4410 65th Dr Vero Beach, FL 32967

Estimated Value: $582,618 - $728,000

4

Beds

1

Bath

2,819

Sq Ft

$225/Sq Ft

Est. Value

About This Home

This home is located at 4410 65th Dr, Vero Beach, FL 32967 and is currently estimated at $634,655, approximately $225 per square foot. 4410 65th Dr is a home located in Indian River County with nearby schools including Dodgertown Elementary School, Storm Grove Middle School, and Vero Beach High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 12, 2021

Sold by

Simmons Heather Richter and Dickison Carol Rosezel

Bought by

Simmons Heather Richter and Dickison Carol Rosezel

Current Estimated Value

Purchase Details

Closed on

Sep 25, 2007

Sold by

Burgoon Berger Construction Corp

Bought by

Simmons Heather Richter and Dickinson Carol Rosezel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$412,603

Outstanding Balance

$268,931

Interest Rate

6.57%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$365,724

Purchase Details

Closed on

Nov 30, 2005

Sold by

Ashley Lakes Llc

Bought by

Burgoon Berger Construction Corp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Simmons Heather Richter | -- | None Available | |

| Simmons Heather Richter | $89,900 | Celebration Title Agency Inc | |

| Burgoon Berger Construction Corp | $970,400 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Simmons Heather Richter | $412,603 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,888 | $482,348 | -- | -- |

| 2023 | $4,888 | $295,407 | $0 | $0 |

| 2022 | $4,250 | $405,832 | $0 | $0 |

| 2021 | $3,781 | $333,868 | $51,000 | $282,868 |

| 2020 | $3,511 | $267,188 | $0 | $0 |

| 2019 | $3,477 | $260,425 | $0 | $0 |

| 2018 | $3,260 | $241,527 | $0 | $0 |

| 2017 | $3,275 | $239,322 | $0 | $0 |

| 2016 | $3,331 | $240,690 | $0 | $0 |

| 2015 | $3,295 | $232,160 | $0 | $0 |

| 2014 | $2,996 | $215,050 | $0 | $0 |

Source: Public Records

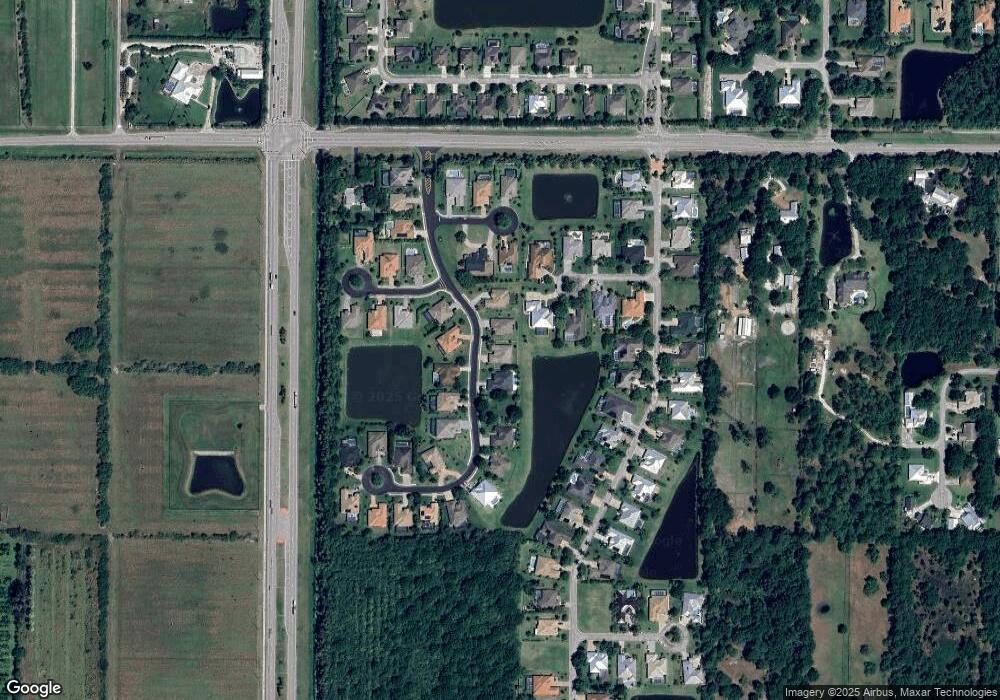

Map

Nearby Homes

- 4310 Amelia Plantation Ct

- 4350 Amelia Plantation Ct

- 6365 45th St

- 4465 62nd Ct

- 6535 Pine Ln

- 6230 Arrowhead Ln

- 4100 Abington Woods Cir

- 4236 Abington Woods Cir

- 4795 Ashley Lake Cir

- 4565 61st Terrace

- 4243 Abington Woods Cir

- 4842 Ashley Lake Cir

- 4180 60th Ct

- 6090 46th Ln

- 3945 62nd Ave

- 1051 66th Ave

- 6450 36th Ln

- 6780 49th St

- 6379 Arcadia Square

- 6575 36th Ln