2269 Huntington Point Rd Unit 117 Chula Vista, CA 91914

Rolling Hills Ranch NeighborhoodEstimated Value: $651,000 - $672,000

2

Beds

3

Baths

1,458

Sq Ft

$455/Sq Ft

Est. Value

About This Home

This home is located at 2269 Huntington Point Rd Unit 117, Chula Vista, CA 91914 and is currently estimated at $663,199, approximately $454 per square foot. 2269 Huntington Point Rd Unit 117 is a home located in San Diego County with nearby schools including Thurgood Marshall Elementary School, Eastlake Middle School, and Eastlake High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 26, 2010

Sold by

Schmidt Michael A and Schmidt Kim Y

Bought by

Schmidt Michael A and Schmidt Kim Y

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$176,575

Outstanding Balance

$117,012

Interest Rate

4.51%

Mortgage Type

New Conventional

Estimated Equity

$546,187

Purchase Details

Closed on

Jul 28, 2008

Sold by

Valenzuela Luis Ramirez

Bought by

Schmidt Michael A and Schmidt Kim Y

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Interest Rate

6.42%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 1, 2005

Sold by

Shea Homes Lp

Bought by

Valenzuela Luis Ramirez

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$355,174

Interest Rate

5.75%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Schmidt Michael A | -- | Tsi | |

| Schmidt Michael A | -- | Tsi | |

| Schmidt Michael A | $280,000 | First American Title Company | |

| Valenzuela Luis Ramirez | $448,500 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Schmidt Michael A | $176,575 | |

| Closed | Schmidt Michael A | $180,000 | |

| Previous Owner | Valenzuela Luis Ramirez | $355,174 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,115 | $360,556 | $128,687 | $231,869 |

| 2024 | $4,115 | $353,487 | $126,164 | $227,323 |

| 2023 | $4,048 | $346,557 | $123,691 | $222,866 |

| 2022 | $3,935 | $339,763 | $121,266 | $218,497 |

| 2021 | $3,843 | $333,102 | $118,889 | $214,213 |

| 2020 | $3,754 | $329,687 | $117,670 | $212,017 |

| 2019 | $3,655 | $323,223 | $115,363 | $207,860 |

| 2018 | $3,597 | $316,886 | $113,101 | $203,785 |

| 2017 | $3,536 | $310,674 | $110,884 | $199,790 |

| 2016 | $3,435 | $304,583 | $108,710 | $195,873 |

| 2015 | $3,391 | $300,009 | $107,078 | $192,931 |

| 2014 | $3,328 | $294,133 | $104,981 | $189,152 |

Source: Public Records

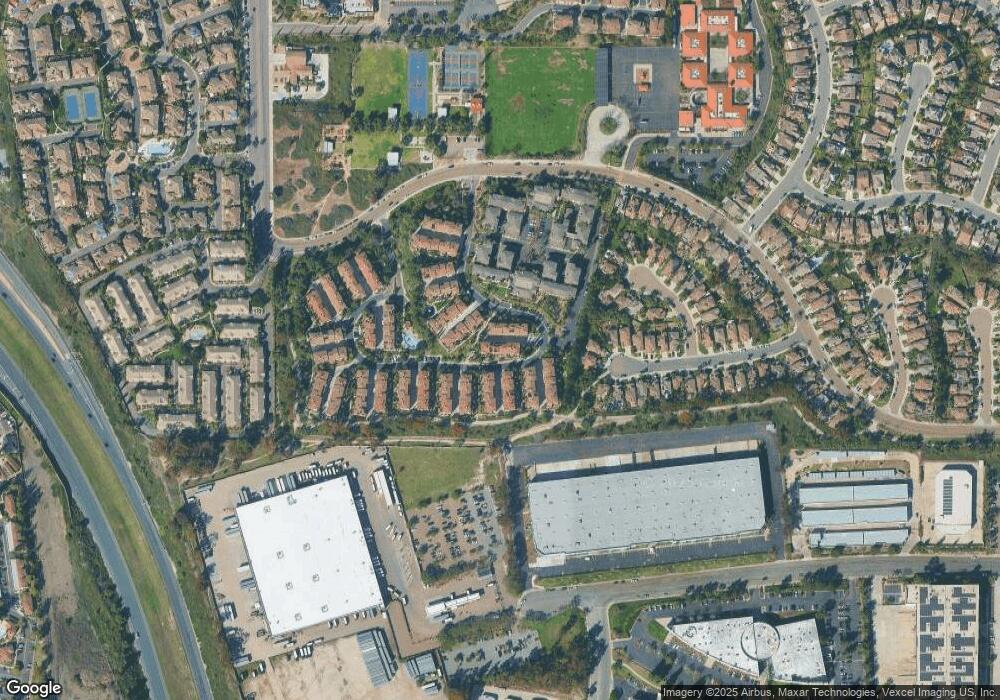

Map

Nearby Homes

- 2269 Huntington Point Rd Unit 114

- 2264 Huntington Point Rd Unit 102

- 2259 Lago Madero

- 2240 Lago Ventana

- 2284 Lago Ventana

- 2180 Hamden Dr

- 707 Eastshore Terrace Unit 26

- 732 Eastshore Terrace Unit 77

- 753 Eastshore Terrace Unit 127

- 750 Eastshore Terrace Unit 120

- 746 Eastshore Terrace Unit 108

- 767 Eastshore Terrace Unit 223

- 742 Eastshore Terrace Unit 98

- 775 Eastshore Terrace Unit 225

- 2151 Northshore Dr

- 544 Rocking Horse Dr

- 2148 Waterside Dr

- 2532 Oak Knoll Ct

- 845 Ridgewater Dr

- 2100 Northshore Dr Unit A

- 2269 Huntington Point Rd Unit 113

- 2277 Huntington Point Rd Unit 135

- 2277 Huntington Point Rd Unit 136

- 2273 Huntington Point Rd Unit 128

- 2277 Huntington Point Rd

- 2273 Huntington Point Rd Unit 131

- 2273 Huntington Point Rd Unit 127

- 2281 Huntington Point Rd Unit 141

- 2273 Huntington Point Rd Unit 126

- 2269 Huntington Point Rd

- 2281 Huntington Point Rd Unit 140

- 2277 Huntington Point Rd Unit 132

- 2281 Huntington Point Rd Unit 139

- 2281 Huntington Point Rd Unit 142

- 2273 Huntington Point Rd Unit 129

- 2277 Huntington Point Rd Unit 133

- 2281 Hntngtn pt Rd Unit 144

- 2281 Hntngtn pt Rd Unit 143

- 2281 Hntngtn pt Rd Unit 142

- 2281 Hntngtn pt Rd Unit 141