4370 E Sack Dr Phoenix, AZ 85050

Paradise Valley Village NeighborhoodEstimated Value: $536,000 - $575,000

4

Beds

3

Baths

2,147

Sq Ft

$259/Sq Ft

Est. Value

About This Home

This home is located at 4370 E Sack Dr, Phoenix, AZ 85050 and is currently estimated at $556,045, approximately $258 per square foot. 4370 E Sack Dr is a home located in Maricopa County with nearby schools including Quail Run Elementary School, Sunrise Middle School, and Paradise Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 23, 2011

Sold by

Dubin Kristy Joyce and Schwartz Kristiy Joyce

Bought by

Lambert Kelly L and Lambert Thomas M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,000

Interest Rate

4.84%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 1, 2007

Sold by

D R Horton Inc

Bought by

Schwartz Craig Lindsay and Schwartz Kristy Joyce

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$258,668

Interest Rate

6.18%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lambert Kelly L | $175,000 | Title Management Agency Of A | |

| Schwartz Craig Lindsay | $323,335 | Dhi Title Of Arizona Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lambert Kelly L | $140,000 | |

| Previous Owner | Schwartz Craig Lindsay | $258,668 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,569 | $29,669 | -- | -- |

| 2024 | $2,446 | $28,257 | -- | -- |

| 2023 | $2,446 | $40,280 | $8,050 | $32,230 |

| 2022 | $2,423 | $31,080 | $6,210 | $24,870 |

| 2021 | $2,463 | $28,320 | $5,660 | $22,660 |

| 2020 | $2,379 | $26,730 | $5,340 | $21,390 |

| 2019 | $2,390 | $25,000 | $5,000 | $20,000 |

| 2018 | $2,303 | $23,700 | $4,740 | $18,960 |

| 2017 | $2,199 | $22,350 | $4,470 | $17,880 |

| 2016 | $2,164 | $20,900 | $4,180 | $16,720 |

| 2015 | $2,008 | $21,480 | $4,290 | $17,190 |

Source: Public Records

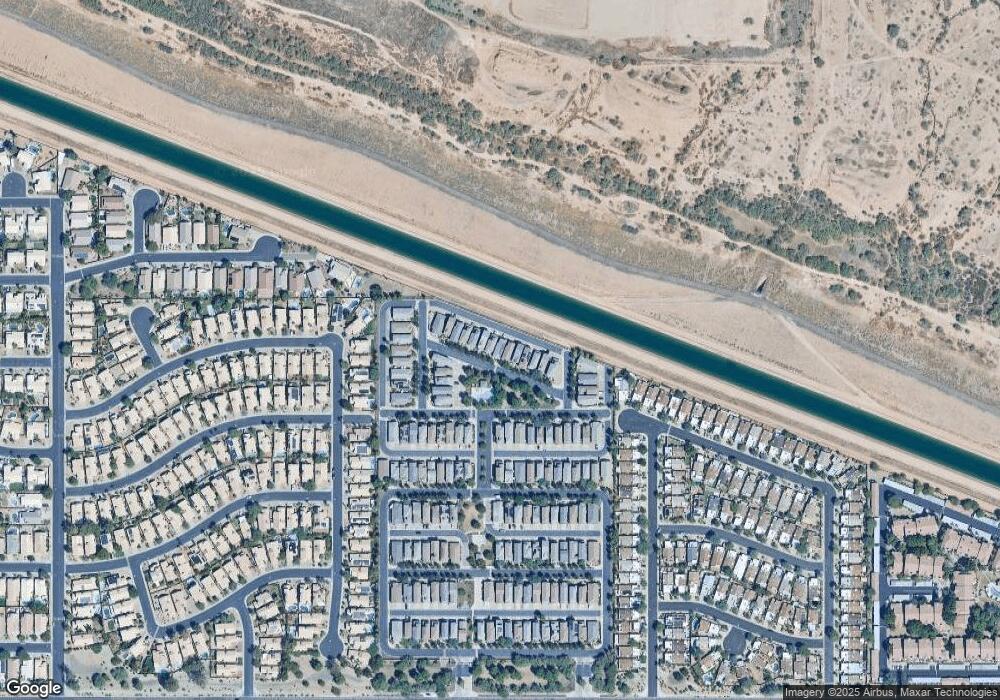

Map

Nearby Homes

- 4382 E Selena Dr

- 4257 E Rosemonte Dr

- 4302 E Wescott Dr

- 4525 E Renee Dr

- 4546 E Renee Dr

- 18809 N 45th Place

- 18319 N 44th St

- 4301 E Bluefield Ave

- 18245 N 42nd Place

- 4114 E Union Hills Dr Unit 1213

- 4114 E Union Hills Dr Unit 1233

- 4333 E Desert Cactus St

- 4110 E Wagoner Rd

- 4750 E Michigan Ave

- 4740 E Villa Maria Dr

- 4805 E Wagoner Rd

- 18239 N 40th St Unit 121

- 18239 N 40th St Unit 115

- 4758 E Charleston Ave

- 4741 E Charleston Ave

- 4372 E Sack Dr

- 4368 E Sack Dr

- 4366 E Sack Dr

- 4374 E Sack Dr

- 4376 E Sack Dr

- 4364 E Sack Dr

- 4378 E Sack Dr

- 4362 E Sack Dr

- 4360 E Sack Dr

- 4380 E Sack Dr

- 4358 E Sack Dr

- 4382 E Sack Dr

- 18919 N 43rd Way

- 18915 N 43rd Way

- 18911 N 43rd Way

- 4356 E Sack Dr

- 18907 N 43rd Way

- 18903 N 43rd Way

- 4369 E Morrow Dr

- 4371 E Morrow Dr