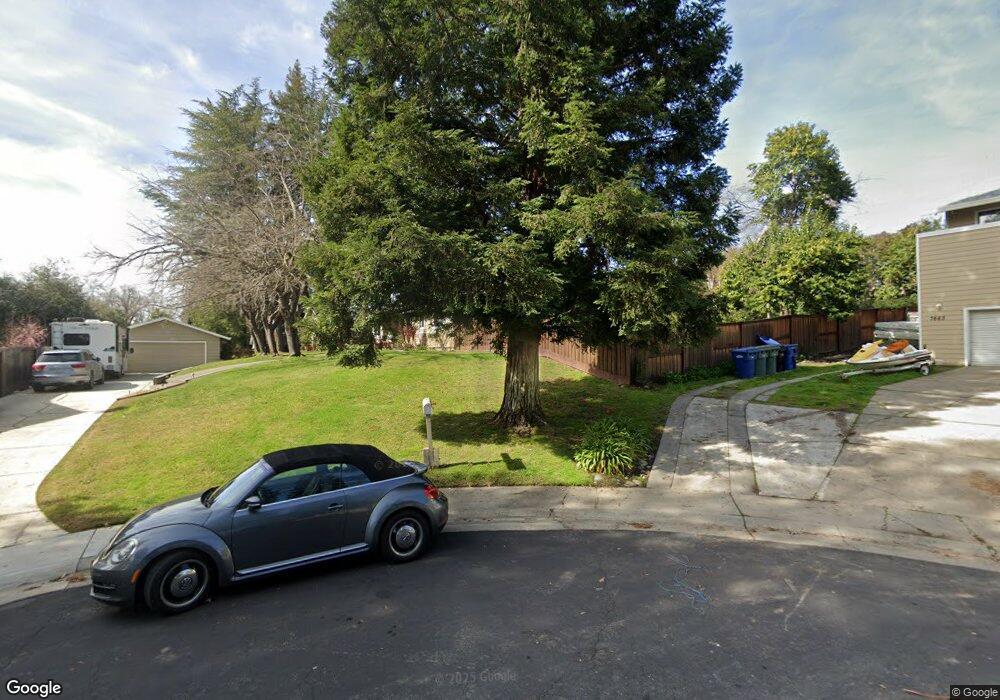

7659 Kreth Rd Fair Oaks, CA 95628

Estimated Value: $761,000 - $1,532,000

4

Beds

3

Baths

3,889

Sq Ft

$270/Sq Ft

Est. Value

About This Home

This home is located at 7659 Kreth Rd, Fair Oaks, CA 95628 and is currently estimated at $1,050,197, approximately $270 per square foot. 7659 Kreth Rd is a home located in Sacramento County with nearby schools including Albert Schweitzer Elementary School, John Barrett Middle School, and Del Campo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 23, 2018

Sold by

Pierucci Richard L and Hastie Nancy J

Bought by

Pierucci Richard L and Hastie Nancy J

Current Estimated Value

Purchase Details

Closed on

Feb 8, 2001

Sold by

Hastie Bruce Edward

Bought by

Hastie Nancy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$225,000

Interest Rate

7.08%

Purchase Details

Closed on

May 17, 1996

Sold by

Schlappi Mark L and Schlappi Carole R

Bought by

Hastie Bruce Edward and Hastie Nancy Jo

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$151,875

Interest Rate

7.97%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Pierucci Richard L | -- | None Available | |

| Hastie Nancy | -- | Stewart Title | |

| Hastie Bruce Edward | $195,000 | Fidelity National Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hastie Nancy | $225,000 | |

| Previous Owner | Hastie Bruce Edward | $151,875 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,976 | $409,919 | $139,532 | $270,387 |

| 2024 | $4,976 | $401,883 | $136,797 | $265,086 |

| 2023 | $4,832 | $394,004 | $134,115 | $259,889 |

| 2022 | $4,814 | $386,280 | $131,486 | $254,794 |

| 2021 | $4,721 | $378,707 | $128,908 | $249,799 |

| 2020 | $4,654 | $374,825 | $127,587 | $247,238 |

| 2019 | $4,536 | $367,477 | $125,086 | $242,391 |

| 2018 | $4,437 | $360,273 | $122,634 | $237,639 |

| 2017 | $4,393 | $353,210 | $120,230 | $232,980 |

| 2016 | $4,106 | $346,285 | $117,873 | $228,412 |

| 2015 | $4,035 | $341,085 | $116,103 | $224,982 |

| 2014 | $3,951 | $334,404 | $113,829 | $220,575 |

Source: Public Records

Map

Nearby Homes

- 7605 Sunset Ave

- 4040 Minnesota Ave

- 7529 Pineridge Ln

- 4337 Bannister Rd

- 7825 Greenridge Way

- 7637 Vasos Way

- 7724 Greenridge Way

- 7786 Winding Way

- 4134-lot 1 Bannister Rd

- 5013 Kendra Ct

- 7818 Tamara Dr

- 7323 Pheasant Rd

- 4215 New York Ave

- 4134 Bannister Rd

- 7841 Lemon St

- 5136 Romero Way

- 7055 Winding Way

- 7244 Robin Rd

- 4310 Hussey Dr

- 7408 Santa Susana Way

- 7629 San Nita Way

- 7663 Kreth Rd

- 7655 Kreth Rd

- 7636 Heather Rd

- 7620 San Nita Way

- 7619 San Nita Way

- 7624 Heather Rd

- 7664 Kreth Rd

- 7640 Heather Rd

- 7631 Kreth Rd

- 7660 Kreth Rd

- 7625 Kreth Rd

- 7618 Heather Rd

- 7656 Kreth Rd

- 7609 San Nita Way

- 7650 Heather Rd

- 7619 Kreth Rd

- 7650 Kreth Rd

- 7610 San Nita Way

- 7600 Heather Rd

Your Personal Tour Guide

Ask me questions while you tour the home.