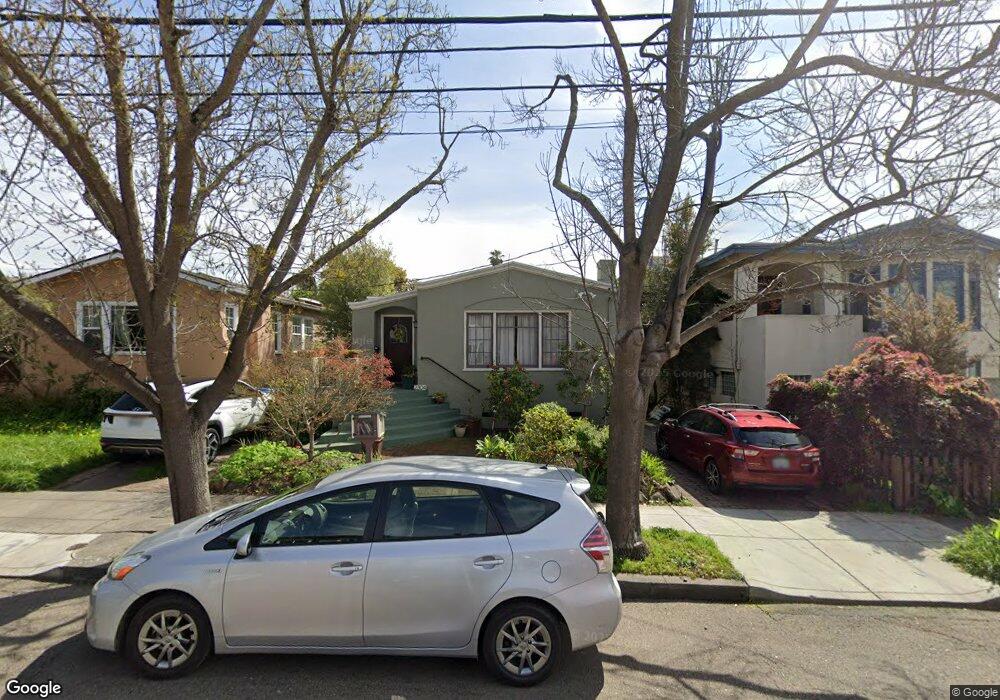

2304 Howe St Berkeley, CA 94705

South Berkeley NeighborhoodEstimated Value: $1,380,707 - $1,562,000

3

Beds

2

Baths

1,464

Sq Ft

$992/Sq Ft

Est. Value

About This Home

This home is located at 2304 Howe St, Berkeley, CA 94705 and is currently estimated at $1,452,427, approximately $992 per square foot. 2304 Howe St is a home located in Alameda County with nearby schools including Emerson Elementary School, Malcolm X Elementary School, and John Muir Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 29, 2023

Sold by

Lane Muriel

Bought by

Muriel Lane Trust and Lane

Current Estimated Value

Purchase Details

Closed on

Jun 20, 2011

Sold by

Baruch Robert E and The Estate Of Seymour Baruch

Bought by

Lane Muriel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$411,600

Interest Rate

4.56%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 9, 1996

Sold by

Baruch Seymour and Baruch Florence

Bought by

Baruch Seymour and Forrest Florence

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Muriel Lane Trust | -- | None Listed On Document | |

| Lane Muriel | $588,000 | Placer Title Company | |

| Baruch Seymour | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lane Muriel | $411,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,097 | $414,965 | $91,062 | $330,903 |

| 2024 | $8,097 | $406,694 | $89,277 | $324,417 |

| 2023 | $7,857 | $398,582 | $87,526 | $318,056 |

| 2022 | $7,630 | $390,632 | $85,811 | $311,821 |

| 2021 | $7,668 | $382,838 | $84,129 | $305,709 |

| 2020 | $7,193 | $385,843 | $83,267 | $302,576 |

| 2019 | $6,871 | $378,278 | $81,634 | $296,644 |

| 2018 | $6,729 | $370,864 | $80,034 | $290,830 |

| 2017 | $6,472 | $363,593 | $78,465 | $285,128 |

| 2016 | $6,220 | $356,466 | $76,927 | $279,539 |

| 2015 | $6,123 | $351,114 | $75,772 | $275,342 |

| 2014 | $6,054 | $344,239 | $74,288 | $269,951 |

Source: Public Records

Map

Nearby Homes

- 2243 Ashby Ave

- 2110 Ashby Ave

- 2702 Dana St

- 2477 Prince St

- 6446 Colby St

- 3050 Shattuck Ave

- 2057 Emerson St

- 2918 Newbury St

- 2537 Ellsworth St

- 2543 Chilton Way

- 2316 Blake St Unit D

- 2550 Dana St Unit 2F

- 6555 Shattuck Ave

- 669 Alcatraz Ave

- 6320 Shattuck Ave

- 2509 Dwight Way

- 2951 Linden Ave

- 1901 Parker St Unit 3

- 2732 Parker St

- 3033 Ellis St Unit B