2652 Traditions Loop Paso Robles, CA 93446

Estimated Value: $814,000 - $838,679

2

Beds

3

Baths

1,772

Sq Ft

$467/Sq Ft

Est. Value

About This Home

This home is located at 2652 Traditions Loop, Paso Robles, CA 93446 and is currently estimated at $827,670, approximately $467 per square foot. 2652 Traditions Loop is a home located in San Luis Obispo County with nearby schools including Kermit King Elementary School, Daniel Lewis Middle School, and Paso Robles High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 4, 2022

Sold by

Liv David and Liv Donna

Bought by

David And Donna Jean Rusco Revocable Living T and Rusco

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,185,000

Outstanding Balance

$1,181,720

Interest Rate

5.11%

Mortgage Type

Reverse Mortgage Home Equity Conversion Mortgage

Estimated Equity

-$354,050

Purchase Details

Closed on

Dec 10, 2020

Sold by

Rusco David A and Rusco Donna J

Bought by

Rusco David and Rusco Donna

Purchase Details

Closed on

Dec 28, 2009

Sold by

Mccolley Carol E

Bought by

Rusco David A and Rusco Donna J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$213,000

Interest Rate

4.91%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 30, 2009

Sold by

Witt Virginia B

Bought by

Mccolley Carol E

Purchase Details

Closed on

Mar 8, 2005

Sold by

Centex Homes

Bought by

Witt Virginia B

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| David And Donna Jean Rusco Revocable Living T | -- | Fnc Title Services | |

| Rusco David | -- | None Available | |

| Rusco David A | $383,000 | Fidelity National Title Co | |

| Mccolley Carol E | -- | None Available | |

| Witt Virginia B | $453,000 | Fidelity Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | David And Donna Jean Rusco Revocable Living T | $1,185,000 | |

| Previous Owner | Rusco David A | $213,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,918 | $494,369 | $174,253 | $320,116 |

| 2024 | $5,810 | $484,677 | $170,837 | $313,840 |

| 2023 | $5,810 | $475,175 | $167,488 | $307,687 |

| 2022 | $5,708 | $465,858 | $164,204 | $301,654 |

| 2021 | $5,547 | $456,725 | $160,985 | $295,740 |

| 2020 | $5,445 | $452,043 | $159,335 | $292,708 |

| 2019 | $5,364 | $443,180 | $156,211 | $286,969 |

| 2018 | $5,296 | $434,492 | $153,149 | $281,343 |

| 2017 | $5,002 | $425,974 | $150,147 | $275,827 |

| 2016 | $4,911 | $417,622 | $147,203 | $270,419 |

| 2015 | $4,908 | $411,350 | $144,992 | $266,358 |

| 2014 | $4,737 | $403,293 | $142,152 | $261,141 |

Source: Public Records

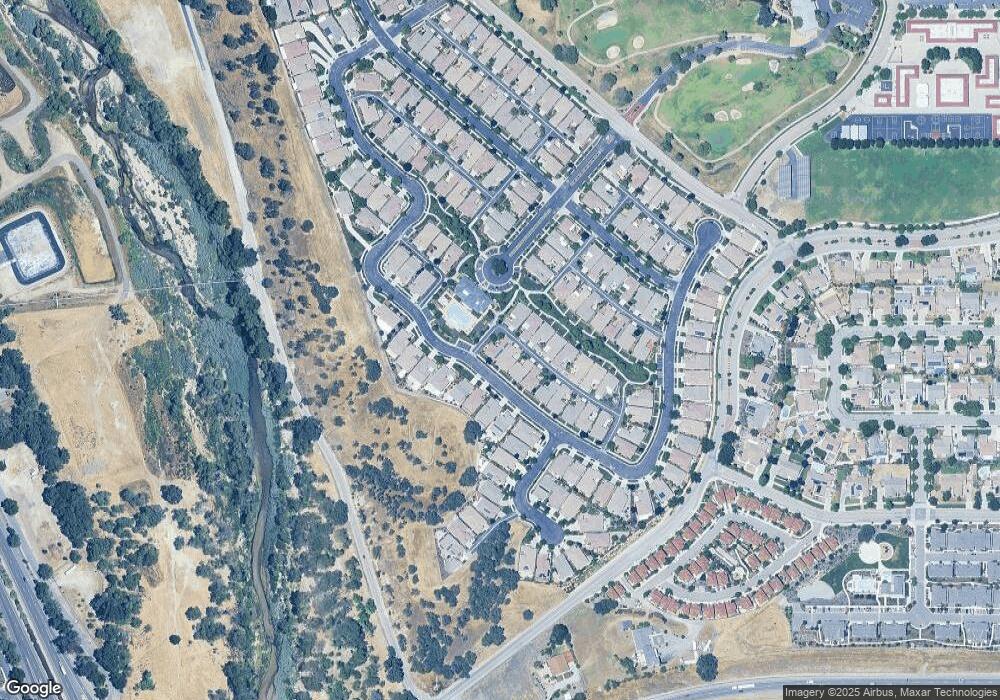

Map

Nearby Homes

- 2649 Clubhouse Dr

- 2425 Traditions Loop

- 2757 Traditions Loop

- 2642 Vineyard Cir

- 706 Manor Ln

- 707 Manor Ln

- 713 Manor Ln

- 701 Manor Ln

- 719 Manor Ln

- 725 Manor Ln

- 2823 Cottage Ln

- 2828 Cottage Ln

- 1926 Kleck Rd

- 3121 Spring St Unit 106

- 534 Fein Ave

- 3870 Buena Vista Dr

- 436 Calle Alto St

- 147 Via Camelia

- 2145 Park St

- 1212 Mariah Ln

- 2654 Traditions Loop

- 2656 Traditions Loop

- 2649 Willits Ln

- 2651 Willits Ln

- 2653 Willits Ln

- 2658 Traditions Loop

- 2653 Traditions Loop

- 2655 Traditions Loop

- 2655 Willits Ln

- 2651 Traditions Loop

- 2660 Traditions Loop

- 2657 Traditions Loop

- 2657 Willits Ln

- 2649 Traditions Loop

- 2659 Traditions Loop

- 2662 Traditions Loop

- 2659 Willits Ln

- 2647 Traditions Loop

- 688 the Esplanade

- 715 Palo Alto Ct