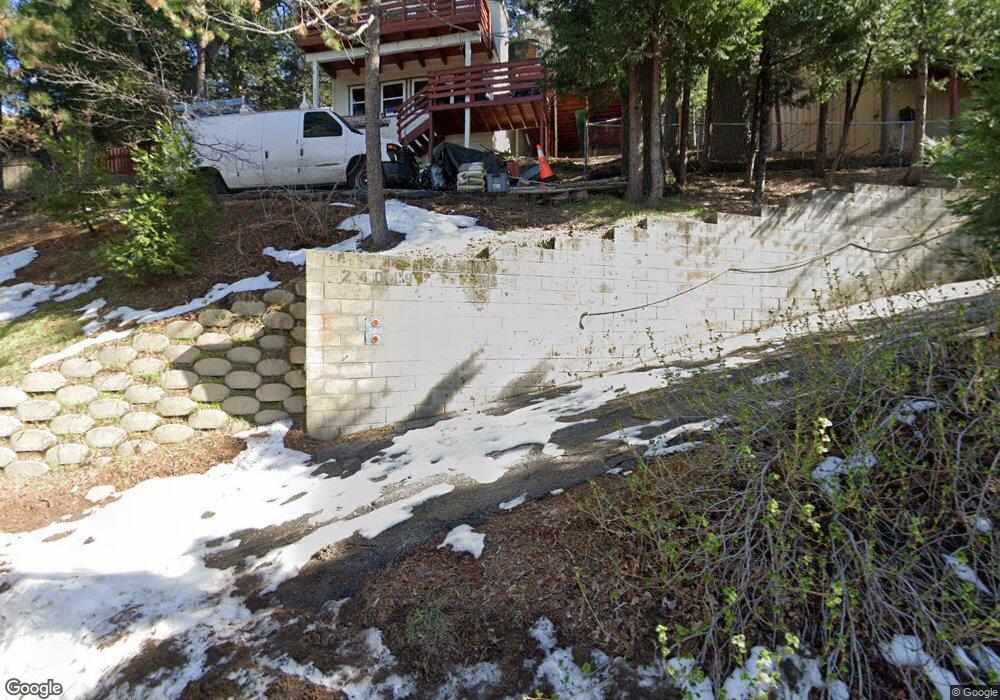

24057 Cresta Dr Crestline, CA 92325

Estimated Value: $335,000 - $369,000

2

Beds

2

Baths

832

Sq Ft

$419/Sq Ft

Est. Value

About This Home

This home is located at 24057 Cresta Dr, Crestline, CA 92325 and is currently estimated at $348,662, approximately $419 per square foot. 24057 Cresta Dr is a home located in San Bernardino County with nearby schools including Valley Of Enchantment Elementary School, Mary P. Henck Intermediate School, and Rim Of The World Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 13, 2008

Sold by

Us Bank Na

Bought by

Salbato Tristan R and Salbato Amanda K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,771

Outstanding Balance

$101,189

Interest Rate

6.04%

Mortgage Type

FHA

Estimated Equity

$247,473

Purchase Details

Closed on

Sep 14, 2007

Sold by

Lapierre Lillian and Lapierre Robert

Bought by

Us Bank Na

Purchase Details

Closed on

Nov 19, 2003

Sold by

Dexter William E and Dexter Janet M

Bought by

Lapierre Robert and Lapierre Lillian

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,200

Interest Rate

7.25%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Salbato Tristan R | $160,000 | Stewart Title | |

| Us Bank Na | $255,000 | Stewart Title Co | |

| Lapierre Robert | $179,000 | Advantage Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Salbato Tristan R | $157,771 | |

| Previous Owner | Lapierre Robert | $143,200 | |

| Closed | Lapierre Robert | $35,800 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,766 | $210,164 | $32,838 | $177,326 |

| 2024 | $2,669 | $206,043 | $32,194 | $173,849 |

| 2023 | $2,633 | $202,003 | $31,563 | $170,440 |

| 2022 | $2,563 | $198,042 | $30,944 | $167,098 |

| 2021 | $2,546 | $194,159 | $30,337 | $163,822 |

| 2020 | $2,541 | $192,168 | $30,026 | $162,142 |

| 2019 | $2,479 | $157,100 | $30,200 | $126,900 |

| 2018 | $1,899 | $157,100 | $30,200 | $126,900 |

| 2017 | $1,773 | $146,100 | $28,100 | $118,000 |

| 2016 | $1,658 | $137,800 | $26,500 | $111,300 |

| 2015 | $1,590 | $130,000 | $25,000 | $105,000 |

| 2014 | $2,125 | $171,443 | $26,789 | $144,654 |

Source: Public Records

Map

Nearby Homes

- 23995 Scenic Dr

- 24015 Altdorf Dr

- 24200 Altdorf Dr

- 23950 Bowl Rd

- 707 Rocky Loop

- 23959 Lakeview Dr

- 0 Lakeview Dr Unit 26384629

- 2661 Scenic Dr

- 0-2661 Scenic Dr

- 2662 Scenic Dr

- 24032 Skyland Dr

- 23876 Crest Forest Dr

- 23844 Bowl Rd

- 622 Heatherly Ln

- 23825 Scenic Dr

- 993 Mercury Way

- 24310 Altdorf Dr

- 999 Mercury Way

- 23804 Lakeview Dr

- 23776 Lakeview Dr

- 24049 Cresta Dr

- 24073 Cresta Dr

- 24065 Cresta Dr

- 24058 Cresta Dr

- 24054 Cresta Dr

- 24043 Cresta Dr

- 24048 Cresta Dr

- 24064 Cresta Dr

- 24083 Cresta Dr

- 24044 Cresta Dr

- 24035 Cresta Dr

- 24072 Cresta Dr

- 24074 Altdorf Dr

- 24057 Alpine Dr

- 24058 Altdorf Dr

- 24086 Cresta Dr

- 24068 Cresta Dr

- 24070 Cresta Dr

- 24036 Cresta Dr

- 24029 Cresta Dr

Your Personal Tour Guide

Ask me questions while you tour the home.