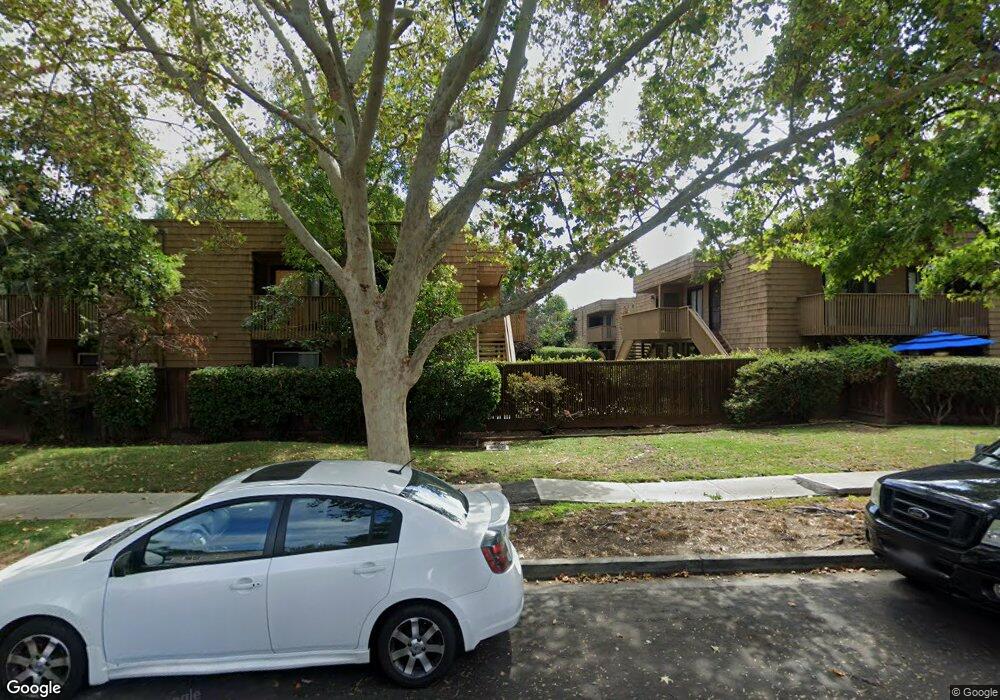

2398 Walters Way Unit 19 Concord, CA 94520

Princess Park NeighborhoodEstimated Value: $280,327 - $369,000

2

Beds

1

Bath

720

Sq Ft

$442/Sq Ft

Est. Value

About This Home

This home is located at 2398 Walters Way Unit 19, Concord, CA 94520 and is currently estimated at $318,332, approximately $442 per square foot. 2398 Walters Way Unit 19 is a home located in Contra Costa County with nearby schools including Ygnacio Valley Elementary School, Oak Grove Middle School, and Ygnacio Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 10, 2025

Sold by

Ritterbusch Sandra E

Bought by

Sandra E Ritterbusch Trust and Ritterbusch

Current Estimated Value

Purchase Details

Closed on

Dec 19, 2013

Sold by

Kamp Steven L

Bought by

Ritterbusch Sandra E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,000

Interest Rate

4.32%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 2, 2013

Sold by

Schlink William

Bought by

Kamp Steven L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$70,000

Interest Rate

4.28%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 18, 2004

Sold by

Dahlhauser Daniel and Dahlhauser Joan

Bought by

Schlink William

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sandra E Ritterbusch Trust | -- | None Listed On Document | |

| Ritterbusch Sandra E | $185,000 | Chicago Title Company | |

| Kamp Steven L | $72,000 | Chicago Title Company | |

| Schlink William | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ritterbusch Sandra E | $135,000 | |

| Previous Owner | Kamp Steven L | $70,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,490 | $226,772 | $73,545 | $153,227 |

| 2024 | $3,305 | $222,326 | $72,103 | $150,223 |

| 2023 | $3,305 | $217,968 | $70,690 | $147,278 |

| 2022 | $3,241 | $213,695 | $69,304 | $144,391 |

| 2021 | $3,146 | $209,506 | $67,946 | $141,560 |

| 2019 | $3,073 | $203,294 | $65,932 | $137,362 |

| 2018 | $2,947 | $199,309 | $64,640 | $134,669 |

| 2017 | $2,835 | $195,402 | $63,373 | $132,029 |

| 2016 | $2,734 | $191,572 | $62,131 | $129,441 |

| 2015 | $2,677 | $188,695 | $61,198 | $127,497 |

| 2014 | $2,606 | $185,000 | $60,000 | $125,000 |

Source: Public Records

Map

Nearby Homes

- 1255 Detroit Ave Unit 14

- 1133 Meadow Ln Unit 106

- 1133 Meadow Ln Unit 53

- 1260 Meadow Ln

- 1712 Oakmead Dr

- 1630 Nicholas Dr

- 2045 Sierra Rd Unit 2

- 2310 Belmont Rd

- 2055 Sierra Rd Unit 12

- 2055 Sierra Rd Unit 53

- 1080 San Miguel Rd Unit 134

- 2100 Laguna Cir Unit D

- 96 Welcome Ave

- 1520 Detroit Ave

- 1699 Laguna St Unit 302

- 2005 Sierra Rd

- 2361 Bedford Rd

- 1154 Tilson Dr

- 1800 Laguna St Unit 5

- 2722 Cowell Rd

- 2398 Walters Way

- 2398 Walters Way

- 2398 Walters Way Unit 31

- 2398 Walters Way Unit 30

- 2398 Walters Way Unit 29

- 2398 Walters Way Unit 28

- 2398 Walters Way Unit 27

- 2398 Walters Way Unit 26

- 2398 Walters Way Unit 25

- 2398 Walters Way Unit 24

- 2398 Walters Way Unit 23

- 2398 Walters Way Unit 22

- 2398 Walters Way Unit 21

- 2398 Walters Way Unit 20

- 2398 Walters Way Unit 18

- 2398 Walters Way Unit 17

- 2398 Walters Way Unit 16

- 2398 Walters Way Unit 49

- 2398 Walters Way Unit 48

- 2398 Walters Way Unit 15

Your Personal Tour Guide

Ask me questions while you tour the home.