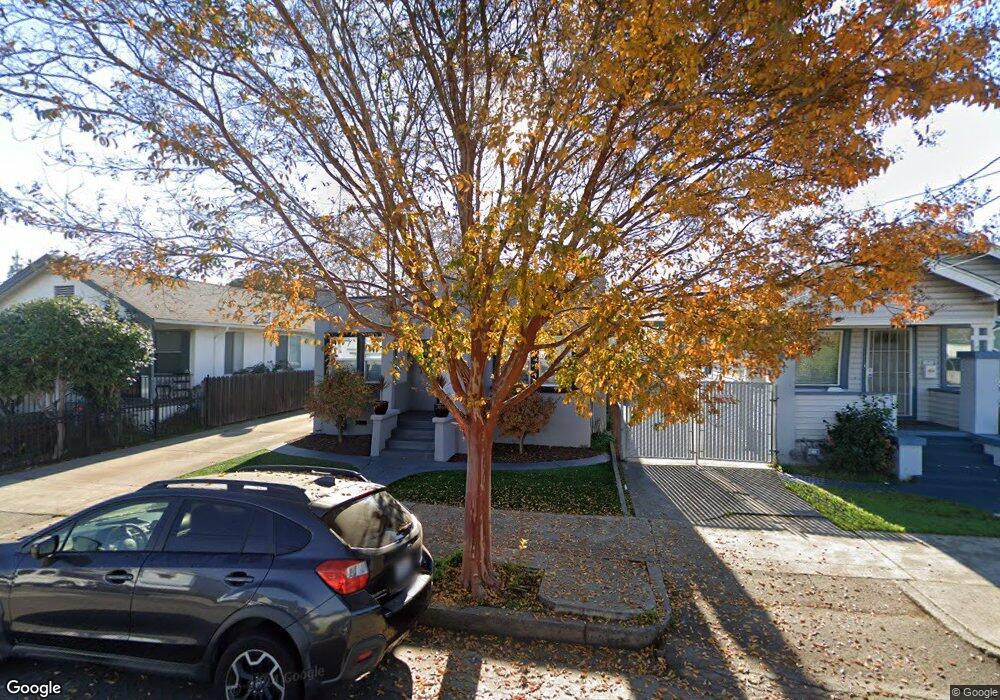

369 Warren Ave San Leandro, CA 94577

Assumption Parish NeighborhoodEstimated Value: $706,000 - $1,001,000

3

Beds

2

Baths

1,200

Sq Ft

$686/Sq Ft

Est. Value

About This Home

This home is located at 369 Warren Ave, San Leandro, CA 94577 and is currently estimated at $823,785, approximately $686 per square foot. 369 Warren Ave is a home located in Alameda County with nearby schools including McKinley Elementary School, Bancroft Middle School, and San Leandro High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 27, 2011

Sold by

Delgado Martin

Bought by

Topete Ricardo

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$243,662

Outstanding Balance

$169,189

Interest Rate

4.25%

Mortgage Type

FHA

Estimated Equity

$654,596

Purchase Details

Closed on

Jul 1, 2005

Sold by

Foster James R and Foster Yvonne M

Bought by

Delgado Martin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$420,000

Interest Rate

6.3%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 9, 1998

Sold by

Foster James R and Foster James

Bought by

Foster James F and Foster Yvonne M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$45,000

Interest Rate

7.02%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Aug 31, 1994

Sold by

Kavasch Kent S and Kavasch Catherine L

Bought by

Foster James

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$146,087

Interest Rate

5.99%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Topete Ricardo | $250,000 | Old Republic Title Company | |

| Delgado Martin | $525,000 | Chicago Title Co | |

| Foster James F | -- | -- | |

| Foster James | $162,500 | First American Title Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Topete Ricardo | $243,662 | |

| Previous Owner | Delgado Martin | $420,000 | |

| Previous Owner | Foster James F | $45,000 | |

| Previous Owner | Foster James | $146,087 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,681 | $313,997 | $94,199 | $219,798 |

| 2024 | $4,681 | $307,841 | $92,352 | $215,489 |

| 2023 | $4,617 | $301,807 | $90,542 | $211,265 |

| 2022 | $4,489 | $295,890 | $88,767 | $207,123 |

| 2021 | $4,327 | $290,090 | $87,027 | $203,063 |

| 2020 | $4,195 | $287,117 | $86,135 | $200,982 |

| 2019 | $4,078 | $281,490 | $84,447 | $197,043 |

| 2018 | $3,958 | $275,971 | $82,791 | $193,180 |

| 2017 | $3,902 | $270,561 | $81,168 | $189,393 |

| 2016 | $3,706 | $265,257 | $79,577 | $185,680 |

| 2015 | $3,641 | $261,274 | $78,382 | $182,892 |

| 2014 | $3,609 | $256,157 | $76,847 | $179,310 |

Source: Public Records

Map

Nearby Homes

- 2062 Washington Ave

- 348 Maud Ave

- 65 Thornton St

- 1316 135th Ave

- 1550 Bancroft Ave Unit 112

- 2399 E 14th St Unit 66

- 2399 E 14th St Unit 24

- 2399 E 14th St Unit 112

- 483 Joaquin Ave

- 499 Estudillo Ave Unit 309

- 1599 Hays St Unit 306

- 890 Linwood Way

- 0 Montrose Dr

- 1400 Carpentier St

- 1400 Carpentier St Unit 315

- 1053 San Jose St

- 2144 Alvarado St

- 1468 Grand Ave Unit 5

- 1468 Grand Ave Unit 21

- 970 Joaquin Ave Unit U7

Your Personal Tour Guide

Ask me questions while you tour the home.