Estimated Value: $1,247,000 - $1,362,000

4

Beds

4

Baths

2,252

Sq Ft

$585/Sq Ft

Est. Value

About This Home

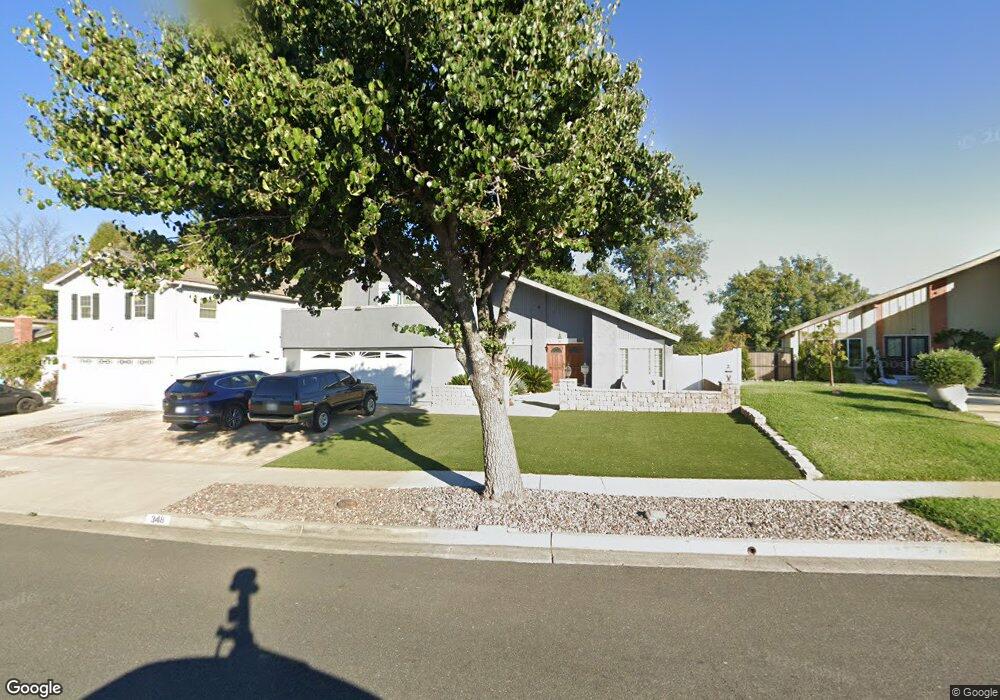

This home is located at 348 Devonshire Dr, Brea, CA 92821 and is currently estimated at $1,317,486, approximately $585 per square foot. 348 Devonshire Dr is a home located in Orange County with nearby schools including Brea Country Hills Elementary School, Brea Junior High School, and Brea-Olinda High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 29, 2021

Sold by

Hanano and Michelle

Bought by

Hanano Family Revocable Trust

Current Estimated Value

Purchase Details

Closed on

Mar 20, 2000

Sold by

Raymond Proctor and Raymond Theresa

Bought by

Hanano Richard and Hanano Michelle

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$278,690

Interest Rate

8.24%

Purchase Details

Closed on

Jan 21, 1998

Sold by

Turner Richard C and Turner Jane

Bought by

Proctor Raymond and Proctor Theresa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$243,500

Interest Rate

6.97%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hanano Family Revocable Trust | -- | None Listed On Document | |

| Hanano Richard | $310,000 | Benefit Land Title Company | |

| Proctor Raymond | $265,000 | Orange Coast Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hanano Richard | $278,690 | |

| Previous Owner | Proctor Raymond | $243,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,682 | $499,507 | $334,294 | $165,213 |

| 2024 | $5,682 | $489,713 | $327,739 | $161,974 |

| 2023 | $5,524 | $480,111 | $321,312 | $158,799 |

| 2022 | $5,470 | $470,698 | $315,012 | $155,686 |

| 2021 | $5,367 | $461,469 | $308,835 | $152,634 |

| 2020 | $5,330 | $456,738 | $305,669 | $151,069 |

| 2019 | $5,187 | $447,783 | $299,676 | $148,107 |

| 2018 | $5,109 | $439,003 | $293,800 | $145,203 |

| 2017 | $5,011 | $430,396 | $288,040 | $142,356 |

| 2016 | $4,912 | $421,957 | $282,392 | $139,565 |

| 2015 | $4,842 | $415,619 | $278,150 | $137,469 |

| 2014 | $4,702 | $407,478 | $272,701 | $134,777 |

Source: Public Records

Map

Nearby Homes

- 1941 Hillhaven Dr

- 2304 Carrotwood Dr

- 2050 Fallingleaf Cir

- 2890 Longspur Dr

- 2851 Rolling Hills Dr Unit 257

- 2851 Rolling Hills Dr Unit 248

- 2851 Rolling Hills Dr

- 2363 Morning Dew Dr

- 2583 Sandpebble Ln

- 3054 Associated Rd Unit 20

- 3062 Associated Rd Unit 1

- 2488 E Kern River Ln

- 3010 Associated Rd Unit 122

- 3000 Associated Rd Unit 60

- 149 Bluegrass St

- 2756 Pine Creek Cir

- 2531 Hartford Ave

- 3019 Sheffield Place

- 2760 Quail Ridge Cir Unit 57

- 2454 Beacon St

- 340 Devonshire Dr

- 356 Devonshire Dr

- 332 Devonshire Dr

- 364 Devonshire Dr

- 355 Devonshire Dr

- 345 Devonshire Dr

- 2140 Heather Ln

- 335 Devonshire Dr

- 324 Devonshire Dr

- 2130 Heather Ln

- 325 Devonshire Dr

- 354 Amberwick Ln

- 316 Devonshire Dr

- 344 Amberwick Ln

- 2110 Heather Ln

- 2141 Hillhaven Dr

- 334 Amberwick Ln

- 400 Devonshire Dr

- 315 Devonshire Dr

- 2131 Hillhaven Dr