51 Calle Sol Unit 33 San Clemente, CA 92672

Rancho San Clemente NeighborhoodEstimated Value: $979,980 - $1,219,000

3

Beds

3

Baths

1,698

Sq Ft

$643/Sq Ft

Est. Value

About This Home

This home is located at 51 Calle Sol Unit 33, San Clemente, CA 92672 and is currently estimated at $1,091,745, approximately $642 per square foot. 51 Calle Sol Unit 33 is a home located in Orange County with nearby schools including Clarence Lobo Elementary School, Bernice Ayer Middle School, and San Clemente High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 28, 2008

Sold by

Castro John A and Castro Narsis K

Bought by

The John A Castro & Narsis K Castro Revo

Current Estimated Value

Purchase Details

Closed on

Jul 3, 2001

Sold by

Castro John A

Bought by

Castro John A and Castro Narsis K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$97,550

Interest Rate

7.15%

Purchase Details

Closed on

Mar 11, 1993

Sold by

Security Pacific National Trust Company

Bought by

Castro John A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Interest Rate

7.74%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| The John A Castro & Narsis K Castro Revo | -- | None Available | |

| Castro John A | -- | American Title | |

| Castro John A | $225,000 | Southland Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Castro John A | $97,550 | |

| Closed | Castro John A | $180,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,886 | $390,067 | $167,650 | $222,417 |

| 2024 | $3,886 | $382,419 | $164,363 | $218,056 |

| 2023 | $3,803 | $374,921 | $161,140 | $213,781 |

| 2022 | $3,731 | $367,570 | $157,980 | $209,590 |

| 2021 | $3,659 | $360,363 | $154,882 | $205,481 |

| 2020 | $3,623 | $356,668 | $153,293 | $203,375 |

| 2019 | $3,552 | $349,675 | $150,287 | $199,388 |

| 2018 | $3,484 | $342,819 | $147,340 | $195,479 |

| 2017 | $3,416 | $336,098 | $144,451 | $191,647 |

| 2016 | $3,351 | $329,508 | $141,618 | $187,890 |

| 2015 | $3,300 | $324,559 | $139,491 | $185,068 |

| 2014 | $3,237 | $318,202 | $136,759 | $181,443 |

Source: Public Records

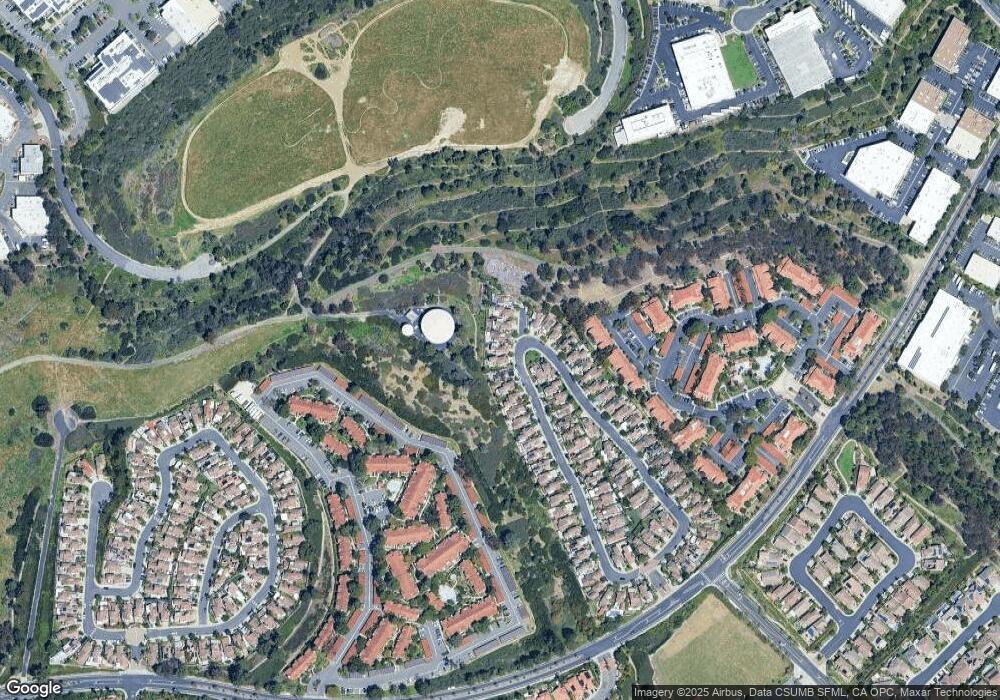

Map

Nearby Homes

- 1046 Calle Del Cerro Unit 411

- 1052 Calle Del Cerro Unit 705

- 1062 Calle Del Cerro Unit 1225

- 1068 Calle Del Cerro Unit 1505

- 609 Via Umbroso

- 27 Burriana

- 402 El Vuelo

- 715 Calle Monserrat

- 815 Calle Dulcinea

- 405 Avenida Salvador

- 315 Calle Dorado

- 317 Calle Felicidad

- 207 Calle Rica

- 55 Via Sonrisa

- 19 Calle Altea

- 152 El Levante

- 33 Calle Pelicano

- 2009 Via Aguila

- 100 Via Monte Picayo

- 170 Avenida Presidio

- 108 Calle Sol Unit 81

- 108 Calle Sol

- 110 Calle Sol

- 98 Calle Sol Unit 80

- 112 Calle Sol

- 96 Calle Sol Unit 79

- 114 Calle Sol Unit 84

- 46 Calle Sol Unit 72

- 94 Calle Sol Unit 78

- 1046 Calle Del Cerro

- 1046 Calle Del Cerro Unit B

- 1046 Calle Del Cerro Unit 402

- 1046 Calle Del Cerro Unit 426

- 1046 Calle Del Cerro Unit 406

- 1046 Calle Del Cerro Unit 432

- 1046 Calle Del Cerro Unit 423

- 1046 Calle Del Cerro Unit 403

- 1046 Calle Del Cerro Unit 420

- 1046 Calle Del Cerro Unit 401

- 1046 Calle Del Cerro Unit 418