445 Archbriar Way Simi Valley, CA 93065

West Simi Valley NeighborhoodEstimated Value: $574,000 - $704,000

3

Beds

3

Baths

1,480

Sq Ft

$438/Sq Ft

Est. Value

About This Home

This home is located at 445 Archbriar Way, Simi Valley, CA 93065 and is currently estimated at $647,736, approximately $437 per square foot. 445 Archbriar Way is a home located in Ventura County with nearby schools including Arroyo Elementary School, Sinaloa Middle School, and Royal High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 25, 2021

Sold by

Prevost Paul

Bought by

Prevost Paul and Spease Prevost Marcella

Current Estimated Value

Purchase Details

Closed on

Nov 7, 2001

Sold by

Prevost Alicia Ann

Bought by

Prevost Paul

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$224,000

Outstanding Balance

$86,969

Interest Rate

6.63%

Estimated Equity

$560,767

Purchase Details

Closed on

Sep 27, 1999

Sold by

Bouchard David R Kimberly M

Bought by

Prevost Paul and Prevost Alicia Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Interest Rate

7.5%

Purchase Details

Closed on

Oct 17, 1997

Sold by

Veranda Village Llc

Bought by

Bouchard David Ross and Bouchard Kimberly Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$174,800

Interest Rate

7.26%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Prevost Paul | -- | None Available | |

| Prevost Paul | -- | Fidelity National Title Co | |

| Prevost Paul | $225,000 | Equity Title | |

| Bouchard David Ross | $185,000 | Investors Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Prevost Paul | $224,000 | |

| Closed | Prevost Paul | $180,000 | |

| Previous Owner | Bouchard David Ross | $174,800 | |

| Closed | Prevost Paul | $46,450 | |

| Closed | Prevost Paul | $10,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,408 | $345,789 | $138,312 | $207,477 |

| 2024 | $4,408 | $339,009 | $135,600 | $203,409 |

| 2023 | $4,141 | $332,362 | $132,941 | $199,421 |

| 2022 | $4,110 | $325,846 | $130,335 | $195,511 |

| 2021 | $4,067 | $319,457 | $127,779 | $191,678 |

| 2020 | $3,973 | $316,183 | $126,470 | $189,713 |

| 2019 | $3,789 | $309,985 | $123,991 | $185,994 |

| 2018 | $3,748 | $303,908 | $121,560 | $182,348 |

| 2017 | $3,658 | $297,950 | $119,177 | $178,773 |

| 2016 | $3,489 | $292,109 | $116,841 | $175,268 |

| 2015 | $3,408 | $287,724 | $115,087 | $172,637 |

| 2014 | $3,351 | $282,090 | $112,834 | $169,256 |

Source: Public Records

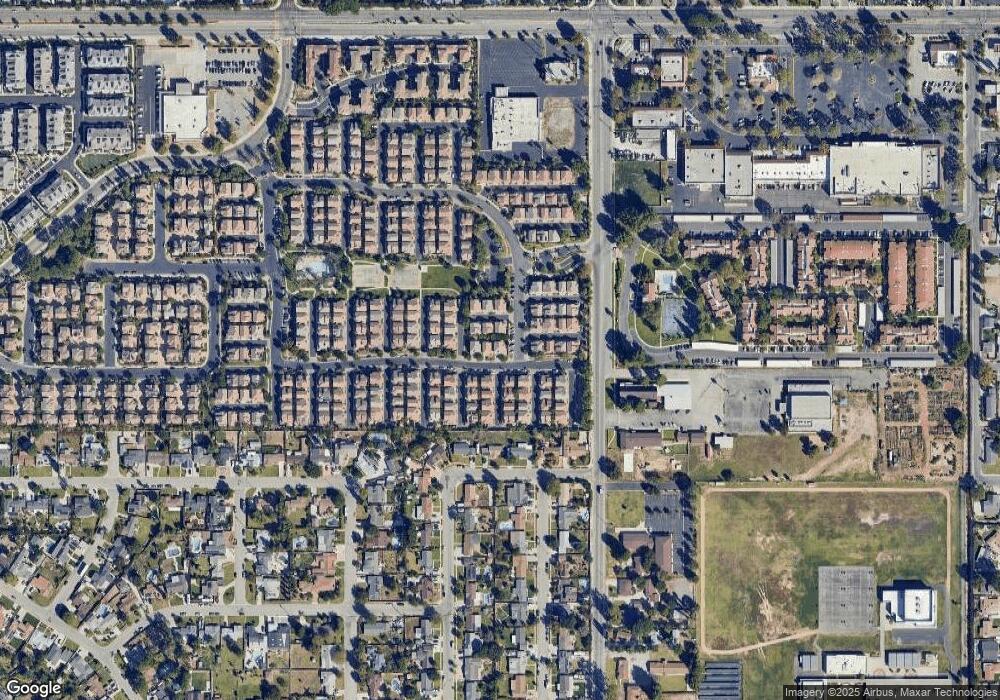

Map

Nearby Homes

- 1760 Millpark Ln

- 1743 Duskwood Way

- 1766 Sinaloa Rd Unit 177

- 1766 Sinaloa Rd Unit 282

- 1772 Sinaloa Rd Unit 189

- 1754 Sinaloa Rd Unit 271

- 459 Mark Dr

- 1529 Paul St

- 118 Red Brick Dr Unit 1

- 105 Red Brick Dr Unit 2

- 1507 4th St

- 101 Red Brick Dr Unit 5

- 1335 El Monte Dr

- 786 Royal Ave

- 938 Ventura Ave

- 1148 Bryson Ave

- 90 La Paz Ct

- 1459 Willowbrook Ln

- 1246 Patricia Ave Unit 21

- 1246 Patricia Ave Unit 28

- 437 Archbriar Way

- 448 Fieldflower Ln

- 436 Fieldflower Ln

- 431 Archbriar Way

- 432 Fieldflower Ln Unit 99

- 432 Fieldflower Ln

- 1690 Moonseed Ln

- 1691 Moonseed Ln

- 468 Windharp Ln Unit 268

- 1691 Spinwood Ln

- 445 Fieldflower Ln

- 1690 Woodscent Ln

- 437 Fieldflower Ln

- 469 Windharp Ln

- 476 Windharp Ln

- 1679 Moonseed Ln

- 1678 Moonseed Ln

- 431 Fieldflower Ln Unit 94

- 1739 Woodscent Ln Unit 91

- 1739 Woodscent Ln

Your Personal Tour Guide

Ask me questions while you tour the home.