3966 Villamonte Ct Unit 25 Camarillo, CA 93010

Estimated Value: $644,000 - $747,000

3

Beds

3

Baths

1,586

Sq Ft

$447/Sq Ft

Est. Value

About This Home

This home is located at 3966 Villamonte Ct Unit 25, Camarillo, CA 93010 and is currently estimated at $708,174, approximately $446 per square foot. 3966 Villamonte Ct Unit 25 is a home located in Ventura County with nearby schools including Somis School, Adolfo Camarillo High School, and University Preparation Charter School at CSU Channel Islands.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 4, 2017

Sold by

Campbell Harley G and Campbell Diane L

Bought by

Campbell Harley G and Campbell Diane L

Current Estimated Value

Purchase Details

Closed on

Aug 18, 1997

Sold by

Campbell Harley G

Bought by

Campbell Harley G and Campbell Diane L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$151,000

Outstanding Balance

$21,792

Interest Rate

7.58%

Estimated Equity

$686,382

Purchase Details

Closed on

Jul 29, 1997

Sold by

Campbell Diane L

Bought by

Campbell Harley G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$151,000

Outstanding Balance

$21,792

Interest Rate

7.58%

Estimated Equity

$686,382

Purchase Details

Closed on

Jul 22, 1997

Sold by

Country Lane Camarillo Lp

Bought by

Campbell Harley G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$151,000

Outstanding Balance

$21,792

Interest Rate

7.58%

Estimated Equity

$686,382

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Campbell Harley G | -- | None Available | |

| Campbell Harley G | -- | -- | |

| Campbell Harley G | -- | Fidelity National Title Co | |

| Campbell Harley G | $201,500 | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Campbell Harley G | $151,000 | |

| Closed | Campbell Harley G | $20,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,567 | $321,550 | $128,620 | $192,930 |

| 2024 | $3,567 | $315,246 | $126,098 | $189,148 |

| 2023 | $3,379 | $309,065 | $123,625 | $185,440 |

| 2022 | $3,376 | $303,005 | $121,201 | $181,804 |

| 2021 | $3,349 | $297,064 | $118,824 | $178,240 |

| 2020 | $3,342 | $294,019 | $117,606 | $176,413 |

| 2019 | $3,223 | $288,254 | $115,300 | $172,954 |

| 2018 | $3,178 | $282,603 | $113,040 | $169,563 |

| 2017 | $3,065 | $277,063 | $110,824 | $166,239 |

| 2016 | $2,990 | $271,631 | $108,651 | $162,980 |

| 2015 | $2,951 | $267,553 | $107,020 | $160,533 |

| 2014 | $2,906 | $262,315 | $104,925 | $157,390 |

Source: Public Records

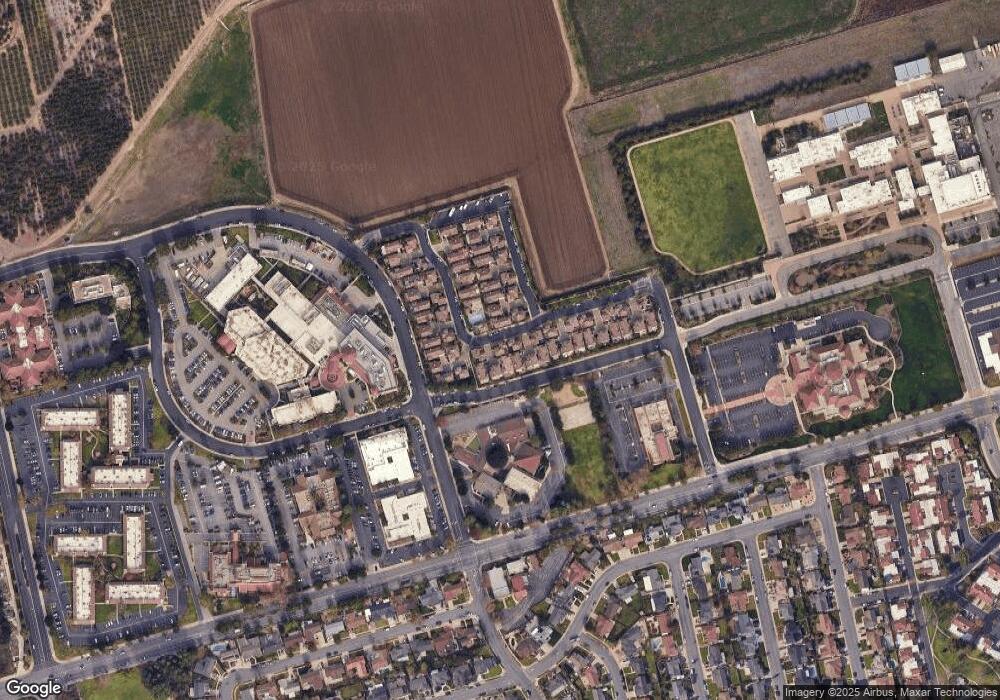

Map

Nearby Homes

- 2576 Villamonte Ct

- 2255 Placita San Rufino

- 4130 Fortuna Ave

- 2722 Antonio Dr

- 2713 Antonio Dr Unit 110

- 2713 Antonio Dr Unit 108

- 2713 Antonio Dr Unit 105

- 2803 Antonio Dr Unit 102

- 2803 Antonio Dr Unit 304

- 2533 Antonio Dr Unit 302

- 4532 Los Damascos Place

- 2052 Santo Domingo

- 4718 La Puma Ct

- 590 Alosta Dr

- 1631 Alta Vista Place

- 2857 Via Descanso

- 1492 Via Bonito

- 4305 Groves Place

- 2854 Via Descanso

- 2860 Via Descanso

- 3958 Villamonte Ct Unit 24

- 3972 Villamonte Ct Unit 26

- 3938 Villamonte Ct

- 3952 Villamonte Ct Unit 23

- 2511 Via Mantilla

- 3980 Villamonte Ct

- 3944 Villamonte Ct Unit 22

- 3986 Villamonte Ct

- 2517 Via Mantilla

- 3998 Villamonte Ct

- 2503 Via Mantilla

- 3994 Villamonte Ct

- 3930 Villamonte Ct

- 3902 Villamonte Ct

- 2503 Villamonte Ct

- 4010 Villamonte Ct

- 2525 Via Mantilla

- 4002 Villamonte Ct Unit 31

- 2531 Via Mantilla

- 3924 Villamonte Ct