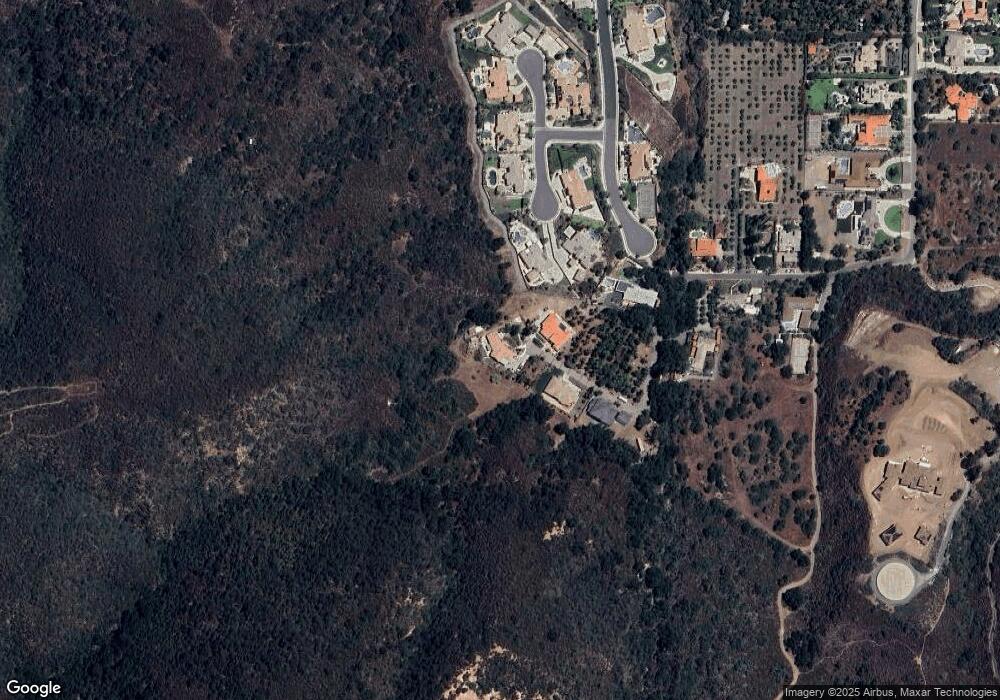

4396 Crown Ranch Rd Corona, CA 92881

South Corona NeighborhoodEstimated Value: $1,182,109 - $1,406,000

3

Beds

3

Baths

2,430

Sq Ft

$514/Sq Ft

Est. Value

About This Home

This home is located at 4396 Crown Ranch Rd, Corona, CA 92881 and is currently estimated at $1,249,277, approximately $514 per square foot. 4396 Crown Ranch Rd is a home located in Riverside County with nearby schools including Dwight D. Eisenhower Elementary School, Citrus Hills Intermediate School, and Santiago High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 24, 2021

Sold by

Lisardo Joseph S and Lisardo Karin L

Bought by

Lisardo Joseph S and Lisardo Karin L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$450,000

Outstanding Balance

$403,393

Interest Rate

2.7%

Mortgage Type

New Conventional

Estimated Equity

$845,884

Purchase Details

Closed on

Mar 30, 2007

Sold by

Herndon Benjamin E and Herndon Douglass P

Bought by

Lisardo Joseph S and Lisardo Karin L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$712,000

Interest Rate

7.07%

Mortgage Type

Commercial

Purchase Details

Closed on

Feb 14, 2002

Sold by

Mcauley Billie Rhue

Bought by

Baker Jeffery Wells and Baker Cynthia Jan

Purchase Details

Closed on

Mar 9, 1999

Sold by

Herndon Benjamin and Herndon Douglass

Bought by

Mcauley Billie Rhue and Baker Jeffery W

Purchase Details

Closed on

May 11, 1995

Sold by

Jameson Charles H and Jameson David John

Bought by

Herndon Benjamin E and Herndon Douglass P

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lisardo Joseph S | -- | American Coast Title | |

| Lisardo Joseph S | $890,000 | Wrt | |

| Baker Jeffery Wells | -- | -- | |

| Mcauley Billie Rhue | $122,000 | Stewart Title Company | |

| Herndon Benjamin E | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lisardo Joseph S | $450,000 | |

| Previous Owner | Lisardo Joseph S | $712,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,939 | $1,192,390 | $525,395 | $666,995 |

| 2023 | $12,939 | $1,146,091 | $504,995 | $641,096 |

| 2022 | $12,214 | $1,095,750 | $482,753 | $612,997 |

| 2021 | $10,344 | $928,602 | $409,113 | $519,489 |

| 2020 | $9,224 | $829,109 | $365,279 | $463,830 |

| 2019 | $8,921 | $804,960 | $354,640 | $450,320 |

| 2018 | $8,549 | $774,000 | $341,000 | $433,000 |

| 2017 | $8,008 | $729,000 | $321,000 | $408,000 |

| 2016 | $7,811 | $704,000 | $310,000 | $394,000 |

| 2015 | $7,755 | $704,000 | $310,000 | $394,000 |

| 2014 | $7,313 | $676,000 | $298,000 | $378,000 |

Source: Public Records

Map

Nearby Homes

- 4085 Strandberg St

- 4071 Judy Cir

- 4034 Crown Ranch Rd

- 1127 Casper Cir

- 1252 Via Venezia Cir

- 1257 Via Venezia Cir

- 3995 Holly Springs Dr

- 3740 Coleville Cir

- 4050 Lester Ave

- 1377 Versante Cir

- 4050 Murphy Ct

- 532 W Orange Height Ln

- 1345 Sallie Jeffreys Way

- 342 Selkirk Dr

- 1411 Sallie Jeffreys Way

- 3931 Ashwood Cir

- 3933 Malaga St

- 457 Minaret St

- 1414 Baldwin Dr

- 3527 Galatea Way

- 4386 Crown Ranch Rd

- 4190 Robby Cir

- 4195 Robby Cir

- 4376 Crown Ranch Rd

- 4364 Crown Ranch Rd

- 4180 Robby Cir

- 4185 Robby Cir

- 4371 Crown Ranch Rd

- 4175 Strandberg Cir

- 4170 Robby Cir

- 4332 Crown Ranch Rd

- 4339 Crown Ranch Rd

- 4165 Robby Cir

- 4160 Robby Cir

- 4312 Crown Ranch Rd

- 4303 Crown Ranch Rd

- 0 Crown Ranch Rd

- 4316 Crown Ranch Rd

- 4150 Robby Cir

- 4155 Strandberg St

Your Personal Tour Guide

Ask me questions while you tour the home.