4912 S Klein Ave Unit 32 Sioux Falls, SD 57106

Southwest Sioux Falls NeighborhoodEstimated Value: $181,000 - $195,000

2

Beds

1

Bath

1,076

Sq Ft

$173/Sq Ft

Est. Value

About This Home

This home is located at 4912 S Klein Ave Unit 32, Sioux Falls, SD 57106 and is currently estimated at $185,695, approximately $172 per square foot. 4912 S Klein Ave Unit 32 is a home located in Minnehaha County with nearby schools including R.F. Pettigrew Elementary School, Memorial Middle School, and Roosevelt High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 5, 2022

Sold by

Higgins Casey

Bought by

Underberg Seth

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$149,600

Outstanding Balance

$142,425

Interest Rate

5%

Estimated Equity

$43,270

Purchase Details

Closed on

Oct 5, 2018

Sold by

Brockhoft Courtney and Brockhoft Ashley

Bought by

Meyer Jeffrey D and Meyer Beth E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$89,250

Interest Rate

4.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 30, 2015

Sold by

James W James W

Bought by

Butler Courtney

Purchase Details

Closed on

Sep 29, 2011

Sold by

Gaard A Gaard A

Bought by

Leyse James W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$91,675

Interest Rate

4.22%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Underberg Seth | $187,000 | -- | |

| Underberg Seth | $187,000 | -- | |

| Meyer Jeffrey D | $119,000 | Stewart Title Company | |

| Butler Courtney | $100,000 | -- | |

| Leyse James W | $96,500 | Rels Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Underberg Seth | $149,600 | |

| Closed | Underberg Seth | $149,600 | |

| Previous Owner | Meyer Jeffrey D | $89,250 | |

| Previous Owner | Leyse James W | $91,675 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,638 | $159,100 | $15,200 | $143,900 |

| 2023 | $2,632 | $151,200 | $15,200 | $136,000 |

| 2022 | $2,333 | $126,500 | $15,200 | $111,300 |

| 2021 | $2,101 | $113,700 | $0 | $0 |

| 2020 | $2,101 | $109,700 | $0 | $0 |

| 2019 | $2,155 | $110,287 | $0 | $0 |

| 2018 | $1,439 | $103,349 | $0 | $0 |

| 2017 | $1,434 | $91,869 | $7,190 | $84,679 |

| 2016 | $1,434 | $91,700 | $7,190 | $84,510 |

| 2015 | $1,478 | $91,061 | $7,190 | $83,871 |

| 2014 | -- | $90,533 | $7,190 | $83,343 |

Source: Public Records

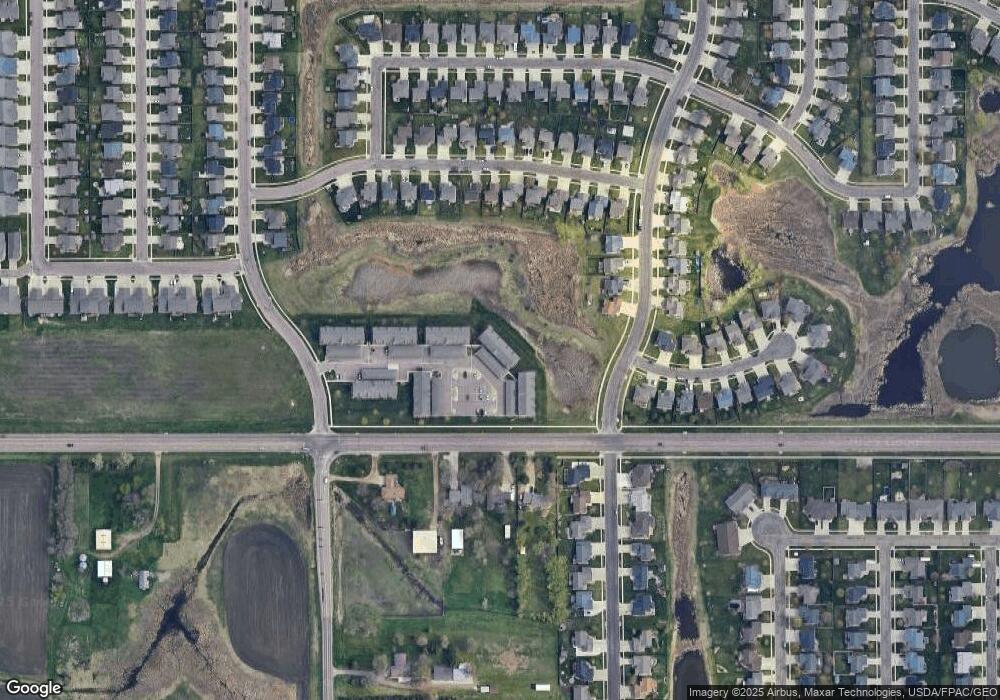

Map

Nearby Homes

- 4813 S Klein Ave Ave

- 4805 S Wassom Ave

- 4528 S Wassom Ave

- 7420 W Luke Dr

- 4609 S Samantha Dr

- 5312 S Leinster Ave

- 7425 W 52nd St

- 7900 W Pettigrew Ln

- 4609 S Galway Ave

- 7412 W 51st St

- 26867 469th Ave

- 4924 S Dunlap Ct

- 4847 S Samantha Dr

- 3401 S Chalice Place

- 7035 W 56th St Unit 16

- 5547 S Wexford Ct

- 5920 S Galway Ave

- 5521 S Aaron Ave

- 4204 S Sertoma Ave Ave

- 6601 W 55th St

- 4912 S Klein Ave Unit 30

- 4912 S Klein Ave Unit 29

- 4912 S Klein Ave Unit 28

- 4912 S Klein Ave Unit 27

- 4912 S Klein Ave Unit 25

- 4908 S Klein Ave Unit 24

- 4908 S Klein Ave Unit 23

- 4908 S Klein Ave Unit 22

- 4908 S Klein Ave Unit 21

- 4908 S Klein Ave Unit 20

- 4908 S Klein Ave Unit 19

- 4908 S Klein Ave Unit 18

- 4908 S Klein Ave Unit 17

- 4916 S Klein Ave Unit 40

- 4916 S Klein Ave Unit 39

- 4916 S Klein Ave Unit 38

- 4916 S Klein Ave Unit 37

- 4916 S Klein Ave Unit 36

- 4916 S Klein Ave Unit 35

- 4916 S Klein Ave Unit 34