7203 Surfbird Cir Unit 52 Carlsbad, CA 92011

Aviara NeighborhoodEstimated Value: $1,449,434 - $1,578,000

3

Beds

3

Baths

1,845

Sq Ft

$822/Sq Ft

Est. Value

About This Home

This home is located at 7203 Surfbird Cir Unit 52, Carlsbad, CA 92011 and is currently estimated at $1,517,359, approximately $822 per square foot. 7203 Surfbird Cir Unit 52 is a home located in San Diego County with nearby schools including Aviara Oaks Elementary, Aviara Oaks Middle, and Sage Creek High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 11, 2015

Sold by

Jennings William P

Bought by

Jennings William P

Current Estimated Value

Purchase Details

Closed on

Jun 18, 2009

Sold by

Jennings Lynn G

Bought by

Jennings William P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Outstanding Balance

$189,748

Interest Rate

4.79%

Mortgage Type

New Conventional

Estimated Equity

$1,327,611

Purchase Details

Closed on

Oct 24, 2002

Sold by

Jennings William P

Bought by

Jennings William P and Jennings Lynn G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Interest Rate

5.99%

Purchase Details

Closed on

Oct 17, 1997

Sold by

L & W Investments Inc

Bought by

Jennings William P and Jennings Lynn G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$364,600

Interest Rate

7.25%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jennings William P | -- | None Available | |

| Jennings William P | -- | Advantage Title Inc | |

| Jennings William P | -- | First American Title Ins Co | |

| Jennings William P | -- | First American Title Ins Co | |

| Jennings William P | $456,000 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jennings William P | $300,000 | |

| Closed | Jennings William P | $300,000 | |

| Previous Owner | Jennings William P | $364,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,621 | $727,715 | $191,600 | $536,115 |

| 2024 | $7,621 | $713,447 | $187,844 | $525,603 |

| 2023 | $7,581 | $699,459 | $184,161 | $515,298 |

| 2022 | $7,464 | $685,745 | $180,550 | $505,195 |

| 2021 | $7,406 | $672,300 | $177,010 | $495,290 |

| 2020 | $7,356 | $665,407 | $175,195 | $490,212 |

| 2019 | $7,222 | $652,360 | $171,760 | $480,600 |

| 2018 | $6,940 | $639,570 | $168,393 | $471,177 |

| 2017 | $90 | $627,031 | $165,092 | $461,939 |

| 2016 | $6,556 | $614,737 | $161,855 | $452,882 |

| 2015 | $6,528 | $605,504 | $159,424 | $446,080 |

| 2014 | $6,961 | $593,644 | $156,302 | $437,342 |

Source: Public Records

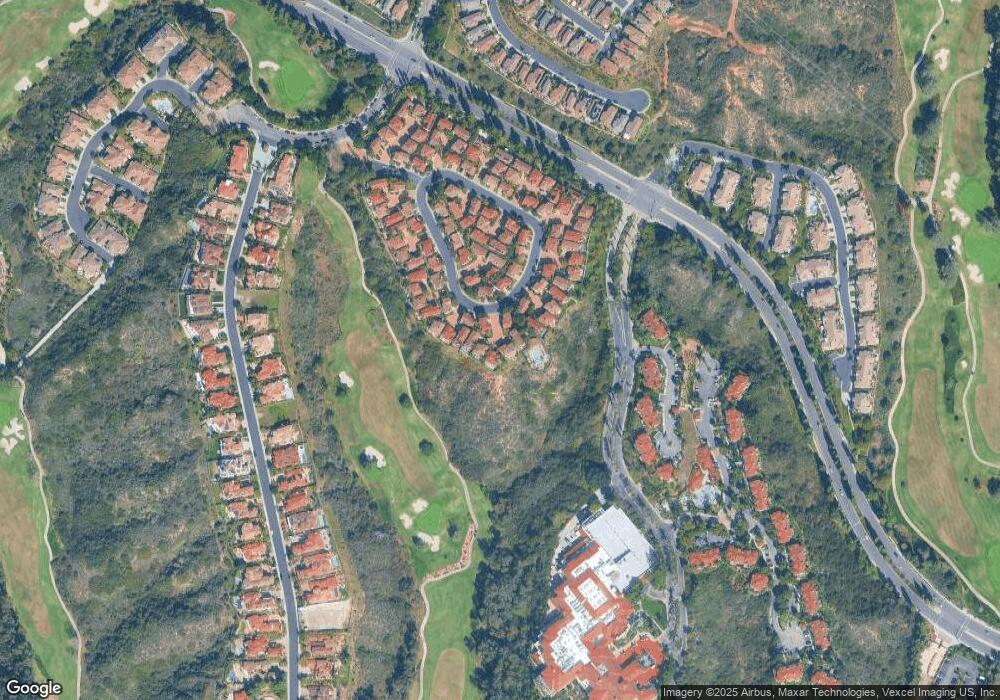

Map

Nearby Homes

- 7215 Daffodil Place

- 6647 Encelia Place

- 1341 Mallard Ct

- 6325 Alexandri Cir

- 6485 Alexandri Cir

- 6777 Lonicera St

- 6467 Alexandri Cir Unit 75

- 6419 Alexandri Cir

- 7012 Goldenrod Way

- 7212 Columbine Dr

- 6438 Lilium Ln

- 1845 Cliff Swallow Ln

- 6915 Pear Tree Dr

- 6903 Quail Place

- 6557 Coneflower Dr

- 6911 Quail Place Unit C

- 7013 Lavender Way

- 25 El Camino Real

- 1933 Alga Rd Unit C

- 7234 Estrella de Mar Rd

- 7199 Surfbird Cir Unit 51

- 7207 Surfbird Cir Unit 53

- 7215 Surfbird Cir

- 7195 Surfbird Cir

- 7211 Surfbird Cir Unit 54

- 7191 Surfbird Cir Unit 49

- 7223 Surfbird Cir

- 7219 Surfbird Cir

- 7183 Surfbird Cir

- 7187 Surfbird Cir

- 7227 Surfbird Cir

- 7200 Surfbird Cir Unit 99

- 7179 Surfbird Cir

- 7167 Surfbird Cir

- 7235 Surfbird Cir

- 7175 Surfbird Cir Unit 45

- 7192 Surfbird Cir

- 7178 Surfbird Cir

- 7231 Surfbird Cir

- 7238 Surfbird Cir