541 Wind Sock Way Unit 30 Carlsbad, CA 92011

South Beach NeighborhoodEstimated Value: $1,609,651 - $1,827,000

3

Beds

3

Baths

2,155

Sq Ft

$789/Sq Ft

Est. Value

About This Home

This home is located at 541 Wind Sock Way Unit 30, Carlsbad, CA 92011 and is currently estimated at $1,699,663, approximately $788 per square foot. 541 Wind Sock Way Unit 30 is a home located in San Diego County with nearby schools including Pacific Rim Elementary, Aviara Oaks Middle, and Carlsbad High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 22, 2010

Sold by

Zinn Jason R

Bought by

Zinn Jason R and Zinn Debra

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$380,000

Outstanding Balance

$250,503

Interest Rate

5.03%

Mortgage Type

New Conventional

Estimated Equity

$1,449,160

Purchase Details

Closed on

Jul 15, 2002

Sold by

Behnam Esther M and Benham Esther M

Bought by

Zinn Jason R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$335,000

Interest Rate

5.25%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 1, 1999

Sold by

Wl Homes Llc

Bought by

Benham Esther M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$256,600

Interest Rate

7.25%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Zinn Jason R | -- | California Title Company | |

| Zinn Jason R | $470,000 | Equity Title Company | |

| Benham Esther M | $332,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Zinn Jason R | $380,000 | |

| Previous Owner | Zinn Jason R | $335,000 | |

| Previous Owner | Benham Esther M | $256,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,659 | $680,697 | $312,829 | $367,868 |

| 2024 | $7,659 | $667,351 | $306,696 | $360,655 |

| 2023 | $7,621 | $654,267 | $300,683 | $353,584 |

| 2022 | $7,512 | $641,439 | $294,788 | $346,651 |

| 2021 | $7,458 | $628,862 | $289,008 | $339,854 |

| 2020 | $7,411 | $622,415 | $286,045 | $336,370 |

| 2019 | $7,287 | $610,212 | $280,437 | $329,775 |

| 2018 | $7,002 | $598,248 | $274,939 | $323,309 |

| 2017 | $6,895 | $586,519 | $269,549 | $316,970 |

| 2016 | $6,640 | $575,019 | $264,264 | $310,755 |

| 2015 | $6,615 | $566,383 | $260,295 | $306,088 |

| 2014 | $6,513 | $555,290 | $255,197 | $300,093 |

Source: Public Records

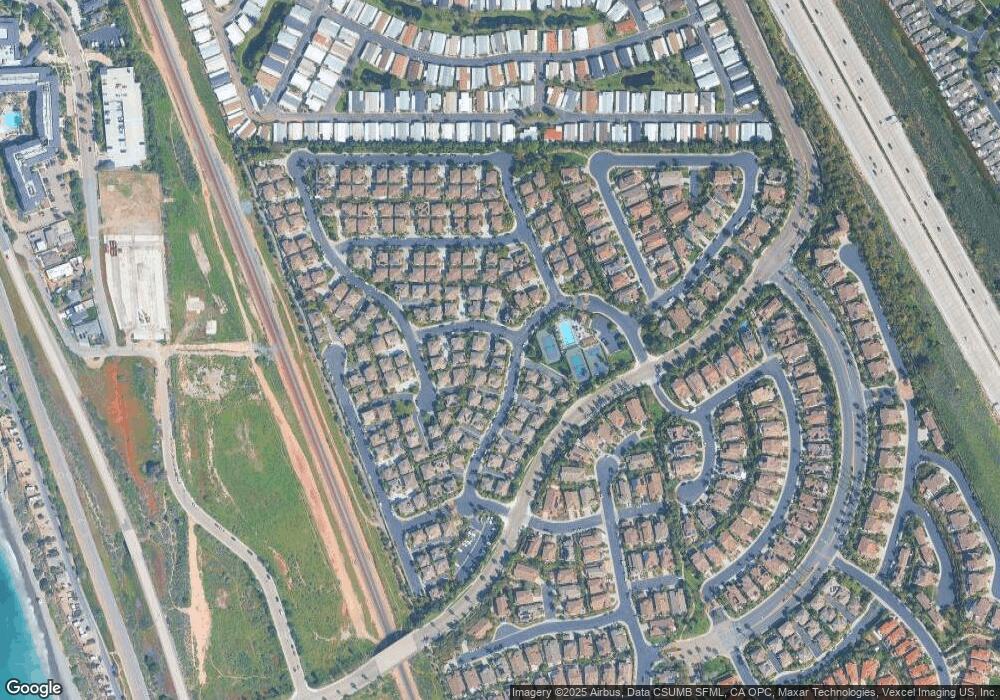

Map

Nearby Homes

- 7313 San Luis St Unit 236

- 7236 San Benito St Unit 355

- 7233 San Bartolo St Unit 376

- 7305 San Bartolo St Unit 374

- 7241 San Luis St

- 7313 Santa Barbara St Unit 294

- 7317 Santa Barbara St Unit 292

- 7025 San Bartolo St Unit 42

- 7232 Santa Barbara St Unit 318

- 7207 Santa Barbara St Unit 154

- 7008 San Bartolo St Unit 27

- 7002 San Bartolo St Unit 30

- 7205 Santa Barbara St Unit 153

- 7027 San Bartolo St Unit 43

- 7024 San Bartolo St Unit 19

- 7023 San Bartolo St Unit 41

- 7144 Santa Rosa St Unit 86

- 7004 San Bartolo St

- 7066 Leeward St Unit 95

- 7013 Lavender Way

- 528 Wind Sock Way Unit 64

- 537 Wind Sock Way Unit 31

- 542 Wind Sock Way

- 538 Wind Sock Way Unit 66

- 522 Wind Sock Way

- 540 Wind Sock Way Unit 67

- 526 Wind Sock Way Unit 65

- 524 Wind Sock Way

- 551 Dew Point Ave

- 527 Wind Sock Way Unit 33

- 7362 Seafarer Place

- 7364 Seafarer Place Unit 60

- 521 Wind Sock Way

- 525 Wind Sock Way Unit 34

- 7347 Spinnaker St

- 543 Wind Sock Way Unit 29

- 7349 Spinnaker St Unit 70

- 549 Dew Point Ave

- 539 Wind Sock Way

- 535 Dew Point Ave