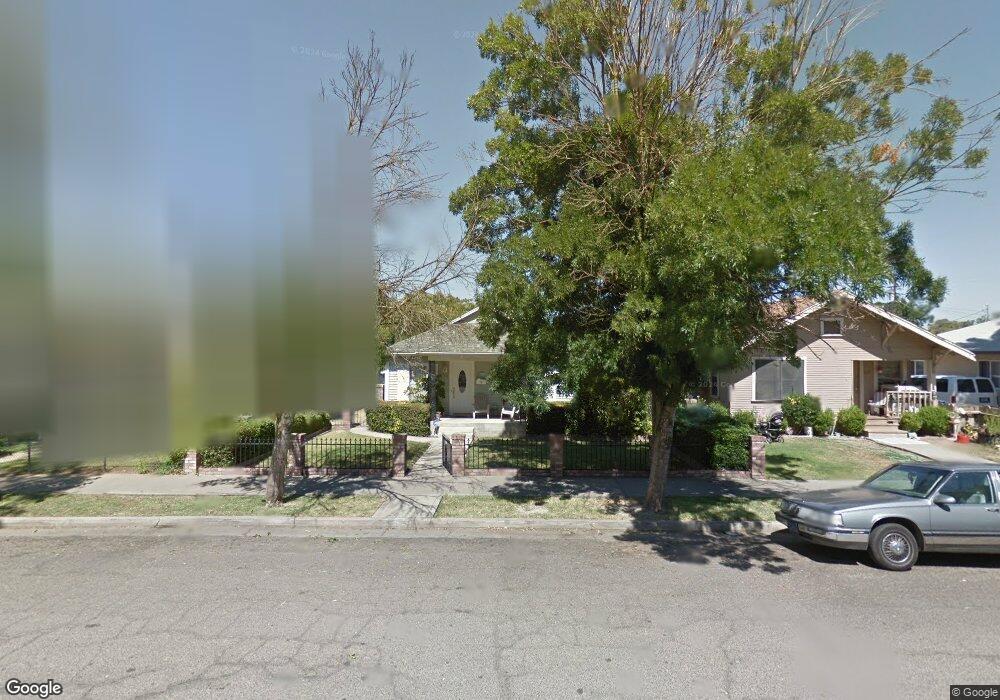

308 S 4th St Patterson, CA 95363

Estimated Value: $302,000 - $375,000

3

Beds

2

Baths

1,066

Sq Ft

$328/Sq Ft

Est. Value

About This Home

This home is located at 308 S 4th St, Patterson, CA 95363 and is currently estimated at $349,548, approximately $327 per square foot. 308 S 4th St is a home located in Stanislaus County with nearby schools including Las Palmas Elementary School, Creekside Middle School, and Patterson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 22, 2008

Sold by

Bank Of New York

Bought by

Brandt Amanda

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$95,323

Interest Rate

6.39%

Mortgage Type

FHA

Purchase Details

Closed on

Jun 3, 2008

Sold by

Tanori Frank G

Bought by

Bank Of New York and Certificateholders Cwabs Inc Asset Backe

Purchase Details

Closed on

Oct 3, 2001

Sold by

Tanori Frank G

Bought by

Tanori Frank G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,700

Interest Rate

6.87%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brandt Amanda | $97,000 | First American Title Company | |

| Bank Of New York | $128,350 | None Available | |

| Tanori Frank G | -- | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Brandt Amanda | $95,323 | |

| Previous Owner | Tanori Frank G | $114,700 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,466 | $124,897 | $38,625 | $86,272 |

| 2024 | $1,462 | $122,449 | $37,868 | $84,581 |

| 2023 | $1,430 | $120,049 | $37,126 | $82,923 |

| 2022 | $1,349 | $117,697 | $36,399 | $81,298 |

| 2021 | $1,330 | $115,390 | $35,686 | $79,704 |

| 2020 | $1,330 | $114,208 | $35,321 | $78,887 |

| 2019 | $1,310 | $111,970 | $34,629 | $77,341 |

| 2018 | $1,247 | $109,775 | $33,950 | $75,825 |

| 2017 | $1,221 | $107,624 | $33,285 | $74,339 |

| 2016 | $1,189 | $105,515 | $32,633 | $72,882 |

| 2015 | $1,171 | $103,931 | $32,143 | $71,788 |

| 2014 | $1,144 | $101,896 | $31,514 | $70,382 |

Source: Public Records

Map

Nearby Homes

- 0 Orange Ave

- 855 Toyon Ln

- 449 D Arpino Ct

- 559 S Del Puerto Ave

- 250 E Las Palmas Ave Unit 13

- 15707 S 9th St

- 708 Bonneau Ct

- 108 N 6th St

- 604 Kinshire Way

- 538 Chesterfield Dr

- 600 Sears Dr

- 849 Miraggio Dr

- 517 Nordell Place

- 445 M St

- 191 Fall Ave

- 209 Fall Ave

- 408 Peregrine Dr

- 701 N 3rd St

- 1132 Marsh Wren Ct

- 1129 Imperial Lily Dr

Your Personal Tour Guide

Ask me questions while you tour the home.