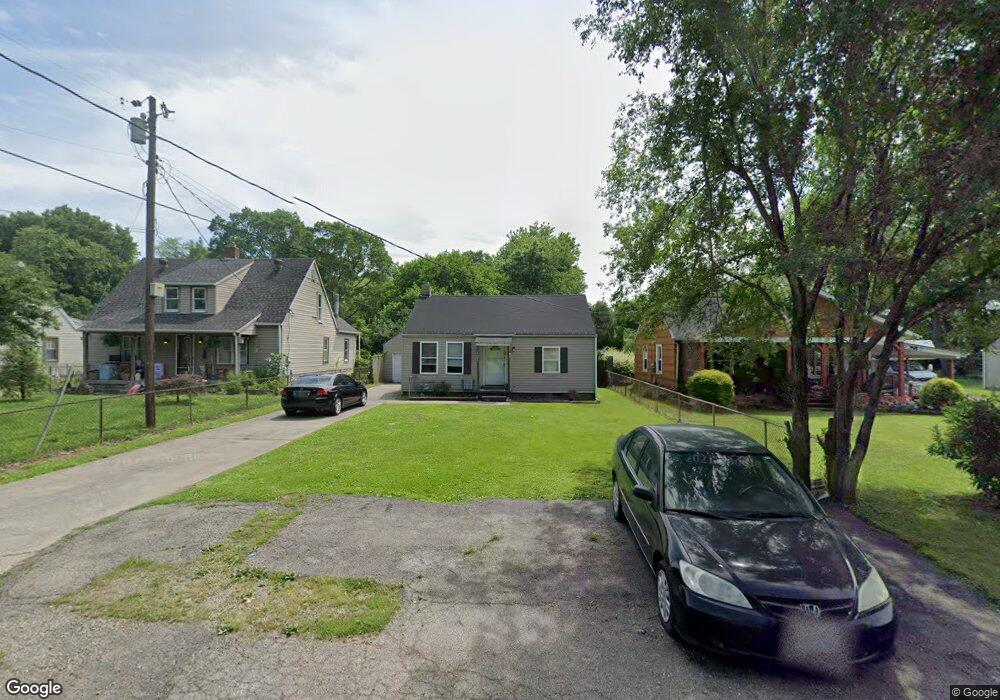

3225 Mohawk St Middletown, OH 45044

Amanda-Oneida NeighborhoodEstimated Value: $72,000 - $112,000

3

Beds

1

Bath

1,144

Sq Ft

$81/Sq Ft

Est. Value

About This Home

This home is located at 3225 Mohawk St, Middletown, OH 45044 and is currently estimated at $92,835, approximately $81 per square foot. 3225 Mohawk St is a home located in Butler County with nearby schools including Amanda Elementary School, Highview 6th Grade Center, and Middletown Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 11, 2019

Sold by

Theodore Gilbert

Bought by

Theodore Lisa M

Current Estimated Value

Purchase Details

Closed on

Jun 10, 2011

Sold by

Theodore Gilbert and Theodore Lisa M

Bought by

Theodore Gilbert and Theodore Lisa M

Purchase Details

Closed on

Mar 25, 2004

Sold by

Theodore Lisa M and Theodore Lisa

Bought by

Theodore Gilbert

Purchase Details

Closed on

Sep 7, 2001

Sold by

Theodore Gilbert and Theodore Lisa M

Bought by

Theodore Gilbert and Theodore Lisa M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$37,000

Interest Rate

7.03%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 5, 2001

Sold by

Craft Paul

Bought by

Chase Manhattan Mtg Corp

Purchase Details

Closed on

Sep 23, 1998

Sold by

Craft Pete and Craft Carolyn

Bought by

Craft Paul and Craft Teresa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,700

Interest Rate

6.99%

Mortgage Type

VA

Purchase Details

Closed on

Sep 18, 1998

Sold by

Oyer Steven D

Bought by

Craft Pete and Craft Carolyn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,700

Interest Rate

6.99%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Theodore Lisa M | -- | -- | |

| Theodore Gilbert | -- | Attorney | |

| Theodore Gilbert | -- | -- | |

| Theodore Gilbert | -- | Midland Title Security Inc | |

| Chase Manhattan Mtg Corp | $39,000 | -- | |

| Craft Paul | $62,000 | -- | |

| Craft Pete | $33,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Theodore Gilbert | $37,000 | |

| Previous Owner | Craft Paul | $52,700 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,208 | $22,800 | $4,400 | $18,400 |

| 2024 | $1,208 | $22,800 | $4,400 | $18,400 |

| 2023 | $1,201 | $22,450 | $4,400 | $18,050 |

| 2022 | $976 | $16,380 | $4,400 | $11,980 |

| 2021 | $940 | $16,380 | $4,400 | $11,980 |

| 2020 | $979 | $16,380 | $4,400 | $11,980 |

| 2019 | $868 | $11,980 | $4,430 | $7,550 |

| 2018 | $776 | $11,980 | $4,430 | $7,550 |

| 2017 | $777 | $11,980 | $4,430 | $7,550 |

| 2016 | $705 | $10,400 | $4,430 | $5,970 |

| 2015 | $694 | $10,400 | $4,430 | $5,970 |

| 2014 | $654 | $10,400 | $4,430 | $5,970 |

| 2013 | $654 | $10,650 | $4,430 | $6,220 |

Source: Public Records

Map

Nearby Homes

- 3222 Mohawk St

- 3210 Finley St

- 3111 Omaha St

- 3102 Omaha St

- 2012 Oneka Ave

- 3209 Rufus St

- 3113 Rufus St

- 1408 Hood Ave

- 2804 Yankee Rd

- 1401 Hood Ave

- 1321 Oxford State Rd

- 1309 Oxford State Rd

- 1507 Pershing Ave

- 1505 Pershing Ave

- 3003 Judy Dr

- 1808 Meadow Ave

- 2220 Yankee Rd

- 1511 Meadow Ave

- 1507 Meadow Ave

- 1621 Lafayette Ave

- 3223 Mohawk St

- 3227 Mohawk St

- 3221 Mohawk St

- 3231 Mohawk St

- 3219 Mohawk St

- 3217 Mohawk St

- 3233 Mohawk St

- 3224 Mohawk St

- 3226 Mohawk St

- 2005 Oxford State Rd

- 3228 Mohawk St

- 2007 Oxford State Rd

- 3220 Mohawk St

- 3235 Mohawk St

- 3230 Mohawk St

- 2009 Oxford State Rd

- 3218 Mohawk St

- 3232 Mohawk St

- 3213 Mohawk St

- 3216 Mohawk St