737 Kathy Ave Sidney, OH 45365

Estimated Value: $211,000 - $233,111

4

Beds

2

Baths

1,640

Sq Ft

$138/Sq Ft

Est. Value

About This Home

This home is located at 737 Kathy Ave, Sidney, OH 45365 and is currently estimated at $226,028, approximately $137 per square foot. 737 Kathy Ave is a home located in Shelby County with nearby schools including Sidney High School, Holy Angels Catholic School, and Christian Academy Schools.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 18, 2002

Sold by

Mortgage Guarenty Ins

Bought by

Brandyberry Sean E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$98,500

Outstanding Balance

$44,966

Interest Rate

7.25%

Mortgage Type

New Conventional

Estimated Equity

$181,062

Purchase Details

Closed on

May 22, 2002

Sold by

Shrf James J Bannan Pr

Bought by

Greenville Fed S&L Assn

Purchase Details

Closed on

May 21, 1999

Sold by

Kelly Harold J

Bought by

Bannan James J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$91,665

Interest Rate

6.99%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 19, 1993

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brandyberry Sean E | $98,500 | -- | |

| Greenville Fed S&L Assn | $87,000 | -- | |

| Bannan James J | $94,500 | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Brandyberry Sean E | $98,500 | |

| Previous Owner | Bannan James J | $91,665 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,218 | $63,340 | $10,430 | $52,910 |

| 2023 | $2,218 | $63,340 | $10,430 | $52,910 |

| 2022 | $1,758 | $43,970 | $9,170 | $34,800 |

| 2021 | $1,776 | $43,960 | $9,170 | $34,790 |

| 2020 | $1,775 | $43,960 | $9,170 | $34,790 |

| 2019 | $1,456 | $36,140 | $7,590 | $28,550 |

| 2018 | $1,436 | $36,140 | $7,590 | $28,550 |

| 2017 | $1,420 | $36,140 | $7,590 | $28,550 |

| 2016 | $1,350 | $34,300 | $7,590 | $26,710 |

| 2015 | $1,354 | $34,280 | $7,590 | $26,690 |

| 2014 | $1,353 | $34,280 | $7,590 | $26,690 |

| 2013 | $1,470 | $34,410 | $7,590 | $26,820 |

Source: Public Records

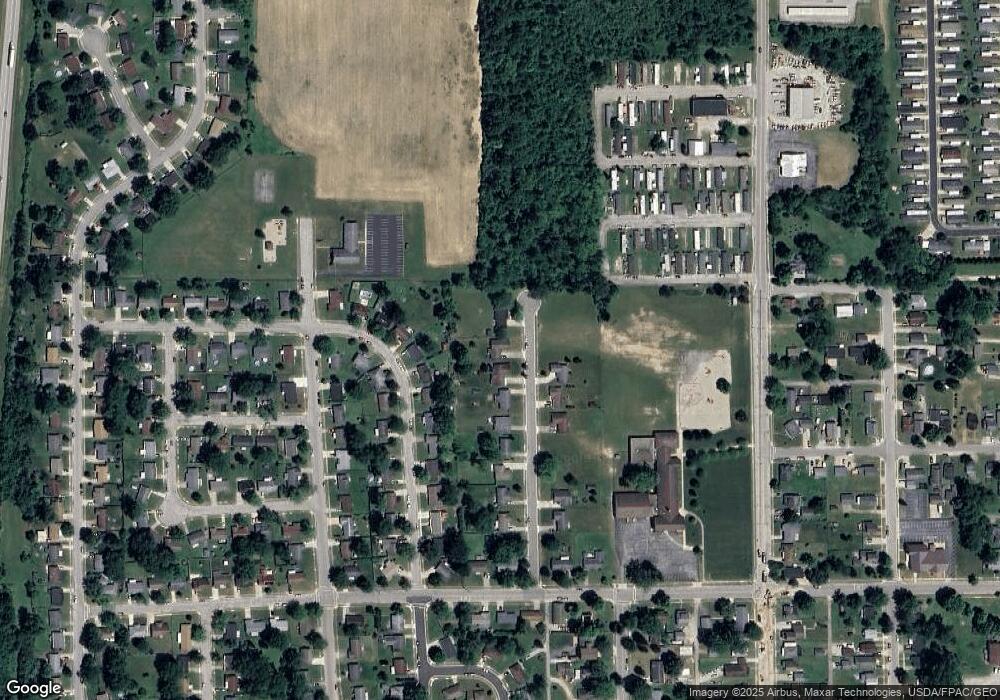

Map

Nearby Homes

- 807 6th Ave

- 1726 Fair Oaks Dr

- 621 Maywood Place

- 1042 Apple Blossom Ln

- 1624 Holly Place

- 1112 Hazel Nut Ln

- 610 N Wagner Ave

- State Ohio 47

- 00 Folkerth Ave

- Aspen Plan at Burr Oak Mill

- Birch with Full Basement Plan at Burr Oak Mill

- Cedar with Full Basement Plan at Burr Oak Mill

- Elder with Full Basement Plan at Burr Oak Mill

- Spruce Plan at Burr Oak Mill

- 512 Sycamore Ave

- 1402 Gray Oak Dr

- 1385 Gray Oak Dr

- 1415 Gray Oak Dr

- 1356 Shaggy Bark Dr

- 1338 Shaggy Bark Dr