 125 Amber Dr

- 412 Lamplight Dr

- 0 Gunn Rd Unit 10620588

- 302 Beau Claire Cir

- 312 Beau Claire Cir

- 310 Beau Claire Cir

- 260 Caleb Way

- 105 Browning Point

- 109 Rambling Creek Cove

- The Coleman Plan at Cobblestone Crossing Commons

- The Phoenix Plan at Cobblestone Crossing Commons

- The Crawford Plan at Cobblestone Crossing Commons

- The Piedmont Plan at Cobblestone Crossing Commons

- The Bradley Plan at Cobblestone Crossing Commons

- 212 Summerstone Bend

- 216 Summerstone Bend

- 218 Summerstone Bend

- 210 Summerstone Bend

- 209 Summerstone Bend

- 207 Summerstone Bend

- 211 Summerstone Bend

- 208 Summerstone Bend Unit 31

- 220 Summerstone Bend

- 213 Summerstone Bend

- 215 Summerstone Bend

- 222 Summerstone Bend

- 206 Summerstone Bend

- 411 Madison Place Pkwy

- 409 Madison Place Pkwy

- 407 Madison Place Pkwy

- 415 Madison Place Pkwy

- 224 Summerstone Bend

- 204 Summerstone Bend

- 106 Madison Walk