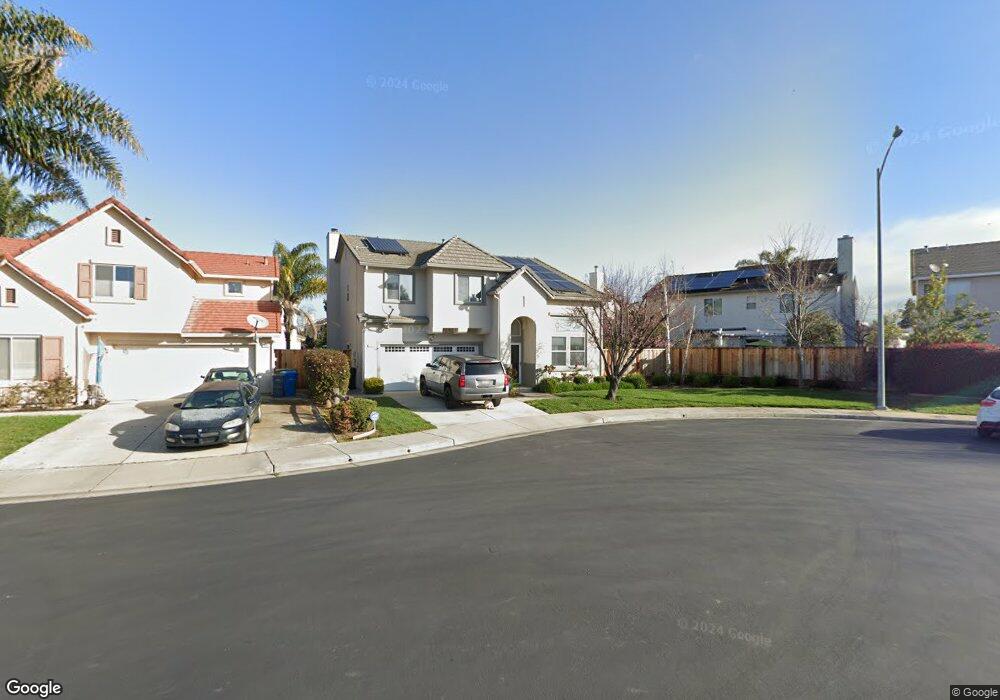

331 Honey Ct Gilroy, CA 95020

Las Animas NeighborhoodEstimated Value: $860,000 - $957,000

3

Beds

3

Baths

1,976

Sq Ft

$464/Sq Ft

Est. Value

About This Home

This home is located at 331 Honey Ct, Gilroy, CA 95020 and is currently estimated at $917,579, approximately $464 per square foot. 331 Honey Ct is a home located in Santa Clara County with nearby schools including South Valley Middle School, Solorsano Middle School, and Christopher High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 14, 2025

Sold by

Gooding Donny Edward and Gooding Melissa C

Bought by

Donny And Melissa Gooding Family Trust and Gooding

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$130,000

Outstanding Balance

$128,606

Interest Rate

5.6%

Mortgage Type

New Conventional

Estimated Equity

$788,973

Purchase Details

Closed on

Aug 12, 2023

Sold by

Gooding Donny Edward and Gooding Melissa C

Bought by

Donny And Melissa Gooding Family Trust and Gooding

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,000

Interest Rate

6.24%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 23, 2023

Sold by

Gooding Donny Edward and Gooding Melissa C

Bought by

Donny And Melissa Gooding Family Trust

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$97,000

Interest Rate

6.33%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 1, 2021

Sold by

Gooding Donny Edward and Gooding Melissa C

Bought by

Gooding Donny Edward and Gooding Melissa C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$665,000

Interest Rate

2.9%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 11, 2020

Sold by

Gooding Donny Edward and Gooding Melissa C Bozzo

Bought by

Gooding Donny Edward and Gooding Melissa C Bozzo

Purchase Details

Closed on

Mar 31, 2009

Sold by

Darab Denise A

Bought by

Gooding Donny E and Gooding Melissa C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$378,026

Interest Rate

5.04%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 21, 2003

Sold by

Darab Denise A

Bought by

Darab Denise A

Purchase Details

Closed on

May 22, 1998

Sold by

Warmington Gilroy Associates Lp

Bought by

Darab Denise Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$209,520

Interest Rate

7.1%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Donny And Melissa Gooding Family Trust | -- | Chicago Title | |

| Gooding Donny Edward | -- | Chicago Title | |

| Donny And Melissa Gooding Family Trust | -- | Chicago Title | |

| Gooding Donny Edward | -- | Chicago Title | |

| Donny And Melissa Gooding Family Trust | -- | Chicago Title | |

| Gooding Donny Edward | -- | Chicago Title | |

| Gooding Donny Edward | -- | Old Republic Title Company | |

| Gooding Donny Edward | -- | Old Republic Title Company | |

| Gooding Donny Edward | -- | None Available | |

| Gooding Donny Edward | -- | None Available | |

| Gooding Donny E | $385,000 | Old Republic Title Company | |

| Darab Denise A | -- | -- | |

| Darab Denise Ann | $262,000 | First American Title Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gooding Donny Edward | $130,000 | |

| Previous Owner | Gooding Donny Edward | $106,000 | |

| Previous Owner | Gooding Donny Edward | $97,000 | |

| Previous Owner | Gooding Donny Edward | $665,000 | |

| Previous Owner | Gooding Donny E | $378,026 | |

| Previous Owner | Darab Denise Ann | $209,520 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,085 | $495,770 | $173,452 | $322,318 |

| 2024 | $6,085 | $486,050 | $170,051 | $315,999 |

| 2023 | $6,050 | $476,520 | $166,717 | $309,803 |

| 2022 | $5,950 | $467,178 | $163,449 | $303,729 |

| 2021 | $5,835 | $458,019 | $160,245 | $297,774 |

| 2020 | $5,858 | $453,323 | $158,602 | $294,721 |

| 2019 | $5,804 | $444,436 | $155,493 | $288,943 |

| 2018 | $5,422 | $435,723 | $152,445 | $283,278 |

| 2017 | $5,535 | $427,180 | $149,456 | $277,724 |

| 2016 | $5,421 | $418,805 | $146,526 | $272,279 |

| 2015 | $5,116 | $412,516 | $144,326 | $268,190 |

| 2014 | $5,084 | $404,436 | $141,499 | $262,937 |

Source: Public Records

Map

Nearby Homes

- 119 Farrell Ave

- 103 Farrell Ave

- 111 Farrell Ave

- 760 Welburn Ave

- 0 Magic Springs Dr Unit ML82028522

- 0 Apn 835-07-018 and Apn 835-07-019 Ave Unit ML82018888

- 0 Dorrance Rd Unit ML82002071

- 0 Apn 841-38-029 Unit ML82027414

- 0000 Hecker Pass

- 626 Broadway

- 620 Broadway

- 622 Broadway

- 1008 Primrose Ln

- 946 Martiri Ct

- 8170 Westwood Dr Unit 22

- 8282 Murray Ave Unit 99

- 8282 Murray Ave Unit 65

- 7821 Santa Theresa Dr

- 700 Las Animas Ave

- 1206 Sycamore Ct

Your Personal Tour Guide

Ask me questions while you tour the home.