29 Merano Unit 176 Mission Viejo, CA 92692

Estimated Value: $979,000 - $1,180,000

3

Beds

2

Baths

1,845

Sq Ft

$574/Sq Ft

Est. Value

About This Home

This home is located at 29 Merano Unit 176, Mission Viejo, CA 92692 and is currently estimated at $1,058,819, approximately $573 per square foot. 29 Merano Unit 176 is a home located in Orange County with nearby schools including Bathgate Elementary School, Newhart Middle School, and Capistrano Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 21, 2020

Sold by

Raheb Ramez and Raheb Marlene

Bought by

Raheb Marlene

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$515,000

Outstanding Balance

$458,504

Interest Rate

2.7%

Mortgage Type

New Conventional

Estimated Equity

$600,315

Purchase Details

Closed on

Oct 13, 2005

Sold by

Melendes Gregory F and Melendes Laura L

Bought by

Raheb Ramez and Raheb Marlene

Purchase Details

Closed on

Jan 29, 2002

Sold by

Willis Lawrence W and Willis Karen L Carter

Bought by

Melendes Gregory F and Melendes Laura L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$264,000

Interest Rate

6.12%

Purchase Details

Closed on

Jun 21, 2000

Sold by

Ramona Agin

Bought by

Willis Lawrence W and Carter Willis Karen L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,000

Interest Rate

8.63%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Raheb Marlene | -- | First Amer Ttl Co Res Div | |

| Raheb Ramez | $645,000 | Alliance Title | |

| Melendes Gregory F | $330,000 | First American Title Co | |

| Willis Lawrence W | $261,000 | First Southwestern Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Raheb Marlene | $515,000 | |

| Previous Owner | Melendes Gregory F | $264,000 | |

| Previous Owner | Willis Lawrence W | $140,000 | |

| Closed | Melendes Gregory F | $11,500 | |

| Closed | Raheb Ramez | $0 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,648 | $881,439 | $596,674 | $284,765 |

| 2024 | $8,648 | $864,156 | $584,974 | $279,182 |

| 2023 | $6,486 | $651,730 | $428,302 | $223,428 |

| 2022 | $6,357 | $638,951 | $419,903 | $219,048 |

| 2021 | $6,231 | $626,423 | $411,670 | $214,753 |

| 2020 | $6,167 | $620,000 | $407,449 | $212,551 |

| 2019 | $6,167 | $620,000 | $407,449 | $212,551 |

| 2018 | $6,167 | $620,000 | $407,449 | $212,551 |

| 2017 | $6,166 | $620,000 | $407,449 | $212,551 |

| 2016 | $5,370 | $552,000 | $339,449 | $212,551 |

| 2015 | $5,803 | $552,000 | $339,449 | $212,551 |

| 2014 | $5,502 | $522,000 | $309,449 | $212,551 |

Source: Public Records

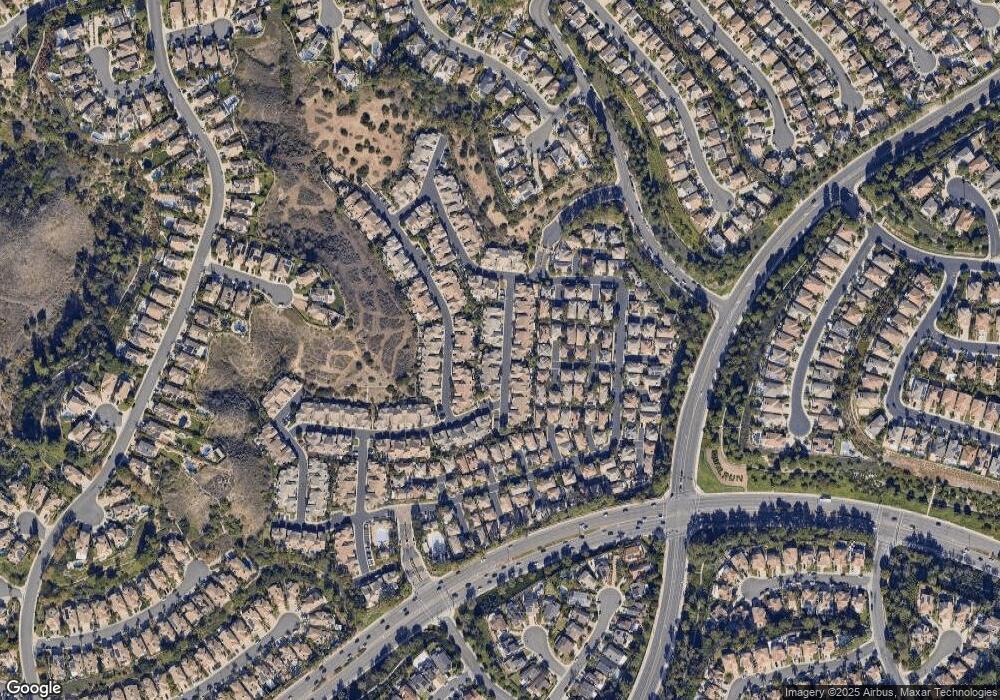

Map

Nearby Homes

- 16 Cambria Unit 32

- 139 Melrose Dr

- 27402 Carino Cir

- 26035 Ravenna Rd

- 26032 Ravenna Rd

- 26101 Calle Cresta

- 26192 Golada

- 25 Mirino Dr

- 27721 Rubidoux

- 27090 S Ridge Dr

- 27661 Pasatiempo

- 27701 Pasatiempo

- 27641 Ruisenor

- 25311 Misty Ridge

- 25805 Marguerite Pkwy Unit B102

- 25765 Marguerite Pkwy Unit H104

- 25835 Marguerite Pkwy Unit 8201

- 25145 Darlington

- 27533 Calinda

- 25911 Orbita Unit 88

- 27 Merano Unit 177

- 25 Merano Unit 178

- 25 Merano

- 23 Merano Unit 179

- 23 Merano

- 17 Merano Unit 191

- 13 Merano

- 11 Merano Unit 194

- 11 Merano

- 6 Merano Unit 201

- 9 Merano Unit 195

- 9 Merano

- 34 Merano Unit 182

- 32 Merano

- 30 Merano Unit 184

- 28 Merano Unit 185

- 38 Merano Unit 180

- 26 Merano Unit 186

- 24 Merano Unit 187

- 30 Le Mans Unit 118