500 W Middlefield Rd Unit 168 Mountain View, CA 94043

Rex Manor NeighborhoodEstimated Value: $525,000 - $823,000

1

Bed

1

Bath

720

Sq Ft

$861/Sq Ft

Est. Value

About This Home

This home is located at 500 W Middlefield Rd Unit 168, Mountain View, CA 94043 and is currently estimated at $619,986, approximately $861 per square foot. 500 W Middlefield Rd Unit 168 is a home located in Santa Clara County with nearby schools including Edith Landels Elementary School, Crittenden Middle School, and Mountain View High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 4, 2000

Sold by

Gilmartin William A and Gilmartin Delores E

Bought by

Davies Ronald M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Outstanding Balance

$54,120

Interest Rate

8.15%

Estimated Equity

$565,866

Purchase Details

Closed on

Jul 29, 1997

Sold by

Logan Lindsay A

Bought by

Gilmartin William A and Gilmartin Delores E

Purchase Details

Closed on

Apr 10, 1996

Sold by

Logan Lindsay Ann

Bought by

Gilmartin William A and Gilmartin Delores E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$83,200

Interest Rate

7.41%

Mortgage Type

Balloon

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Davies Ronald M | $249,000 | First American Title Guarant | |

| Gilmartin William A | -- | American Title Ins Co | |

| Gilmartin William A | $104,000 | American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Davies Ronald M | $150,000 | |

| Previous Owner | Gilmartin William A | $83,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,656 | $375,182 | $187,591 | $187,591 |

| 2024 | $4,656 | $367,826 | $183,913 | $183,913 |

| 2023 | $4,597 | $360,614 | $180,307 | $180,307 |

| 2022 | $4,583 | $353,544 | $176,772 | $176,772 |

| 2021 | $4,479 | $346,612 | $173,306 | $173,306 |

| 2020 | $4,454 | $343,058 | $171,529 | $171,529 |

| 2019 | $4,266 | $336,332 | $168,166 | $168,166 |

| 2018 | $4,237 | $329,738 | $164,869 | $164,869 |

| 2017 | $4,053 | $323,274 | $161,637 | $161,637 |

| 2016 | $3,895 | $316,936 | $158,468 | $158,468 |

| 2015 | $3,799 | $312,176 | $156,088 | $156,088 |

| 2014 | $3,756 | $306,062 | $153,031 | $153,031 |

Source: Public Records

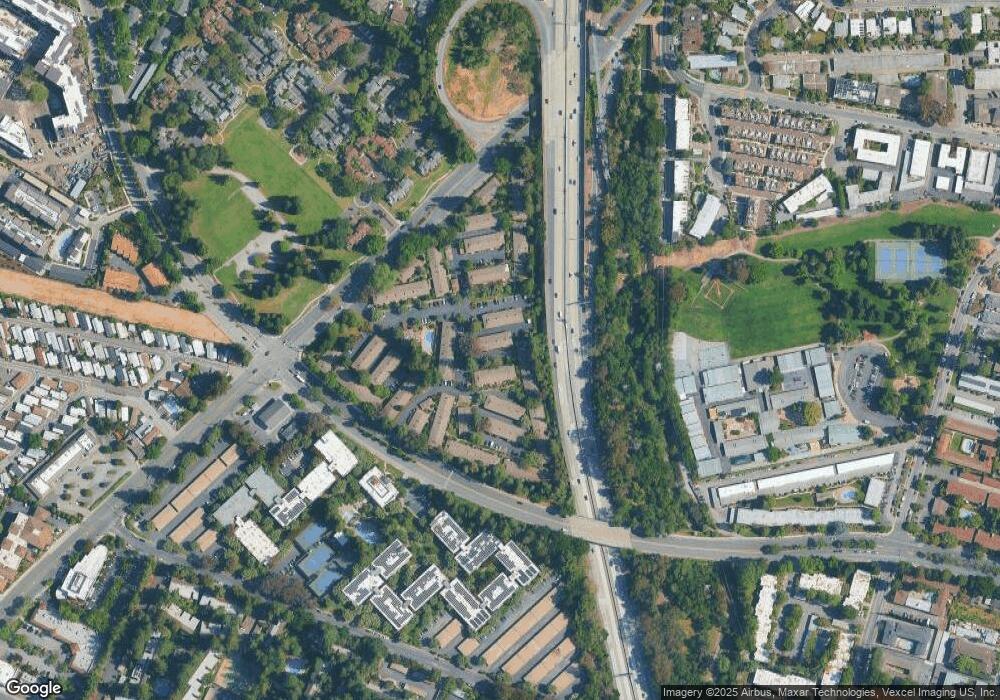

Map

Nearby Homes

- 500 W Middlefield Rd Unit 18

- 440 Moffett Blvd Unit 84

- 440 Moffett Blvd Unit 127

- 440 Moffett Blvd Unit 86

- 440 Moffett Blvd

- 440 Moffett Blvd Unit 61

- 505 Cypress Point Dr Unit 213

- 505 Cypress Point Dr Unit 140

- 505 Cypress Point Dr Unit 137

- 505 Cypress Point Dr Unit 40

- 58 Gladys Ave

- 100 E Middlefield Rd Unit 6G

- 94 Flynn Ave Unit D

- 0 Elmwood St

- 139 Flynn Ave

- 932 Ormonde Dr

- 221 Hope St

- 229 Hope St

- 231 Hope St

- 234 Houghton St

- 500 W Middlefield Rd

- 500 W Middlefield Rd Unit 154

- 500 W Middlefield Rd Unit 146

- 500 W Middlefield Rd Unit 41

- 500 W Middlefield Rd Unit 107

- 500 W Middlefield Rd Unit 153

- 500 W Middlefield Rd

- 500 W Middlefield Rd Unit 181

- 500 W Middlefield Rd Unit 180

- 500 W Middlefield Rd Unit 179

- 500 W Middlefield Rd Unit 178

- 500 W Middlefield Rd Unit 177

- 500 W Middlefield Rd Unit 176

- 500 W Middlefield Rd Unit 175

- 500 W Middlefield Rd Unit 174

- 500 W Middlefield Rd Unit 173

- 500 W Middlefield Rd Unit 172

- 500 W Middlefield Rd Unit 171

- 500 W Middlefield Rd Unit 170

- 500 W Middlefield Rd Unit 169