64 Via Sonrisa San Clemente, CA 92673

Estimated Value: $1,852,758 - $2,127,000

4

Beds

3

Baths

2,908

Sq Ft

$684/Sq Ft

Est. Value

About This Home

This home is located at 64 Via Sonrisa, San Clemente, CA 92673 and is currently estimated at $1,987,940, approximately $683 per square foot. 64 Via Sonrisa is a home located in Orange County with nearby schools including Truman Benedict Elementary School, Bernice Ayer Middle School, and San Clemente High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 4, 2020

Sold by

Gordon Joseph A and Gordon Hanna V

Bought by

Gordon Joseph A and Gordon Hanna V

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$405,000

Outstanding Balance

$359,263

Interest Rate

3%

Mortgage Type

New Conventional

Estimated Equity

$1,628,677

Purchase Details

Closed on

Jan 22, 2016

Sold by

Gordon Joseph A

Bought by

Gordon Joseph A and Gordon Hanna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$351,500

Interest Rate

3.94%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 20, 1998

Sold by

Richmond American Homes Of Ca Inc

Bought by

Gordon Joseph A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$139,000

Interest Rate

6.88%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gordon Joseph A | -- | Fidelity National Title | |

| Gordon Joseph A | -- | North American Title Co Inc | |

| Gordon Joseph A | $404,500 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gordon Joseph A | $405,000 | |

| Closed | Gordon Joseph A | $351,500 | |

| Previous Owner | Gordon Joseph A | $139,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,610 | $671,423 | $241,510 | $429,913 |

| 2024 | $6,610 | $658,258 | $236,774 | $421,484 |

| 2023 | $6,468 | $645,351 | $232,131 | $413,220 |

| 2022 | $6,344 | $632,698 | $227,580 | $405,118 |

| 2021 | $6,220 | $620,293 | $223,118 | $397,175 |

| 2020 | $6,158 | $613,933 | $220,830 | $393,103 |

| 2019 | $6,035 | $601,896 | $216,500 | $385,396 |

| 2018 | $5,918 | $590,095 | $212,255 | $377,840 |

| 2017 | $5,801 | $578,525 | $208,093 | $370,432 |

| 2016 | $5,689 | $567,182 | $204,013 | $363,169 |

| 2015 | $5,602 | $558,663 | $200,949 | $357,714 |

| 2014 | $5,493 | $547,720 | $197,013 | $350,707 |

Source: Public Records

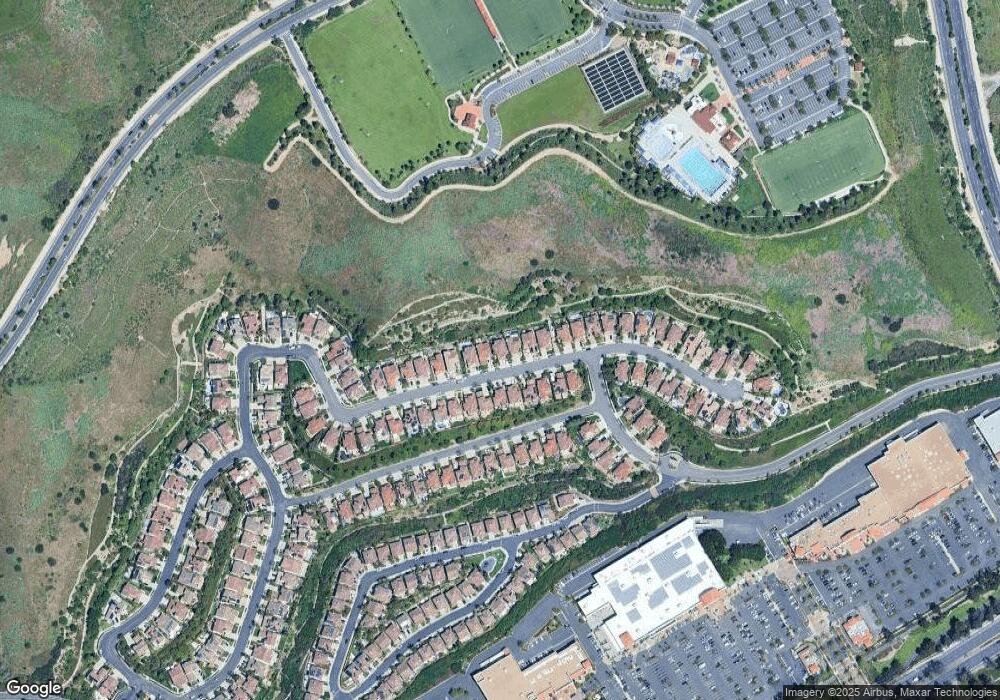

Map

Nearby Homes

- 66 Avenida Merida

- 22 Paseo Rosa

- 2413 Camino Oleada

- 76 Paseo Del Rey

- 180 Paseo Vista

- 1415 Manera Ventosa

- 1405 Manera Ventosa

- 2424 Calle Aquamarina

- 41 Via Huelva

- 100 Via Monte Picayo

- 640 Via Umbroso

- 305 Via Los Tilos

- 1068 Calle Del Cerro Unit 1506

- 1062 Calle Del Cerro

- 1064 Calle Del Cerro Unit 1307

- 1060 Calle Del Cerro Unit 1105

- 1074 Calle Del Cerro Unit 1806

- 2803 Penasco

- 1052 Calle Del Cerro Unit 705

- 2000 Corte Cardelina

Your Personal Tour Guide

Ask me questions while you tour the home.