290 Snowberry Ct Unit 1 Murphys, CA 95247

Estimated Value: $374,000 - $427,000

3

Beds

2

Baths

1,920

Sq Ft

$215/Sq Ft

Est. Value

About This Home

This home is located at 290 Snowberry Ct Unit 1, Murphys, CA 95247 and is currently estimated at $412,479, approximately $214 per square foot. 290 Snowberry Ct Unit 1 is a home located in Calaveras County with nearby schools including Bret Harte Union High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 27, 2011

Sold by

Wright Sherry L and Texeira Terri

Bought by

Gardiner John and Gardiner Wendy

Current Estimated Value

Purchase Details

Closed on

Jun 20, 2011

Sold by

Wright Sherry L

Bought by

Wright Sherry L and Texeira Terri

Purchase Details

Closed on

Oct 2, 2009

Sold by

Texeira Terri M and Texeira Terri

Bought by

Texeira Terri M

Purchase Details

Closed on

Jun 27, 2005

Sold by

Sutherland Patrick J and Sutherland Linda R

Bought by

Texeira Terri and Wright Sherry L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$368,800

Interest Rate

5.62%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 2, 2002

Sold by

Hayes Joyce K

Bought by

Sutherland Patrick J and Sutherland Linda R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$230,000

Interest Rate

6.28%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gardiner John | $172,500 | Placer Title Company | |

| Wright Sherry L | -- | Placer Title Company | |

| Texeira Terri M | -- | None Available | |

| Wright Sherry L | -- | None Available | |

| Texeira Terri | -- | None Available | |

| Texeira Terri | $461,000 | First American Title Co | |

| Sutherland Patrick J | $287,500 | The Sterling Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Texeira Terri | $368,800 | |

| Previous Owner | Sutherland Patrick J | $230,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,903 | $216,659 | $37,676 | $178,983 |

| 2023 | $2,822 | $208,248 | $36,214 | $172,034 |

| 2022 | $2,644 | $204,165 | $35,504 | $168,661 |

| 2021 | $2,629 | $200,162 | $34,808 | $165,354 |

| 2020 | $2,599 | $198,111 | $34,452 | $163,659 |

| 2019 | $2,567 | $194,227 | $33,777 | $160,450 |

| 2018 | $2,376 | $190,419 | $33,115 | $157,304 |

| 2017 | $2,318 | $186,686 | $32,466 | $154,220 |

| 2016 | $2,311 | $183,027 | $31,830 | $151,197 |

| 2015 | $2,283 | $180,278 | $31,352 | $148,926 |

| 2014 | -- | $176,747 | $30,738 | $146,009 |

Source: Public Records

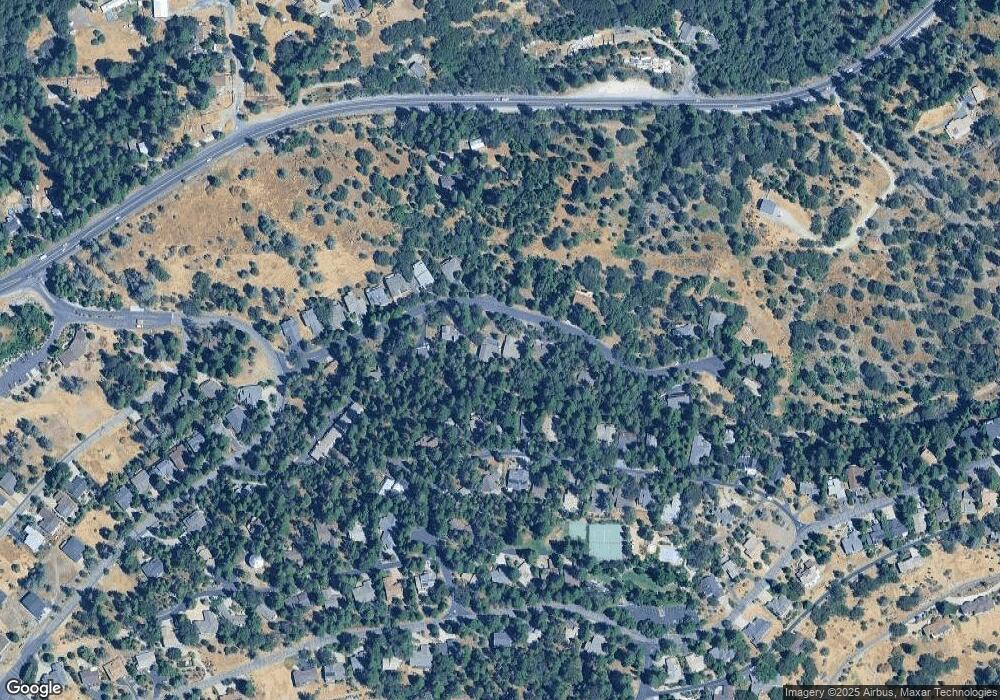

Map

Nearby Homes

- 356 Snowberry Ct

- 257 Snowberry Ct

- 387 Snowberry Ct

- 169 Snowberry Ct

- 280 Forest Meadows Dr

- 323 Forest Meadows Dr

- 954 Sandalwood Dr

- 764 Dogwood Dr

- 731 Dogwood Dr

- 3600 Cedar Vista Dr

- 1015 Dogwood Dr

- 501 Forest Meadows Dr

- 1203 Laurel Ln

- 1218 Laurel Ln

- 297 Forest Meadows Dr

- 1202 Heather Dr

- 1238 Canyon Ridge Ct

- 291 Fairway Village Dr

- 115 Fairway Village Ct

- 808 Sugarbush Ln

- 276 Snowberry Ct

- 300 Snowberry Ct

- 0 Snowberry Ct Unit 202401231

- 0 Snowberry Ct Unit 196-8 161015

- 0 Snowberry Ct

- 320 Snowberry Ct

- 339 Snowberry Ct

- 285 Snowberry Ct

- 273 Snowberry Ct

- 388 Snowberry Ct

- 371 Snowberry Ct

- 745 Larkspur Ln

- 252 Snowberry Ct

- 757 Larkspur Ln

- 733 Larkspur Ln

- 777 Larkspur Ln

- 334 Snowberry Ct

- 238 Snowberry Ct

- 317 Snowberry Ct

- 222 Snowberry Ct

Your Personal Tour Guide

Ask me questions while you tour the home.