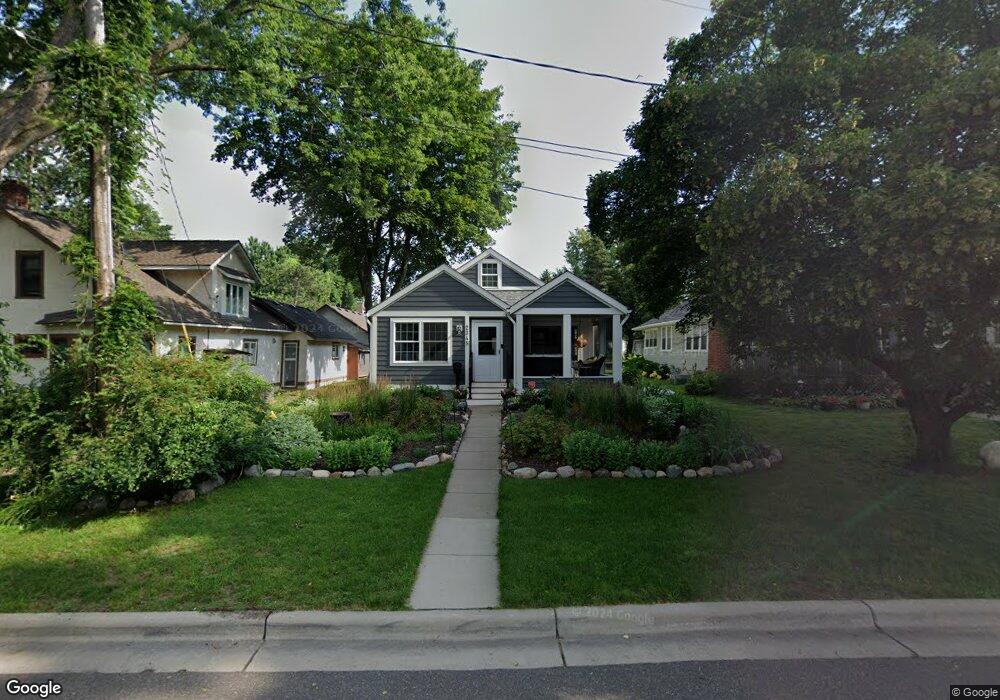

2345 8th St Saint Paul, MN 55110

Estimated Value: $639,000 - $717,000

3

Beds

3

Baths

2,800

Sq Ft

$239/Sq Ft

Est. Value

About This Home

This home is located at 2345 8th St, Saint Paul, MN 55110 and is currently estimated at $668,920, approximately $238 per square foot. 2345 8th St is a home located in Ramsey County with nearby schools including Lakeaires Elementary School, Central Middle School, and Frassati Catholic Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 18, 2020

Sold by

Warren Joseph W and Warren June M

Bought by

Gregory Carolyn A and Gregory Delwyn M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$412,000

Outstanding Balance

$365,623

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$312,652

Purchase Details

Closed on

Mar 16, 2007

Sold by

Hanych Kevin G and Hanych Billie Jo

Bought by

Warren Joseph W and Warren June M

Purchase Details

Closed on

Mar 22, 2004

Sold by

Dockendorff Daniel P and Dockendorff Jennifer

Bought by

Hanych Kevin and Hanych Billy Jo

Purchase Details

Closed on

Apr 24, 2001

Sold by

Schmitz Richard P and Schmitz Linda M

Bought by

Dockendorff Daniel P and Dockendorff Jennifer

Purchase Details

Closed on

Mar 6, 2001

Sold by

Cerrenka Candace C and Cerrenka Frank W

Bought by

Schmitz Richard P and Schmitz Linda M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gregory Carolyn A | $515,000 | Edina Realty Title Inc | |

| Warren Joseph W | $450,000 | -- | |

| Hanych Kevin | $241,000 | -- | |

| Dockendorff Daniel P | $176,000 | -- | |

| Schmitz Richard P | $172,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gregory Carolyn A | $412,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,560 | $680,900 | $110,600 | $570,300 |

| 2023 | $7,560 | $559,200 | $110,600 | $448,600 |

| 2022 | $6,162 | $537,400 | $110,600 | $426,800 |

| 2021 | $5,642 | $458,600 | $110,600 | $348,000 |

| 2020 | $6,584 | $430,400 | $110,600 | $319,800 |

| 2019 | $5,624 | $432,400 | $110,600 | $321,800 |

| 2018 | $4,952 | $385,100 | $110,600 | $274,500 |

| 2017 | $3,722 | $389,200 | $110,600 | $278,600 |

| 2016 | $3,874 | $0 | $0 | $0 |

| 2015 | $4,172 | $316,700 | $100,900 | $215,800 |

| 2014 | $4,170 | $0 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 4927 Lake Ave

- 4996 Stewart Ave

- 4969 Stewart Ave

- 4838 Stewart Ave

- 4890 Cook Ave

- 2239 10th St

- 219X 12th St

- 5102 Wild Marsh Dr

- 5103 Wild Marsh Dr

- 5200 Pathways Ave Unit 105

- 5264 Pathways Ave

- 5246 Division Ave

- 2574 1st St

- 5234 Grand Ave

- 5285 Northwest Ave

- 4987 Campbell Ave

- 2655 Stillwater St

- TBD Park Ave

- 5366 Eagle St

- 22 Dellwood Ave

- 2351 8th St

- 4901 Lake Ave

- 4905 Lake Ave

- 4911 Lake Ave

- 2344 9th St

- 4898 Johnson Ave

- 4926 Johnson Ave

- 4921 Lake Ave

- 2344 8th St

- 4890 Johnson Ave

- 4905 Johnson Ave

- 4893 Lake Ave

- 4901 Johnson Ave

- 4911 Johnson Ave

- 4921 Johnson Ave

- 4885 Lake Ave

- 4927 Johnson Ave

- 4891 Johnson Ave

- 4880 Johnson Ave

- 2337 9th St