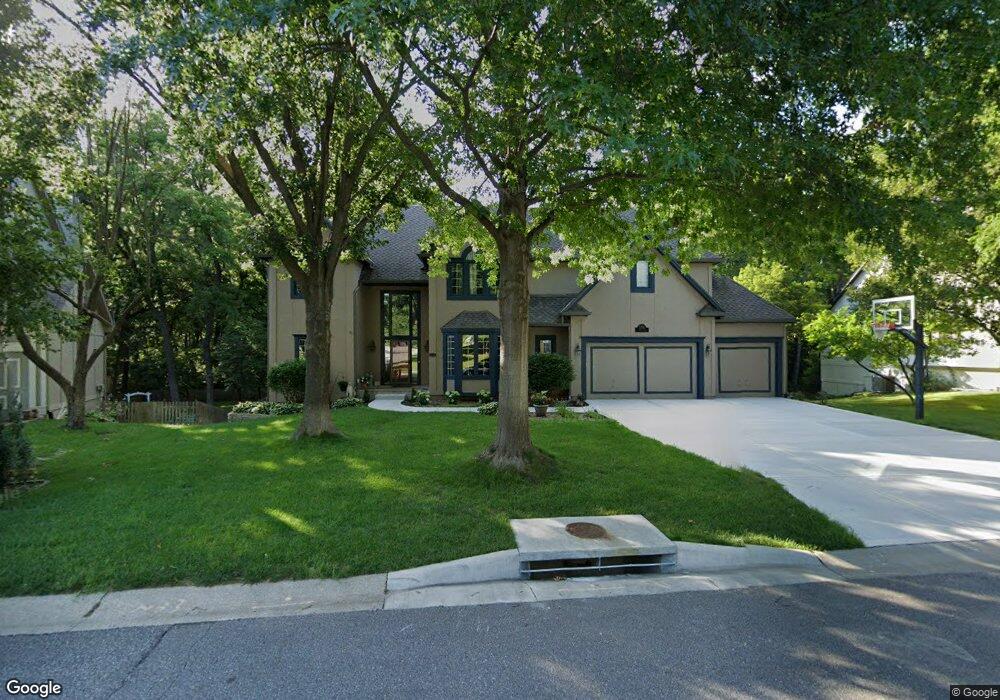

5312 Summit Ct Shawnee, KS 66216

Estimated Value: $542,325 - $580,000

4

Beds

4

Baths

3,350

Sq Ft

$167/Sq Ft

Est. Value

About This Home

This home is located at 5312 Summit Ct, Shawnee, KS 66216 and is currently estimated at $560,081, approximately $167 per square foot. 5312 Summit Ct is a home located in Johnson County with nearby schools including Ray Marsh Elementary School, Trailridge Middle School, and Shawnee Mission Northwest High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 18, 2007

Sold by

Bartels Patrick D and Bartels Janice S

Bought by

Weaver Timothy H and Weaver Michelle A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$334,400

Outstanding Balance

$204,285

Interest Rate

6.16%

Mortgage Type

New Conventional

Estimated Equity

$355,796

Purchase Details

Closed on

Jun 6, 2005

Sold by

Davidson James D and Davidson Pamela J

Bought by

Bartels Patrick D and Bartels Janice S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,500

Interest Rate

5.78%

Mortgage Type

Credit Line Revolving

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Weaver Timothy H | -- | Chicago Title Ins Co | |

| Bartels Patrick D | -- | Chicago Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Weaver Timothy H | $334,400 | |

| Previous Owner | Bartels Patrick D | $81,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,615 | $52,762 | $12,058 | $40,704 |

| 2023 | $5,612 | $52,256 | $11,492 | $40,764 |

| 2022 | $5,362 | $49,761 | $11,492 | $38,269 |

| 2021 | $5,008 | $43,757 | $10,451 | $33,306 |

| 2020 | $4,810 | $41,481 | $9,145 | $32,336 |

| 2019 | $4,622 | $39,825 | $8,315 | $31,510 |

| 2018 | $4,535 | $38,928 | $8,315 | $30,613 |

| 2017 | $4,961 | $41,952 | $7,562 | $34,390 |

| 2016 | $5,007 | $41,814 | $7,562 | $34,252 |

| 2015 | $4,731 | $40,813 | $7,562 | $33,251 |

| 2013 | -- | $41,572 | $7,562 | $34,010 |

Source: Public Records

Map

Nearby Homes

- 5300 Summit Ct

- 13810 W 53rd St

- 5507 Noland Rd

- 5530 Rene St

- 5502 Mullen Rd

- 5703 Cottonwood St

- 5021 Bradshaw St

- 5013 Bradshaw St

- 13305 W 51st St

- 5713 Widmer Rd

- 14210 W 50th St

- 14105 W 48th Terrace

- 5633 Oakview St

- 14170 W 49th St

- 5807 Noland Rd

- 12809 W 57th Terrace

- 5919 Pflumm Rd

- 4940 Alden St

- 12508 W 56th St

- 13130 W 52nd Terrace

- 5400 Summit Ct

- 5308 Summit Ct

- 13608 W 54th St

- 5404 Summit Ct

- 5304 Summit Ct

- 13605 W 53rd Terrace

- 5309 Summit Ct

- 13601 W 53rd Terrace

- 5408 Summit Ct

- 13609 W 54th St

- 13604 W 54th St

- 13609 W 53rd Terrace

- 5313 Park St

- 13519 W 53rd Terrace

- 5305 Summit Ct

- 5317 Park St

- 5301 Summit Ct

- 13515 W 53rd Terrace

- 5321 Park St

- 5411 Summit Ct